Trading As A Business

Answers to all your questions about how to get started with your trading business.

How To Set Up A Stock Trading Business From Home

Not many people approach stock trading like an ordinary business. Sure, they want to make gobs of money, and fast. But, rarely do you see the budding day trader plan out his trading business like he would any other brick and mortar startup. Perhaps this is why there are so many casualties in this industry – because very few treat day trading as a serious business.

It is no surprise. There are a myriad of advertisements across the internet offering get-rich-quick opportunities in the market. Gurus and furus offer their services for a nominal fee and promise millions, just like their best students have made. Heck, they even show you their brokerage statements to prove it!

But is it that simple? And what structure do these services provide for you? Do they teach you how difficult the path to success will be? Do they tell you how many students have dropped out of their programs on account of failure?

Better yet, do they provide a structure and a framework for how to plan your career, much like you would a business?

Day trading without a true business plan is a lot like gambling. You say to yourself, I’m going to throw my life savings at these internet gurus’ wisdom and hope for the best. A year later, you’ve probably coughed up half your savings, if you’re lucky to still have any.

Let’s just hope you kept a side gig in the process.

Such is the plight of many aspiring entrepreneurs in the trading world, unfortunately. So, in this post, we’ll lay out for you just how treacherous the path can be, and offer you a better structure to kick-start your trading business.

What Is a Trading Business?

A trading business is like any other business. You may decide to incorporate or act as a sole proprietor. Regardless, starting a day trading business is very simple. All it takes is applying with a brokerage and loading money into your trading account. For that reason, it can be a dangerous business to start, with such a low barrier to entry.

Just like any other endeavor, you’ll be required to pay taxes on your profits. However, there are certain limitations to the tax rules for day trading that you should be aware of. We will touch on these in a moment, but suffice it to know that like other businesses, you will need to be aware of what write-offs can apply to your business along with the short and long-term capital gains you’ll be responsible for.

Unlike a brick-and-mortar business, you don’t need anything but a computer or mobile device to start a trading business. You won’t have the expense of restaurant equipment, medical malpractice insurance, or the headache of managing employees. These days you can place a stock order with iPhone apps or more advanced trading software on computers. That and an internet connection are all you need to get started. Literally.

But just as buying stoves and ovens, tables and chairs, and having the best recipes in the world won’t guarantee a successful restaurant business, so having the best computer, broker, or guru won’t guarantee you’ll make money in the market.

Why You Need a Trading Business Plan?

One of the most overlooked, yet most important parts of a successful trading business, is the trading business plan. Why do you need a trading business plan? For a handful of reasons:

- It will force you to research your business and the likelihood of success.

- A trading business plan will help you stay grounded with realistic expectations.

- During the rough times, it will guide you into re-evaluating your process.

What Are the 6 Elements of a Good Trading Business Plan?

Every business needs a business plan. Usually, you’ll have an executive summary, description of your team, products/services, market outlook, financials, etc. But for trading, the variables are a bit different. Your team is really just you, with some exceptions. Your product is your trade plan, and your financials are just your available capital.

Let’s look at each of the 6 elements of a good trading business plan more in-depth:

1. Your Trading Purpose

We’re big proponents of purposeful trading. Everyone’s “why” is going to be different, but it’s important to lay this out. It doesn’t have to be for anyone but you. That being said, the more you think about why you want to trade, the more it should motivate you to succeed at it.

Every entrepreneur has a why or a purpose for what they do. Could it be as simple as “making more money?” Sure. But we’d encourage you to dig a little deeper and find more than just that. Here are some examples of why you might want to start a trading business:

- To work for yourself

- Increase wealth

- Learn a new skill

- Spend more time at home

- Be available to your family and friends

- Have the ability to give more

- Pay off debts

There are many reasons why people trade. Spend some time thinking about why you want to start a day trading business and write this down, mull it over, and expound on it. The more concrete your reasons become, the more tangible your efforts will be to achieve success.

Think of them like outcomes. Sure, profitability is the ultimate goal. But what does profitability afford you? Time? Love? Charity? This should be the start of your trading business plan.

2. Your Trading Process/System

Would you open a new restaurant without a menu? How about a proven recipe? Would you just run to the grocery store every day and cook up whatever you felt like that night? Absolutely not.

