Cryptocurrency paper trading is a relatively new experience with very few apps offering this service. While nothing new to the world of equities and futures, crypto simulation offers an opportunity for traders to test strategies in a risk-free environment.

The psychology of trading is one of the most important aspects of trading, aside from mastering technical analysis, fundamentals, and other factors. Understanding your emotional swings, controlling your impulses, and remaining calm and resilient during profit and loss is the key to unlocking your true potential in the markets.

To that end, there are many differences between paper trading and trading real crypto. In this guide, we'll discuss the purpose of paper trading and how you can use it to your advantage when preparing to become a profitable crypto trader.

Crypto Trading Psychology Tips and Tricks

As with any trading instrument, psychology and discipline are paramount to maintaining a positive equity curve. While have all the wisdom in the world for technical analysis can be beneficial, and having a trading plan is crucial, none of that matters if you lack the emotional intelligence to execute well.

In crypto trading, you will face unique psychological challenges in that the crypto market is far and away more volatile than most other asset classes. The price fluctuations are often violent compared to something like stocks or indexes. This, of course, is relevant to the season and the type of correction or growth phase.

In addition, depending on the type of trader you are -- long or short-term -- you'll face considerable pressure to sell as bear markets can exceed 50% of the value gained in bull markets.

Here are some tips we recommend when dealing with crypto trading psychology:

- Practice self-awareness: consider your habits and the practice of redirection when decision-making goes awry.

- Repetition: forming positive trading habits is a result of constant practice and review.

- Eliminate weaknesses: by focusing on your strengths, much of what we call success is simply the elimination of what doesn't work.

- Adapt to changes: not all markets are the same -- adapt when necessary or sit out the times your edge doesn't work.

- Have a life: get outside and feed the brain and the soul. Trapping yourself in the virtual reality of markets can narrow your focus too much. Breathe, exercise, reflect, and come back.

Paper Trading Emotions Explained

The emotions in paper trading aren't the same as when using real money. That's the oft-assumed answer. However, to the dedicated and purposeful trader, the emotional canvas inside paper trading will still be explored in such a way that it will impact your real trading experience.

As with any performance sport, training outside the ring is where the battle is won or lost. It is in a simulated environment that we can observe, practice, and anticipate the moves of the market without the pain or pressure of the real conflict. Yet, the best traders will use this opportunity to channel the inner conflicts they will expect when real money is on the line.

How Do Paper Trading Emotions Differ From Real Trading Emotions?

In one of our interviews with Dr. Brett Steenbarger, Ph.D. we gained valuable insight into this process. Listen to what Dr. Steenbarger has to say about paper trading emotions:

Having a plan in the calm of the moment is different from maintaining and acting on the plan once we get punched in the nose!

That doesn’t make simulated trading worthless, however. Even the best boxers practice in the ring away from formal competition to work on their movement, their combinations, etc. Similarly, basketball teams prepare for the next game by scouting the opponent and then practicing against the offense and defense that the opponent are likely to use.

And, of course, where would a Broadway actress or actor be without practicing lines away from the distraction of crowds.

That is what simulation accomplishes in trading. If we can’t be consistently successful in simulation mode, how in hell are we going to succeed with the pressures of real-time P/L??

Once we establish our consistency in sim, then, of course, we want to go live and tackle the pressures of actual gains and losses. This is why musicians and theater professionals conduct dress rehearsals. Simulation/practice is necessary for development, but not sufficient.

It’s a step in the learning process.

Real vs. Simulated Trading: How to Transition

The end goal is always to transition from simulated trading to real trading, but this process shouldn't be cut and dry. Imagine if Lebron James turned pro and then never practiced again. There's no way he would be the best basketball player in the NBA. Likewise, if you want to be the best crypto trader, consistent practice is a must.

Markets are ever-changing. Yet, sometimes, they rhyme with past markets. For this reason, simulated trading often holds the key to mastering new and current market trends. But how are you going to know how to perform and what's working well if you don't study the past under similar circumstances and conditions? You're gambling, at best.

For that reason, transitioning to real trading should be a process that allows you to go back and forth between the two. Even the most seasoned traders will enter the simulated trading world to hone and update their skills. Let it complement your trading journey by remaining a part of your growth process.

Comparison Between Real and Simulated Crypto Trading Emotions

Knowing that the volatility of crypto markets can affect your emotions and ability to make sound decisions, let's take a look at 5 major differences between real and simulated trading:

Perceived Risk

- Real Crypto Trading:

- Heightened risk perception is a common psychological response. Real financial stakes can lead to increased anxiety and caution.

- Fear of financial loss may influence decision-making, leading to hesitancy or impulsivity.

- Paper Trading:

- Risk perception in paper trading tends to be lower since there's no actual capital at stake.

- Traders might take bolder risks or neglect risk management strategies in simulated environments.

