Stock trading simulators serve a unique purpose in the world of trading and investing. While not always popular, they provide the necessary environment for responsible traders to learn and hone their craft. In this post, we'll discuss the purpose of stock trading simulators and answer many questions regarding their use as a learning tool.

What Is A trading simulator?

A trading simulator is a software application that acts very similar to a broker's platform, allowing traders a realistic market environment with similar or exactly the same tradable assets and values. The only difference is that no real money is on the line.

Usually, a trading simulator will include an order montage window with the ability to place simulated trades. It will also include a charting application, indicators for charts, a realistic scanner for the markets, and more. In other words, it is everything you need to learn how to trade, without the real monetary risk -- similar to a flight simulator, if you will.

How to use a trading simulator?

As with any simulated training program, the best way to use a trading simulator is to gain experience using the controls of buying and selling without risking real money. Like a flight simulator, you want to know what it's like to trade in many different environments.

A trading simulator should be used to collect data, whether actual data or implicitly learned memories of patterns and scenarios. For example, if the stock market is down trending, you'll want to build a repertoire of what types of patterns can be successfully traded in that environment.

Likewise, if the market is trending upward, or sideways, you'll want to study the patterns that work in those environments as well. Over time, the use of a trading simulator should allow you to create a trade book of high probability setups/strategies in different market contexts.

How many hours on a trading simulator?

While some traders like to go back and forth between the trading simulator and real trading, we recommend that you spend at least 1000 hours in the trading simulator before going live.

We've all heard the 10,000 hour adage as the amount of time it takes to master something. And there is truth to this. However, the amount of time needed in a trading simulator will vary from person to person.

As a general rule of thumb, we see that more disciplined traders who spend their time wisely in a trading simulator collecting data and testing strategies will require fewer hours than someone who uses it irregularly. Think of it this way: if Tiger Woods went to the driving range every day just to goof off, do you think he would accomplish all that he has in his career?

Trading is a performance sport, leave no doubt. If you want to perform well, you must practice well, and often.

Is there a way to practice trading stocks?

Indeed there is. The best way to practice stocks is inside a stock trading simulator. Whether you are a swing trader or a day trader, being able to practice trading stocks is the key to your success.

There are many ways to practice trading stocks. You could simply analyze charts and take screenshots and save them in a folder for consistent review. Or, you can use a trading simulator to generate a realistic market without the risk of real money.

At the end of the day, what matters is repetition and analysis. The key to practicing trading is to learn the ins and outs of patterns. Then, you want to consolidate your findings into 1 or 2 quality setups that you can rely on in different market conditions.

Can you replay the stock market?

This is a great question that many traders ask when looking for stock trading simulators. The answer is that there are really only a few options available for replaying the stock market.

For example, here at TradingSim, we have a stock market replay simulator. That means that you can replay and relive the market for up to 3 years into the past. Whether on weekends, at night, or any time of day, you can simulate the market as it occurred on a random day 1, 2, or 3 years ago.

Generally speaking, there are two types of simulators: live simulation, and replay simulation. Let's look at a few of the pros and cons of each:

| Live Simulation |

Replay Simulation |

- Only available during market hours

- Realistic times and data feeds

- Practice limited to 5 days/week

- Most brokers have simulators free

- Only trade current market day

|

- Available anytime day or night

- Realistic price action

- Some simulators require data download

- Practice on weekends or holidays

- Trade any historical day

|

Replay simulation is a lot like having a DVR for the stock market. It's like on-demand television. You can go backward and forward in the market at will.

How do you replay a trade?