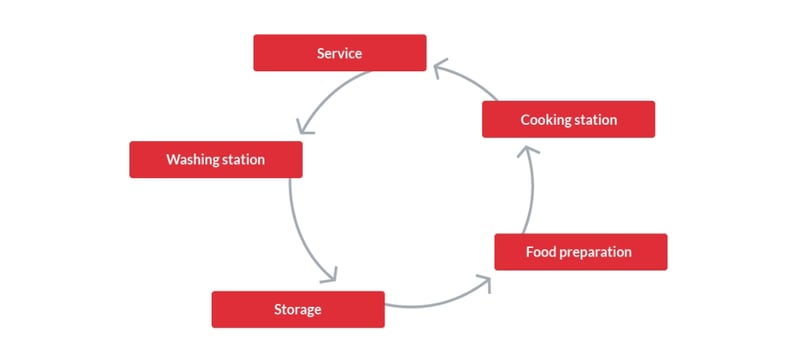

Restaurants work well if they are scalable in a very systematic way. It all starts with the layout of the kitchen. The grill is on one side, the sauté in the middle, and the food prep, washing and storage in another area. Depending on how fancy you get, you’ll have a salad prep, dessert, coffee area, etc.

It’s all designed to flow in a cyclical rhythm to keep things running smoothly.

The menu also very rarely changes in restaurants, unless the chef adds a special here or there. And the recipes are often guarded secrets that never change. Perhaps seasonal offerings will vary, but the staples of the restaurant are usually known and predictable.

So should your trading system be.

In your trading business plan, you must lay out not only the strategies you will use, but in what type of market those strategies will work well. Get the seasonal allegory there?

You see, trading the markets is a lot like other businesses in that the more systematic you are the more consistent you’ll be, and the more your patrons (your profits) will want to come back and dine with you.

Screw around with too many recipes (strategies) at once, come to the market disheveled, unorganized, and unprepared, and you’ll end up with a kitchen in chaos, customers walking out the door, and your profits disappearing. It has to be a well-oiled machine.

To avoid chaos, this section of your trading business plan should involve a Trade Book. We’ll discuss your trade book more in-depth below.

3. What Risks/Costs Are Involved in a Day Trading Business

Starting a new business is risky. There’s no way around it. If you want to get ahead in life, you’re going to have to risk something: money, time, failure, other opportunities.

Humans crave security. But trading markets doesn’t provide that. It provides uncertainty.

Now, you may be thinking that if you make a million dollars in the stock market then you’ll have security. And that may be true. However, the odds of success are not in your favor. And as a rule of thumb, the market is a game of uncertainty at its very core.

In order to win, you must learn the science of probability and the need to overcome your own human emotions. Couple that with an artistic sense of intuition and discretion, along with a favorable market condition, and you might be successful. As part of that, outlining what risks and costs are involved in your day trading business would be a good place to start.

We recommend that you consider the following when calculating your risk/costs

- Computer and other hardware costs

- Software fees, charting tools, scanning software, etc.

- Broker fees: commissions, short locate fees, ECN fees, etc.

- Educational courses, books, and materials

- Chat room/mentorship subscriptions or service fees

- Maximum drawdowns in your account

- Time associated with being in the market (9:30am - 4pm EST)

- Extra time devoted to review, study, and analysis

- Re-investment of capital

- Funds to top up your account

- Time frame needed for profitability (Most traders, like businesses, take 2-4 years.)

These are just some of the costs and risks associated with trading. If you end up with a catastrophic loss, how will that impact your trading business plan?

While there are many free resources available to traders, we’d venture to say that most traders will spend many thousands of dollars just learning how to trade – not to mention how much they lose in the markets.

Obviously, we’re big proponents of learning how to trade the safe way – in a simulator. Unfortunately, most new traders like to learn the hard way. Whichever way you go, we encourage you to keep your costs and risks in check. Outline them and budget for these items long before you pull the trigger on your trading business.

4. How Much Starting Capital Do You Need For Your Trading Business?

Before we answer this question, we cannot stress enough how important it is to first PROVE that you can trade consistently in a simulator for many, many months. Funding your trading account is not the first thing you need to be thinking about.

Spending time in a simulator is the first thing you need to think about. Period. Spend the time necessary to backtest and outcome test your strategies in our analytics here at TradingSim. You can trade the market for the past 3 years at any time, testing your strategies.

Once you’re successful and consistent, then think about funding your account.