Decision-Making Under Pressure:

- Real Crypto Trading:

- Pressure to make quick decisions is heightened in real trading situations.

- The fear of missing out (FOMO) or making a costly mistake can influence decision-making.

- Paper Trading:

- Traders may experience less pressure to act swiftly since there are no immediate financial repercussions.

- Decision-making in simulated environments might lack the urgency seen in live trading.

Psychological Impact of Losses:

- Real Crypto Trading:

- Actual financial losses can evoke strong emotional reactions, including stress, depression, or panic.

- Loss aversion becomes a significant psychological factor, influencing subsequent trading decisions.

- Paper Trading:

- Losses in simulated trading may not have the same emotional impact.

- Traders might be more inclined to take risks or recover from losses without the emotional weight.

Attachment to Profits:

- Real Crypto Trading:

- Profits in real trading environments can trigger feelings of euphoria and overconfidence.

- There's a psychological tendency to become attached to winning positions.

- Paper Trading:

- Profits in paper trading may not elicit the same emotional highs.

- Traders might be more objective and less emotionally attached to simulated gains.

Understanding the subtle nuances between real and simulated trading is a crucial component to becoming a seasoned trader. While paper trading cannot fully prepare you for the type of emotions you'll experience, if you treat it seriously, you'll have a firm foundation to fall back on when your emotions rise.

Behavioral Finance in Crypto

Behavioral finance theory is the integration of psychological principles into financial decision-making, recognizing that traders often deviate from rational behavior. In the crypto realm, where market sentiment plays a pivotal role, understanding these concepts could help with trade and risk management.

Cognitive Biases Influencing Trading Decisions

Several emotional biases can cloud judgment and affect the behavior of crypto investors. In turn, these biases may alter the price projection of a particular asset or instrument. Let's take a look at a handful of the more common biases and how they can influence your trading.

-

Overconfidence Bias:

- Crypto traders often exhibit overconfidence in their abilities to predict market movements.

- This bias can lead to excessive risk-taking and a failure to adequately assess the uncertainties of the market.

-

Loss Aversion:

- Loss aversion may cause traders to be more averse to losses than they are motivated by potential gains.

- This bias can lead to suboptimal decisions, such as holding losing positions for too long or selling winning positions prematurely.

-

Confirmation Bias:

- Traders in the crypto space tend to seek information that confirms their existing beliefs or biases.

- Confirmation bias can result in a lack of thorough analysis and a reluctance to consider alternative viewpoints.

-

Herding Behavior:

- Crypto markets often witness herding behavior, where traders follow the crowd without conducting independent analysis.

- This can lead to market bubbles and sudden, irrational price movements.

-

Recency Bias:

- Traders may be influenced more by recent market trends than by long-term fundamentals.

- This bias can result in impulsive decision-making based on short-term price movements.

Awareness of these biases is the first step in becoming a more mature trader. On the internet and social media, influencers and crypto-believers abound. Often they contribute to the biases we've mentioned above. In paper trading, you gain power over these biases by conducting your own observations, analysis, and strategies, thereby enhancing your decision-making processes.

Risk Management in Crypto and Paper Trading

Perhaps the most important aspect in trading, in general, understanding and respecting risk management is paramount to your success as a crypto trader and investor. This applies to both real and paper trading accounts. There is an old adage in trading that you must cut your losses quickly. We would add that you mustn't enter a trade without knowing where you'll exit.

Setting and sticking to your risk management strategy is the best way to preserve your capital. One thing is certain in trading, you'll never win 100% of the time. In fact, you'll likely lose most of the time. Yet, with proper risk management and the ability to hold onto winners, you'll far exceed your losses in the end. It's all a numbers game.

In addition to managing risk, you would also do well to understand the risks involved with fraud and other factors influencing the crypto market. As with the recent FTX debacle, the crypto space is not nearly as regulated and stable as the stock market. Be sure to do your due diligence and never put all your eggs in one basket when trading crypto.

Cryptocurrency Market Behavior

While many would consider the behavior of crypto irrational, it may actually be more pure than other manipulated markets. It is for the reason of herd mentality that we often see speculative bubbles in issues like Bitcoin. As most participants follow social sentiment for their decision-making, coupled with a finite number of coins, as it were, crypto markets suffer violent swings.

Yet, these swings are not without reason. Without the "stabilization" of central banks, ETFs, futures, and other derivatives, what you might be witnessing is an unadulterated version of price action. Depending on your preferences and ability to understand market dynamics, this may play to your strengths.