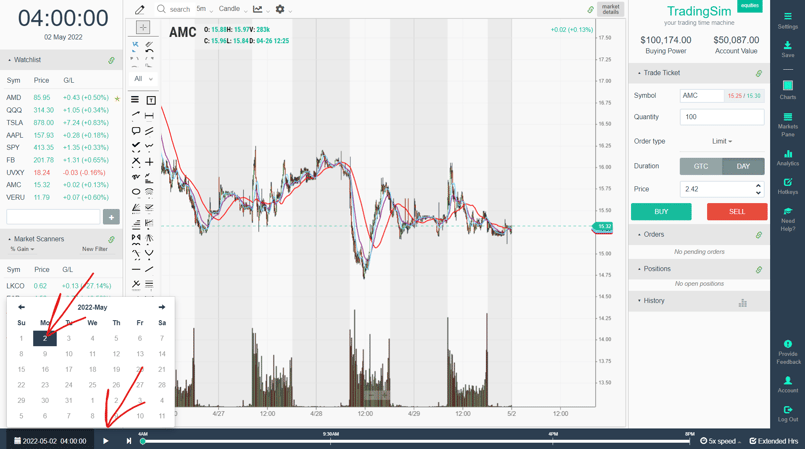

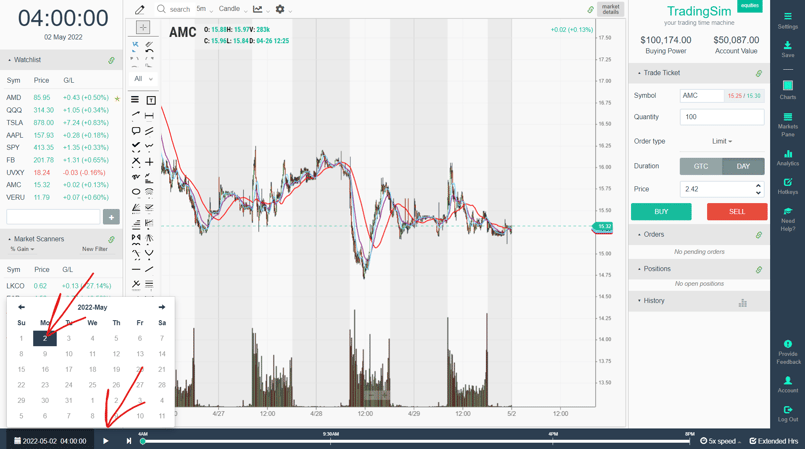

Replaying a trade in a simulator that allows this will depend on the platform. We have done a comparison of the most popular trading simulators with replay. Some require you to choose a day and download its data. Others do not.

Your only other option would be to record your screen during the day. This can be a difficult task when you have multiple screens and multiple chart windows open. It's also a burden to your hard drive and CPU.

Here at TradingSim, we've gone to great lengths to create an on-demand trading simulator with a replay that is both functional and easy to use. In order to replay a trade, you simply choose a day from our calendar, then type the symbol you want, and press play. It's that easy.

Is there a simulator for day trading?

Yes, there is. TradingSim is specifically designed with day traders in mind. While you can swing trade, our application is geared towards day trading. We are one of a very few day trading simulators on the market that has a scanner function for intraday stocks.

When you are searching for a day trading simulator, you want to be able to search for a handful of criteria. Here is what we recommend:

- The ability to replay trades outside of market hours

- A live scanner that allows you to filter gappers, volume, and more

- Realistic price action

- Level II quotes and a trading montage

- Dynamic charting abilities with multiple charts and indicators

- A watchlist

- Built-in analytics to discover your probabilities for success

There is only one simulator that checks all of these boxes: TradingSim.

How many people use stock trading simulators?

Thousands. There are millions of traders all over the world. Whether it is to practice forex strategies, futures, or stocks, there are many traders who practice using trading simulators. It is the quickest path to profitability.

There are actually thousands of students who use simulators as well. Many high school and university economics and finance classes require the use of simulators as part of their curriculum. Many of these students battle it out each semester for the pride of having the best-performing portfolio.

Is there a game that simulates the stock market?

The short answer is "yes". Just a simple google search will turn up a number of results for stock market simulation games. As we mentioned above, many educational institutions make use of stock market simulation games for their classrooms.