There, now that we’ve gotten that out of the way, let’s talk about funding your account.

What Is the Pattern Day Trading (PDT) Rule?

Assessing how much money you need to start with depends largely upon your financial standing. The Pattern Day Trading rule was enacted shortly after the bull run of 1999-2000. It limits how many day trades you can make within a 5-day period to only 3 — that is, if you’re account is below $25,000.

This is something to consider when you fund your account. If you plan on day trading, starting above $25k might be wise. That being said, we’re big proponents of proving to yourself what you can do in the market before you add to your account.

We’ve written before about the PDT rule and ways around it. There are options like offshore brokerage accounts, opening multiple US-based cash brokerage accounts, etc. We won’t dive into that here, but if you’re unfamiliar with these options, be sure to check them out.

As a general rule, start small. Start small enough that your account can grow without the headaches of forced errors due to having a small, restricted account. But not big enough that it will cost you dearly if you make rookie mistakes.

And trust us. You’re going to make rookie mistakes. Plenty of them.

Generating Income During Your Early Trading Days

For your business trading plan, be sure to outline what you will do for income. It takes most traders many years to reach consistency in the markets. And by consistency, we mean being able to not only make a living but also continue to bankroll your trading account.

To that end, take the stress off your shoulders by trading part-time until certain goals are reached. Or, if you decide to go full-time, be sure to outline your expenses, and the amount of savings you will need to set aside for 1-3 years of ups and downs in the market.

In addition, lay out your contingency plan. Define ahead of time what you will need to do if certain milestones aren’t reached.

Lastly, discuss this with your partner. There’s nothing worse than having your family responsibilities jeopardized because of a whimsical and ill-planned trading business. As the saying goes, err on the side of caution. Imagine the worst, then double that, then add a little more on top.

That’s the kind of “risk” cushion you need for your trading business.

5. Define Your Trading Team

Every good business has a good team. Whether it is a board of directors, consultants, or management team; the best businesses have good leadership. Organize your trading business the same way.

Granted, your trading business won’t be structured the same way your normal business is structured. You’re the only one responsible for clicking the buy and sell button in the market. However, there are people you can add to your team to help you along the way.

How To Find a Good Mentor for Trading

Finding a good mentor in stock trading is easier to find nowadays. There are a lot of “mentorship” services available online. Not all of them are created equally, though.

When you’re searching for an educational service or mentorship, we recommend taking your time. Think of it like car shopping. The best car buyers do their research online first, narrow down what they want in a car: brand, price, color, miles, trim level, etc. Then, it is a matter of heading to the dealership to test drive, ask questions, etc.

Just like a dealership, you’re going to find hungry salesman wanting “to do business with you today!” But you need to be on guard. It’s your money, your experience, and ultimately your decision. Stand your ground and always take everything with a grain of salt.

Look at online reviews like TrustPilot. Ask around on Twitter. Look under the hood with “trial” memberships. Really do your due diligence. Yet, understand that no mentorship or educational service is going to be perfect.

In fact, you should go into each educational service expecting to learn something new from as many mentors as possible. In this way, you’ll learn that your biggest asset is being your own trading coach.

Now, to bring this full circle for your trading business plan, do your research first. Outline the top 10 trading educators you can find. Exhaust yourself with the effort, then narrow down your results to the top 5. Start there, and give yourself time to work through your list.

In your trading business plan, identify which services you will try and which ones you might avoid.

Also, include non-trading mentors in your business plan. Perhaps your spouse, a close business friend, or a confidant can provide a fresh perspective. And one of the best ways to find a team is by picking up trading buddies along the way. All of these educational services have tons of people just like you. Reach out to them and try to connect!

We would also be remiss to not recommend a good psychology coach. We’re big fans of Dr. Brett Steenbarger and his books. Don’t go without them.

6. How To Grow Your Trading Business

This section of your trading business plan may not fully materialize until you are well on your way to consistency in trading. You see, the path to success in trading looks something like this:

- Lose a lot

- Lose less

- Break even

- Make a little

- Profit more

- Make big money

You won’t really know how to make big money unless you find a system that is scalable. In fact, many millionaire day traders find themselves at a place in their career where they have to adjust their strategies because their accounts have become too big for the strategies they used when their accounts were smaller.

While this isn’t something you should worry too much about early in your career, it should be in the back of your mind.

