Trading Strategies: they’re infinite. But, thankfully, you don’t have to know them ALL! And that’s what we are here for. Standing at the ledge of your trading career before jumping in can seem scary, and the pit of information so deep. However, it doesn’t have to be that daunting.

Sure the learning curve may seem steep. As we’ve said before, it’s a lot like learning a new language. And that’s not an exaggeration. Think about how hard it was to learn a new language in school. How many years did it take to reach some level of fluency? Did you give up along the way?

Learning the markets is no different. Thankfully, we have the benefit of many proven trading strategies to help us along the way. They’re a lot like knowing when to use verbs, when to use nouns, and how to put the whole sentence together. When you learn this trading strategy, that trading strategy, and can see the big picture trade plan, it eventually all comes together.

But, where do you start? Well, there are no right or wrong answers to this. The bigger question is: will you start? And if you do, how far will you go? And, to that end, we’ve compiled this Trading Strategies 101 so that you can get a taste of what some of the most popular strategies in the market will look like. In turn, you can judge for yourself which path you want to take for further education.

After all, learning never ends in the market. It is ever-evolving. So, stay on your toes, and let’s dive in to some of the best trading strategies available.

Futures Strategies

What Are Futures in Stocks?

Futures are a type of derivative in the markets. What makes them a derivative? The value of the contract is “derived” from the underlying asset.

They aren’t actually “stocks.” Unlike equities, you aren’t buying a share of a company, per se. Instead, you are buying a contract. And that contract is an agreement between buyers and sellers to make the transaction at the close of the expiration date on the contract.

Unlike stocks, futures require you, the buyer, to take possession of the underlying commodity when the contract expires. For example, if you are buying December gold futures, your contract will expire at the end of December and you must either take possession of the commodity or its cash equivalent, which will depend upon the exchange in which the contract was bought.

That being said, for all intents and purposes, futures are bought and sold much like stocks. They are an opportunity for speculators to bet on prices going up or down in a certain commodity or index. Also, they are often used as a hedge for other portfolio positions like stocks. In fact, there are quite a few issues that you can trade as futures. Here are a handful:

- Metals futures for gold, silver, nickel, copper, etc.

- Index futures for markets like the Dow, NASDAQ, and S&P500

- Commodities like wheat, corn, crude oil, soy

- Currency futures, Bitcoin futures, and treasury bonds

Regardless of what futures you buy or sell, you’ll want to make sure you have a good understanding of the dynamics of supply and demand, technical analysis, and even world events. We’ll discuss futures strategies in a moment.

How to Trade Futures

There are many strategies for trading futures, but you must first begin with a broker who offers futures trading. There are plenty to choose from and we won’t go into them here. Instead, let’s discuss the ramifications of margin, speculation, buying and selling, and hedging.

Most brokers offer traders the ability to trade using margin. In other words, your buying power is leveraged with only a small amount of upfront capital. This allows you to trade contracts without putting up 100% of the value of the contract. Some brokers will give you 20:1, others 100:1, or even higher leverage to your initial deposit.

As we’ve said before, this can be a Catch 22. Know what you’re doing, or that amount of leverage will eat away your account quickly.

Speculating on futures is one of the more popular ways to trade futures. It is like any other speculation. Buy a contract betting that it will go up in price, and you will have a profit once you sell the contract. You can also trade futures to the short side, betting on the price of a commodity to go down. We call this short selling.

If you sell a futures contract short and it goes down in price, you’d then cover your short position and take a profit.

Lastly, many institutions and traders trade futures for the purpose of hedging. Hedging is a fancy term for protecting your positions in the market. As an example, let’s say you have a long position in the S&P500. As a longer term investment vehicle, you expect the S&P500 to continue upward. However, in the short term, you expect it to make a correction and go downward.

In order to protect your long term position, you short sell the S&P500 futures until the correction is over. This hedges you from any real losses in your main portfolio.

Futures Trading Strategy

Much like the world of stocks, there are tons of futures strategies to choose from. Some are quantitative, some are discretionary. Regardless, most futures strategies are going to be based upon repeatable patterns. Along those lines, let’s discuss the importance liquidity zones, and use an example of a reversal strategy to illustrate how to trade futures.

Liquidity zones are areas on a futures chart that tell you where big players are either accumulating or distributing their contracts. Typically price will congregate in these areas as long as their is supply or demand present. However, once supply is exhausted, or vice-versa, price will move away from the area in the direction of least resistance.