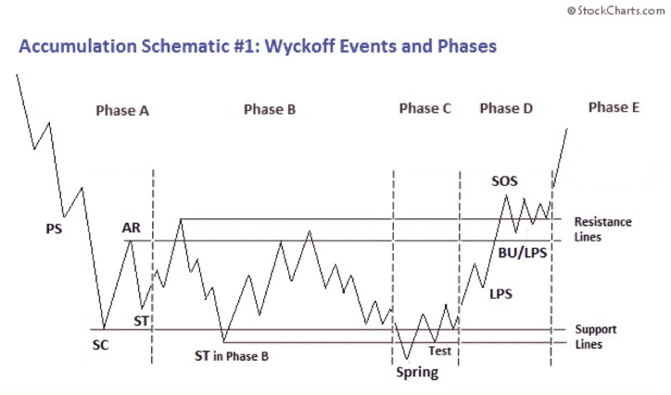

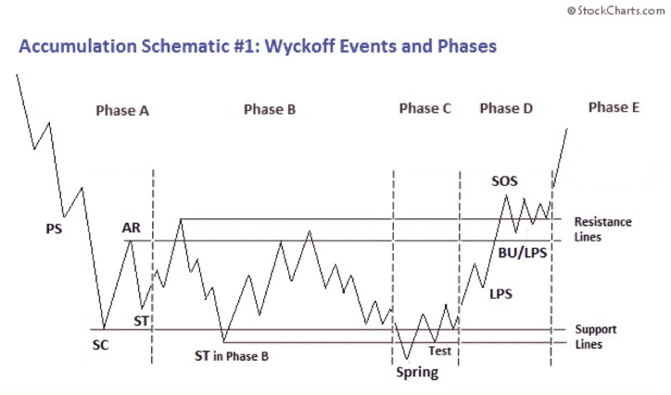

In order to adapt to this dynamic and often volatile nature of crypto, we recommend nothing more than time spent in the simulator observing trends. Couple that with a firm foundation in pure technical analysis like the Wyckoff Method, and you may find yourself a strategy or two worth exploiting.

The Role of Trading Discipline in Crypto Trading

Entire books have been written about trading discipline, and they all can be applied to crypto trading as with any other asset class. Trading discipline is more of a journey than most people are willing to travel. It never ends.

Some of the greatest traders in history have blown up their accounts late in life, while others never make it past the first few months or years of trading. It's constant process that depends heavily on risk management and impulse control. For a solid list of trading psychology books, here are a few of our faves:

- The Psychology of Trading – Brett Steenbarger

- The Daily Trading Coach – Brett Steenbarger

- Trading in the Zone – Mark Douglas

- Flow: The Psychology of Optimal Experience – Mihaly Csikszentmihalyi

- Market Wizards – Jack Schwager

- Reminiscences of a Stock Operator – Edwin Lefevre

- The Art of Thinking Clearly – Rolf Dobelli

- Sway: The Irresistible Pull of Irrational Behavior – Ori and Rom Brafman

- Market Mind Games – Denise Shull

- Trading Psychology 2.0 - Brett Steenbarger

- High Performance Trading – Steve Ward

- The Disciplined Trader – Mark Douglas

- Atomic Habits – James Clear

Our favorite, hands down, is Dr. Steenbarger. He's a prolific trading psychology author, speaker, and coach. With almost 5000 articles on his blog and numerous books published, he knows a thing or two about trading discipline. One of our favorite quotes from him can easily be applied to crypto trading:

The key to sustaining discipline is to identify the specific short-term needs that are occasionally overshadowing trading rules. Traders who overtrade, for example, often have problems during quiet market times. Their needs are for stimulation. By creating stimulating activities during the trading day that don’t take them away from their screens, they can avoid using unwanted market activity as their stimulation. Dr. Brett Steenbarger, Ph.D

Steenbarger often cites that we become "what we consistently do." To that end, practicing in a simulator to overcome bad habits and replace them with positive ones is the best place to start.

Summarizing the Need for Crypto Simulation

We hope you see the importance of crypto paper trading by now. As we've noted, the most important aspects of paper trading are the need to observe, practice, and develop positive psychological habits. In addition, crypto simulators give you an ongoing tool for refining your live trading process. Let's recap a few important points:

- Self-awareness

- Planning

- Repetition

- Habit formation

- Impulse control

- Emotional bias mitigation

- Risk management

These are a great starting point for achieving mastery in crypto trading, and the first step to success in through the use of a simulator.

At TradingSim, we offer one of only a few crypto trading simulators that allows you to trade with true market replay. Additionally, we provide you tools for charting, trading and performance review, and customizable interfaces. If you're looking to get into crypto trading, but need an affordable means to testing the market and defining your strategies, look no further.

If you harbor multiple traders within you–some careful, some impulsive, some successful, some losing–your first task is to avoid labeling these traders and instead take an Observing stance. You need to figure out why these lousy traders within you are trading! The chances are good that they are trading to achieve something other than a good return on equity: a sense of excitement, a feeling of self-esteem, or an imposed self-image.

True deliberate practice is a significant predictor of success.

Dr. Brett Steenbarger, Ph.D

Paper Trading

Paper Trading