Typical businesses require some form of marketing to grow, right? Not only that, but they need a scalable system. Build a successful restaurant, systematize its operation, then you can turn it into a franchise. Voilá!

Trading is very similar. The market is all about compounding your profits. When you find a scalable trading system, you’ll want to spend the necessary time growing it. This requires having the right strategy, the right risk management, proper experience, and the emotional capacity to trust your system despite larger account swings up and down.

Keep this section of your trading business plan open. Add to it as you evolve as a trader and your strategies evolve. Conduct research on what the largest players in the market do to compound their large gains.

How to Start a Stock Trading Business

Now that we’ve outlined the 6 best elements of a successful trading business plan, let’s get into the nitty-gritty of creating your day trading business. We’ll uncover topics like how to create a trade book, the best tools for your trading business, and more.

Create A Trade Book for Trading Strategies

Essential to your trading business is your trade book. Aside from your trading business plan, this is hands down the most important part of your trading business. Every trader should have one.

What Is a Trade Book?

A trade book is a compilation of your trading education, style, strategies, statistics, rules, and more. It is a road map for where you want to be as a trader, and how you are going to get there. It will take a lot of the guesswork out of trading and ground you in a tested strategy.

That is not to say that your trade book is set in stone. It will undoubtedly evolve as your career progresses. Along the way, you’ll want to add bits of information, evolved strategies, and more.

A trade book should be a document that you keep handy and consult frequently to ensure that you’re trading according to the process you have outlined for yourself. This will keep you from the pitfalls of overtrading, trading less than stellar setups, and falling off the bandwagon into “style drift”.

What to Include in Your Trade Book

Everyone’s trade book will be different. However, at a minimum, you should have all the criteria and information you need to execute trades successfully each and every day, from start to finish.

Here are a handful of items you should have in your trade book:

- Your trading “why”

- Education materials

- Current areas of improvement needed

- Strengths

- Your trading edge/strategy

- Trading rules for your strategy

- Sample trading plans (can be for multiple setups)

- Money management rules

- Trade management rules

- Best trade examples with annotations

- Worst trades with annotations

- Any data or statistics to support your trading edge

Let’s take a look at a few examples of these 10 trade book chapters and how you can flesh them out for your own purposes.

1. Areas to Improve and Maintain Discipline

This section of your trade book will need to be updated from time to time as you grow as a trader. The goal here is not to be hard on yourself, but to be realistic with the weaknesses you are showing in your trading.

Here is a snapshot of a personal list of things that this author wrote in his own trade book:

- Tendency to enter trades before technical criteria are met

- Exhausting myself before the move I want occurs

- Limiting my profits by being happy with getting back the money I lost on the trade

- Going in with too much size without the A+ setup revealing itself

- Lack of patience and management once a trade is going in my favor

- Impulsive entry or exits based on time frames that are too low to base decisions off of

- Making decisions based upon p/l

- Internalizing bad performance

- Overtrading in an effort to time the entry perfectly

- Being aware of the Alpha mindset that wants to force trades

- Resetting after every trade

- Breathing exercises for calmness and relaxation

As you can see, there are a lot of issues facing traders. Some of these may affect you, or you may have your own set of struggles to overcome. As you trade, keep a journal to jot down the weaknesses you want to work on, and set a goal each week to tackle those issues.

2. Explaining Your Edge/Strategy in the Market

This is another important aspect of your trading book, perhaps the most important. The goal of your trade book is to define how you trade, what you trade, and when you trade so that you stay rooted in a systematic approach to your trading business.

Your edge will vary, but here is an example of what your edge description might look like in your trading book:

My edge is a combination of things that involve a certain sentiment on the daily time frame, followed by smaller time frames. Here are a handful of what I consider my edges:

- Reversals off daily/weekly moving averages, usually in bear or bull flag formations.

- Trading Range springs and upthrusts, or Mean Regression trades

- Wyckoff Wave Patterns that consolidate into a tight price action with Volume Dry Up (VDU) and pocket pivots as entry points waiting to take off.

- Parabolic reversals intraday

- Shorting manipulated low float stocks that are very extended

Within these, my trading strategies for entries remain the same as outlined below in the Trading Plan section. I am looking for the exact same entries on any time frame.

Once you broadly define your edge like this, you will also create a solid trade plan on how you execute these strategies. But before we get to that, you should also take the time to set your trading rules.