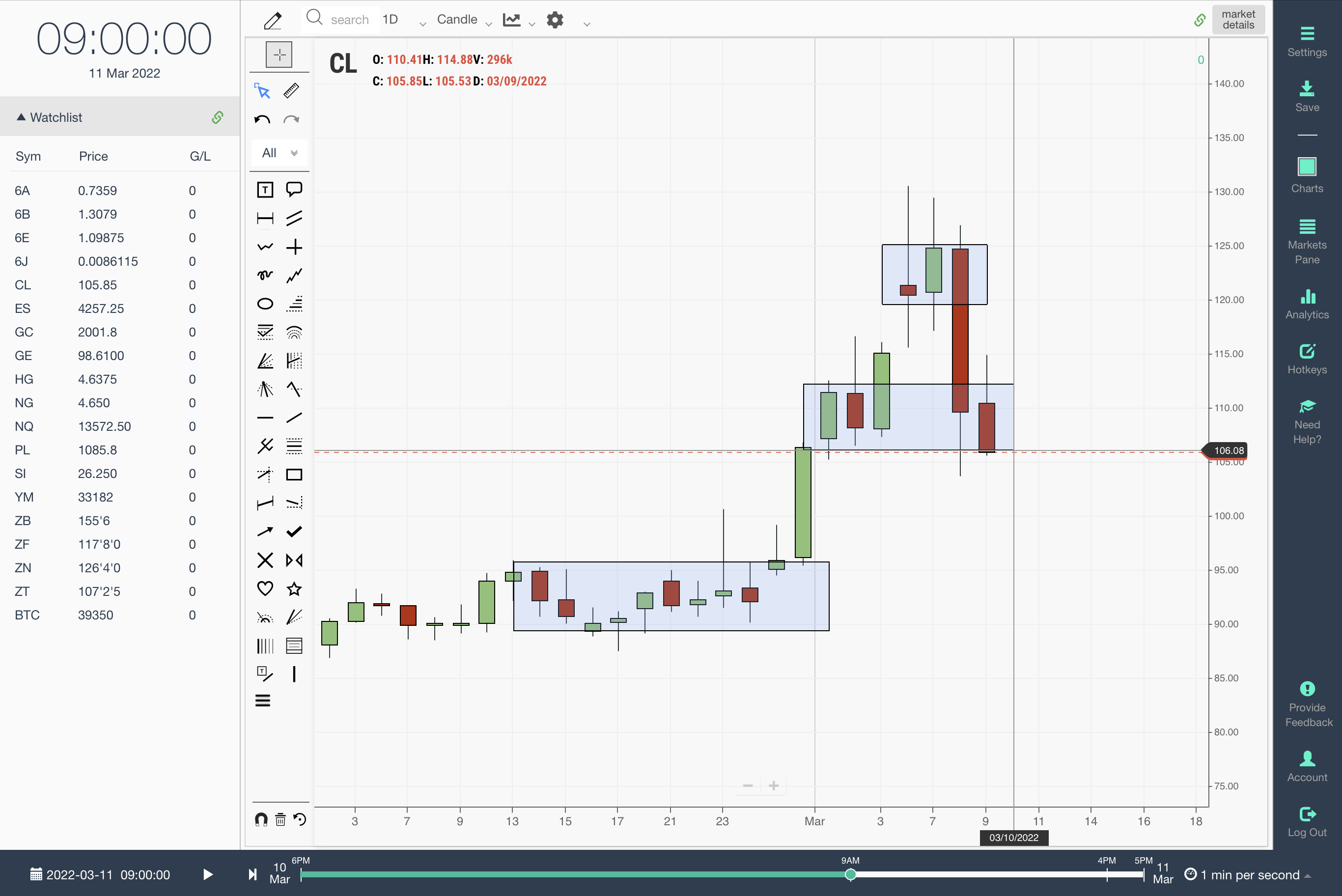

Take a look at this daily chart of Crude Oil Futures:

Notice the key liquidity zones that we have highlighted with rectangles. When a futures contract is under accumulation, it will often remain in an area long enough for institutions to accumulate contracts. Once enough contracts have been bought, the price is marked up. Hence, you see how price moves higher out of these liquidity zones.

In contrast, when the price of a commodity has gotten too extended, you are liable to see distribution of those contracts that were accumulated at much lower prices. The result is “ease of movement” back to the liquidity zones that supported to the issue before.

Finding a Setup within a Futures Trading Strategy

Now that you’ve seen the big picture idea of how a futures asset can move, you’ll want to add a pattern, or “setup” to your arsenal. This will give you a way to define your risk before you take a position, long or short.

For an example, let’s look at the long side.

We’ve written about the volatility contraction pattern and short traps before. The volatility contraction pattern is usually an indication of great demand in a commodity, stock, or other asset. It reveals that supply is hard to come by and that demand is steadily supporting the price of the asset.