While we like the idea of stock market games, it's important to understand the difference between an analytical approach to studying markets through simulation and the fun of gaming. While both can be instructive and fun, we hope you find an application that actually fits your goals for trading.

Are stock market simulators accurate?

Yes and No. For all intents and purposes, stock market simulators go to great lengths to make their applications as realistic and accurate as possible. That being said, because there are no "real orders" being filled by real market makers, your actual orders are usually just filled on the bid or the ask in a simulator.

In a real market environment, you may experience "slippage," where your order isn't completely filled or filled at a higher or lower price than you expected. This is a normal part of trading. In a stock market simulator, you will get filled every time, no matter what.

For that reason, a stock simulator's accuracy varies only slightly from a real trading platform. Other considerations may be the data feeds you have for the simulator. Unless you have real-time data or a replay, you may have delayed price quotes to contend with.

Despite the differences, the benefits of a stock market simulator are not necessarily its accuracy, but its broader value in building pattern recognition skills and providing relevant outcome data on your strategies. We don't recommend worrying too much about the accuracy.

What is a paper trading simulator?

A paper trading simulator is really no different from a stock trading simulator. We get this question from time to time. Basically, "what is the difference between paper trading and a stock simulator?" Both are used synonymously these days when speaking about trading simulators.

Paper trading is just another term for taking trades without real money on the line. Kind of like Monopoly. It allows you to practice your trading by using trades on "paper" instead of real life.

Is paper trading good for beginners?

Yes, yes, and yes. Despite all the naysayers who will tell you that paper trading doesn't prepare you for the emotions involved in real trading, there is an incredible value to traders who begin by practicing with paper trading.

Paper trading may not give you the emotional fortitude to withstand the ups and downs of big PnL swings, but it can prepare you to know what strategies to use. Like our friend Dr. Brett Steenbarger has said before, if you don't enjoy practicing your craft when the stadium lights are off, you won't perform well when they are on.

Having a plan in the calm of the moment is different from maintaining and acting on the plan once we get punched in the nose!

That doesn’t make simulated trading worthless, however. Even the best boxers practice in the ring away from formal competition to work on their movement, their combinations, etc. Similarly, basketball teams prepare for the next game by scouting the opponent and then practicing against the offense and defense that the opponent is likely to use.

And, of course, where would a Broadway actress or actor be without practicing lines away from the distraction of crowds.

Dr. Brett Steenbarger, Ph.D.

Paper trading achieves the same end for you as a trader in training. You should always be practicing your craft if you expect to make it in the markets.

What is the best trading simulator?

The best trading simulator will be the one that allows you to not only practice trading in a realistic trading environment, but also with analytical tools, charts, and scanners. Nowadays, most brokers and charting platforms include some kind of trading simulator. But not all simulators are created equally.

We have done an extensive review of what we consider to be the best simulators on the market. These all have the ability to replay trades when the market is closed. But one stands out from the rest. Feel free to read this review here.

When searching for the best trading simulator to fit your needs, we suggest you follow these criteria:

Regardless of which simulator you go with, know that each will have its strengths and weaknesses. Some may be geared more towards investing with limited stocks in play. Others may be geared more towards day trading.

Is there a crypto trading simulator?

At TradingSim.com, we offer Bitcoin futures in our trading simulator. However, at the time of writing, we do not offer other crypto assets.

There are a few crypto trading simulators on the web. Etoro offers a demo account if you sign up with them. We also found https://testnet.phemex.com/ and https://cryptospaniards.com/simulator/. As a disclaimer, we have tested none of these products, so use them at your own risk.

What is the best free trading simulator?

We recommend giving our 7-day free trial a chance. As the best stock market replay application in the world, we think it is worth your time and money if you are serious about realistic simulation.

On the other hand, most brokers will allow you to use their simulators for free if you have an account with them. This can be a good path for traders who wish to get accustomed to their trading platform while not risking real money.

Whatever route you take, we hope your trading journey is profitable. If we can help you along the way, please check out our free resources here at TradingSim.com.

Day Trading Basics

Day Trading Basics