3. Trading Book Trading Rules

For your trading rules, we suggest you take time to think about what time you’ll trade, your position size, any mental hacks you need, stop loss criteria, and more. These can be broad or very specific. It will be up to you to tweak this over time to find the set of rules that work best for you.

A great example of a set of rules for trading is found in a book called The Complete Turtle Trader by Michael W. Covel. In this book, Covel uncovers the amazing story of how a small group of traders became millionaires by applying to Dennis Richards's experiment for training traders to become successful by following his strategies.

Richards was a floor trader for the Chicago Mercantile Exchange who made 10s of millions of dollars in the 70s and beyond. His “turtle traders,” as he called them, were given a set of rules to follow that looked like this:

- Entry: Buy when the price breaks above the 20-day high

- Stop loss: 2 ATR from the entry price

- Trailing stop loss: 10-day low

- Risk management: 2% of your account

- Vice versa for short trades

They were trend traders and the rules were very simple. However, your rules might be very different and more involved. Here is an example of a few typical rules that traders like to follow:

- Always cut your losses quickly

- Never average down on a losing trade

- Take profits at 20-25%

- Maintain at least a ⅓ risk/reward ratio

Again, this is just a small sampling of rules. It will be up to you to determine the rules you need in place for not only your strategy but your mindset and personality as well. This will help you keep your trading business going for the long haul.

4. How to Create a Trading Plan

We go more in-depth on how to create a solid trading plan in our tutorial found here. Nonetheless, the best trading plans will discuss the following topics in greater detail:- Daily Max Loss

- Daily Profit Goal

- Stock Change %

- Stock Catalyst

- Volume Metrics

- Float

- Average True Range

- Short %

- Exchanges

- Relative Volume

- Indicators needed

- Confirmation of strategy

- Entry Signal

- Stop Loss

- Target

- Trade Management Rules

Fill out all these metrics and you’ll be well on your way to having a solid trading plan. Be sure to really flesh out the details of each criteria, and then give examples of trades that fit these criteria.