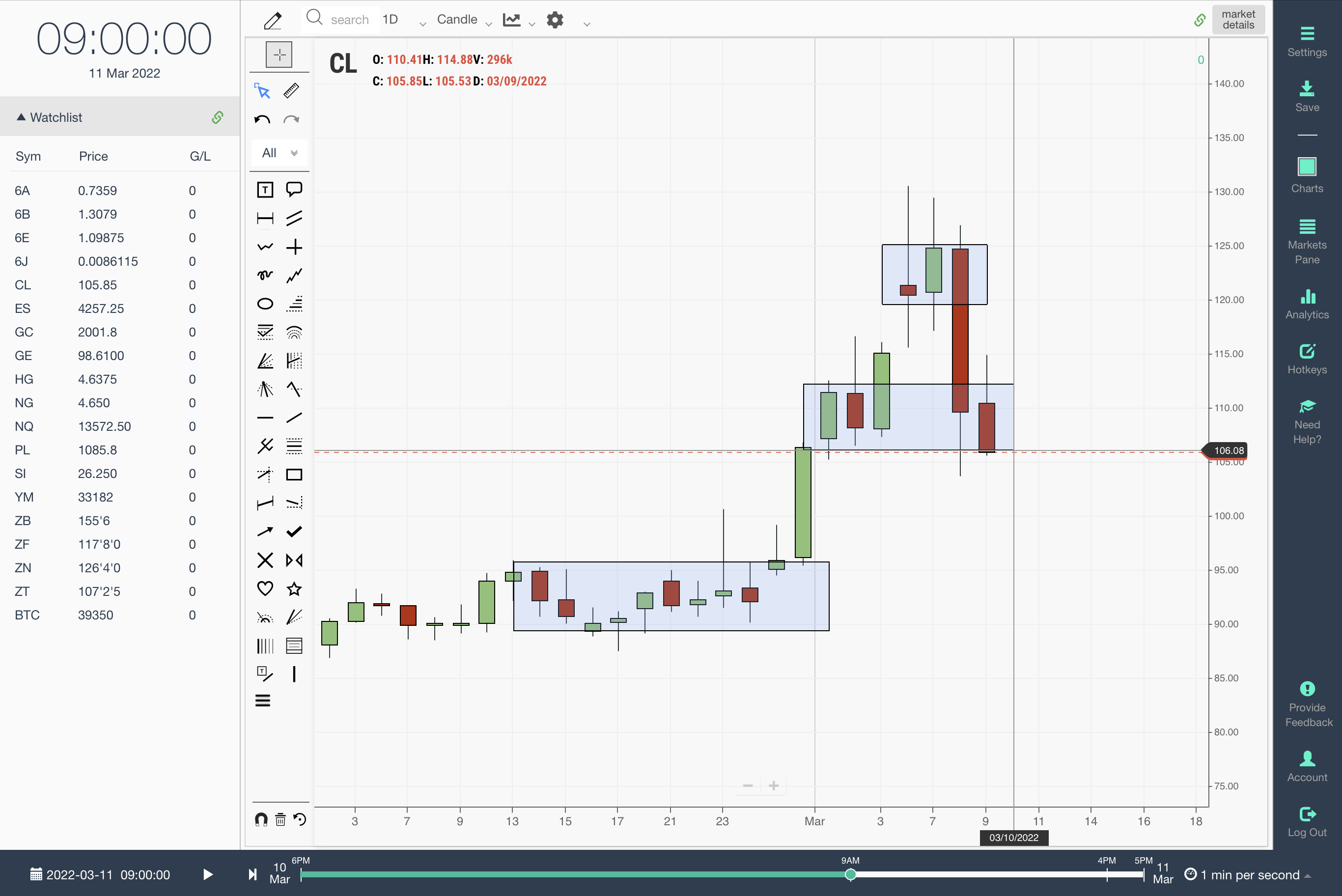

In the Crude Oil example above, if we dial into the 30m charts, we see this pattern playing out before we get a launch from the entire base. Have a look:

Notice that despite the failed breakout, crude oil continued to maintain higher lows. In addition, we can assume that the selling pressure that came in on the failed breakout only fueled the price of the commodity higher. Why? If there were any short sellers in that selling pressure, they eventually had to cover their positions as the price went higher.

We hope you’ll see that many of the same patterns we use in equities trading can be used as futures trading strategies as well. For that reason, be sure to practice your own strategies in our simulator to determine your best possible outcomes before putting real money to work.

Options Strategies

Perhaps one of the more confusing trading strategies to beginners, options require a little more planning than just clicking the buy or sell button. Somewhat similar to futures, you aren’t actually buying shares of a company. Options are a contract.

What are Options?

Options are just that, the option to buy a certain amount of shares of a stock at a specified price. It is essentially a contract, albeit instantaneous, between buyer and seller, for a certain number of shares (usually 100 per contract) at a predetermined price (strike) to be executed by a certain date in the future (expiration).

On the contract expiration date, you have the right to either allow the option to expire or to exercise your right to the shares at whatever price the stock is currently trading.

Here’s an example of how this works in what we would call a basic naked call option.

Stock XYZ is trading at $10. You expect the price of the stock to rise to $20 over the next 6 months. You search for options with a “strike” price of say…$12, just above the current price. The expiration date will be a few weeks or months out.

If the price of the stock goes above your $12 strike, you are in the money. However, to initiate the option, you must pay the “premium”. This can range anywhere from around $1 to $10 or more on popular and volatile stocks like Tesla or the SPY.

Day Trading

Day Trading