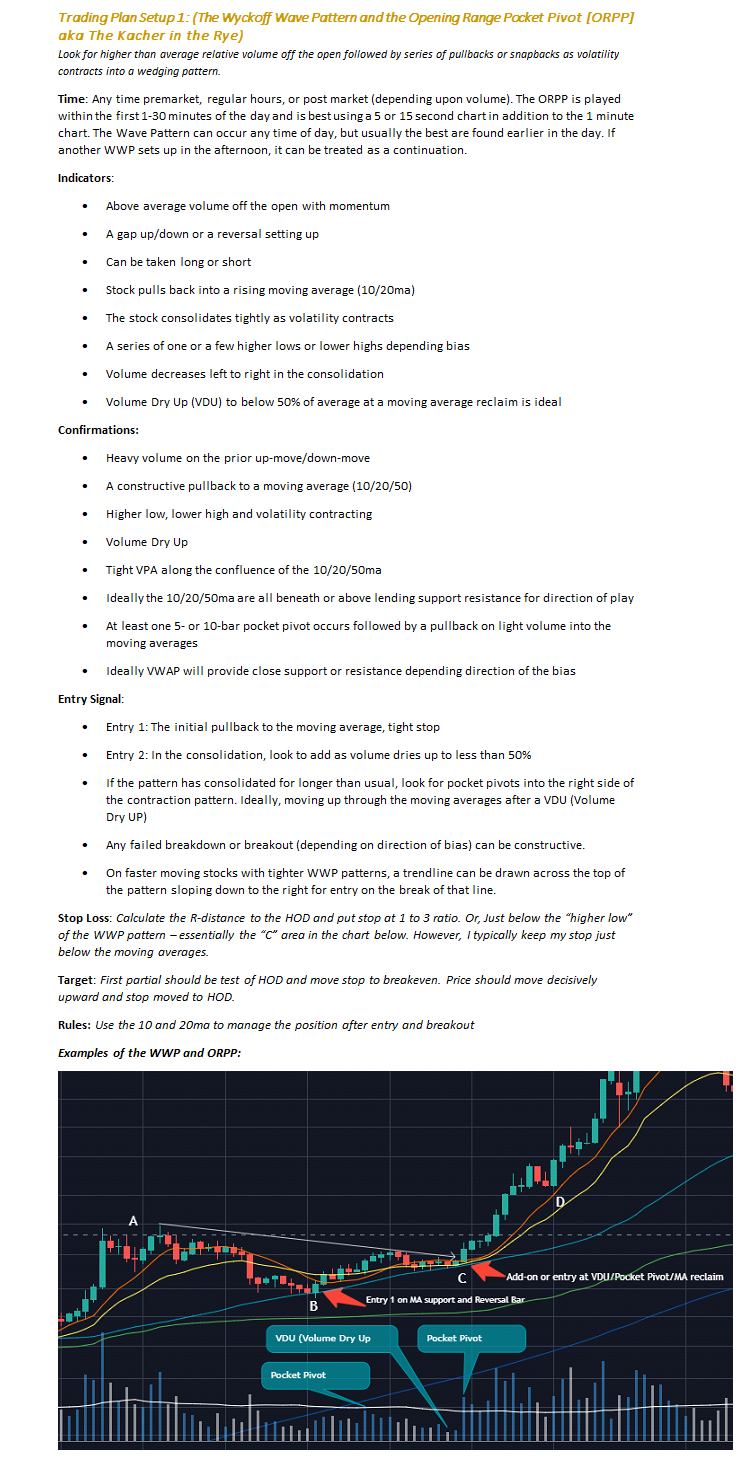

To help visualize this, here is a snapshot of a trade book trading plan:

5. Money and Risk Management for Your Strategies

No trading plan is complete without defining your money and risk management protocol. Every trade might be slightly different, but as a rule of thumb, we recommend only risking about 0.5-2% of your entire capital on any given trade.

Here is an example of how you might define your risk management strategy for shorting a head and shoulders pattern:

Risk Per Trade: $450 or HOD, whichever comes first

Profit Target Per Trade: $1000 +

Max Loss Per Trade: $750

Trade Limits:

- Give the stock enough time to bounce and fail and return back into the trading range.

- Look for a squeeze before a drop if the stock feels weak

- The earliest entry can be on an “undercut and rally” or “overthrow and drop” if momentum is really waning.

Time Constraints: Pre/Post and Normal hours depending on volume, after 10:30am usually the best

Stop Loss Mechanism: Hard stop just above High of Day (HOD) and LOD on early entry. Hard Stop just above higher low / lower high on “right shoulder” entry.

Break-even Win%: This will depend on your statistics with the trading strategy.

6. Use Statistics in Your Trading Book

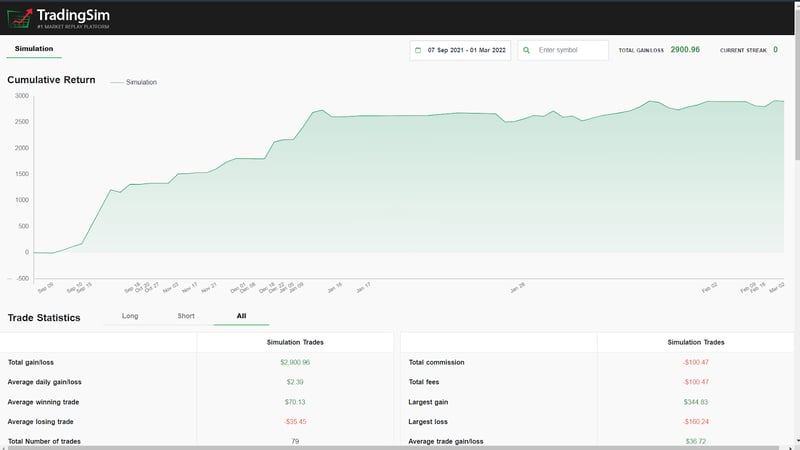

One of the absolute best ways to determine your chances of success on a strategy is to test it in a simulator by outcome testing your results. At TradingSim, we have the analytics that allow you to do just that.

As you test your strategies and begin to populate your trading book, be sure to include the statistics you’ve found in the simulator for each edge that you document.

Studying your winners and losers based upon the specific strategies you use will give you the confidence to take these trades in real life. So be sure to specify your win rates and any caveats for your strategy by testing these outcomes in a simulator first.

Day Trading Computers and Monitors

If you’re going to be a day trader, you’ll need a decent computer and a monitor. While we’ve heard of people day trading on their phones or iPads, it’s less than ideal.

The reason for this is that you need to not only be able to analyze charts in real-time, but you may need to check other data as well. You’ll need screen space for your broker, your charting platform, any newsfeeds or chat rooms, twitter, etc. A solid computer and multiple monitors make this more efficient.

Likewise, you’ll probably want multiple chart windows up simultaneously. This helps you keep track of the movements in individual stocks as the day progresses. Not having screen space for this might result in missed trades. And we wouldn’t want that!

Day Trading Stock Brokers

While we are not in the business of recommending stock brokers, this will be a key component of your trading business, so the decision shouldn’t be taken lightly. We recommend that you try many different brokers and do your own research before pulling the trigger on one.

When you are picking the right broker for day trading, you want to consider the type of trading you want to do. For example, many day traders like to short. In order to do this, you will need a broker with a solid list of shortable stocks. Not every broker will have this.

Consult with your broker and ask around the net for answers to some of the following questions:

- Do you have a good list of hard-to-borrow stocks?

- What trading platform do you provide?

- Are pre-market and after-hours trading allowed?

- What are trade cut-off times?

- Do you have margin, and what are the rates?

- What is customer support like?

- Does the platform include a mobile app?

At the very least, you should be able to demo their product to get a feel for it and decide whether or not it is a good fit for you and your trading style.

Charting and Trading Platforms

While many brokers will include a charting and trading platform, you may find that their charts don’t satisfy your needs. After all, there are quite a few standalone charting services available that cater specifically to charting, regardless of brokers or trade execution.

Many traders will run their charting platforms as a standalone so that they can employ unique trading indicators and technical analysis tools that their broker might lack. This can empower your trading, enabling you to dive deeper into volume and price action without needing a clunky brokerage chart.

It also frees you to choose which broker might provide the best service or execution independent of their software.

Trader Tax Accounting

There are two things guaranteed in life, death and taxes, right? Well, day trading has the potential to rack up a lot of taxes, so you’re going to need an accountant who knows what they are doing.

Making a few investments here and there can easily be handled by your typical CPA. However, there are a lot of rules and regulations involved with actively trading. Wash/sale rules, what constitutes an active trader, marked-to-market rules, and many other things can affect your status and tax liability as a day trader.

For that reason, we recommend you hire a professional who knows what they are doing before you jump into trading. Be sure to consult with them on your other businesses, how much you plan to trade, and any other income sources you have.

While we don’t recommend any specific accountant over another, there are a few trading-specific accountants that we know of:

https://tradersaccounting.com/

https://tradertaxcpa.com/

https://greentradertax.com/

Use them at your own discretion and risk, but understand that reconciling thousands, if not hundreds of thousands of trades, takes specialized software and accounting. You might be able to figure it out on your own by using https://www.tradelogsoftware.com/. But the help of a knowledgeable accountant is always advantageous.

Finding a Day Trading Community

Day trading is a lonely business. You’re sitting at your desk for hours on end, pouring over charts and data. Not only that, but you will experience emotional highs and lows during this process. To that end, we recommend that you find a good day trading community to support you.

We’ve written before on chat rooms and how to make the most of them, so be sure to check that article out. In it, we discuss the role that chat rooms play in the market and in trading development.

Not all chat rooms or educational services are created equally, though. So, be sure to vet services properly and as inexpensively as possible until you find one that resonates with your style of trading and social interaction.

Being a part of a community also serves as an accountability tool in the market. A good business will likely have some type of review board that oversees and provides accountability for the business.

In trading, you’re responsible for your own actions. And, for that reason, it would be ideal for you to have a trusted group of trading partners that you can bounce ideas off, conduct review sessions, and keep yourself on track both mentally and professionally.

The Best Simulation Software for Your Trading Business

While we may seem biased, we truly believe that this piece of the puzzle is one of the most important and overlooked aspects of day trading. So many traders are willing to risk their hard-earned cash before they have a proper understanding of how markets work. It is irresponsible and risky, at best.

Here at TradingSim, we offer the best simulator for market replay, simulation, and analytics. Unlike most stock market simulators, we allow you to replay Level 2 and intraday data for up to 3 years. As a day trader, you’ve got the ability to “relive” the market as much as you want, and when you want.

Because day trading can be both systematic and discretionary, you’ll enjoy the built-in analytics software that TradingSim offers. In order to test your trading skills and outcome test your performance on a specific strategy, you’ll need this. Any great trader knows the power of statistics. Be sure to spend time in the sim testing your process before entering the market with real money.

Not convinced? Don’t take our word for it. The most prolific trading psychologist in the world has this to say about simulation trading:

Indeed, it’s often because of our need to make money and our overconfidence that we pursue shortcuts in our learning processes as traders and take too much risk. That leads to volatility of P/L and losses, which in turn trigger our nervousness, tension, stress, fear, and worry.

What I’ve long liked at TradingSim is the focus on learning trading–and doing that in safe ways where we can’t trigger and traumatize ourselves.

Think about every performance field: athletics, acting, music. In none of those do we start out by following people online, doing some reading, and then trying to make a living from our performance. Rather, we recognize that it takes years of practice and mentoring to become a professional athlete, movie star, or recording artist.

When we take shortcuts in the development process, our unrealistic expectations set us up for disappointment, frustration, and pain.

Many, many times the answer to emotional disruptions in trading is to work on our trading.

Dr. Brett Steenbarger, Ph.D.

What Are the Best Day Trading Courses?

Day trading courses abound on the internet. You can find free ones on YouTube, or pay tens of thousands of dollars to join “exclusive” day trading clubs, services, and challenges. There are also many books written on day trading and the many different styles of trading.

Though we won’t recommend one over the other, what we do recommend is that you spend as little money as possible to begin with on education. The internet abounds with free resources. We’re even dedicated to helping the cause here at TradingSim with our blog and educational material.

That being said, once you’ve scoured the net and read as much as you can, we do recommend trying as many services as you can comfortably afford that cater to your desired style of trading. If it is shorting small-cap stocks and momentum, find a good trading service that teaches you how to do this.

Regardless of the style of trading, we recommend that you use discretion to find a trading course that offers an approach to tape reading, volume and price analysis, and trader development. Study some of the great ones, like Richard D. Wyckoff. You won’t go wrong with an understanding of sound technical analysis, which you can apply to any style of trading.

Finding a System for Your Day Trading Business

As part of your educational growth and development, you’ll eventually need to land upon a solid system. For example, if it is the methods of Wyckoff that truly speak to your style of trading, then perhaps you want to establish a trading system solely dependent on springs and upthrusts.

You’ll learn more about what makes springs and upthrusts work so well inside trading ranges if you spend the time necessary to develop a trading system based on these strategies. Here is an example of what this might look like on a chart:

Spring

But this is only one example. We discuss these types of price action trading strategies more in-depth in another article. And if you’re struggling to find a “system” for your trading, be sure to give our post on “how to find an edge” a quick read.

Keeping a Routine Schedule - Just Like Normal Employees

If you’re going to be a professional day trader, you need a professional routine. The markets open and run from 9:30am until 4pm EST every single day. You need to be there, obviously.

Routines may stifle creativity or balance if taken to extremes, but your need for routine in the markets will depend largely on your trading system. For example, if your system requires you to be present at the opening bell, then you might need to wake up early, have an exercise routine, do some meditation, then research the morning movers for that day in the pre-market.

This kind of routine will allow you to come to the market prepared. Less preparation = Less profits in the long run. Without plans, your system is really just a series of impulsive and reactionary trading ideas that may or may not work. In essence, don’t be a gambler.

The more routine you become in your trading business, the more disciplined you will become. Likewise, the more disciplined you become, the better chance of success you will have.

Here are some tips we recommend you adopt in your routine:

- Rise early in the morning

- Feed your brain and your belly

- Exercise before the day begins

- Arrive at your desk at routine time each morning

- Give yourself plenty of time to research the day’s trades

- Plan your trades before you take them

- Allow for breaks midway through each day

- Balance your work life with family time

- Leave room for review each day

- Become self-aware as to how healthy your routines is

- Be willing to change certain aspects of your routine

No matter the routine, it is imperative that you treat yourself well and pay attention to your mind and body. Day trading can be a destructive career if you don’t.

Parting Thoughts on How to Start a Trading Business

We hope this has helped you gain a proper understanding of what it takes to run a day trading business. While many different factors can affect the success of a new business, giving yourself the best chance of success from the outset can make a huge difference.

Take great care that you don’t embark on this journey lightly. Treat it with utmost respect and diligence, just as you would any other endeavor as an entrepreneur. And if we can help you along the way, please reach out to us. We wish you the best!

Love these and want more?

Stay in the know

Make the most out of every trade!