The health care stocks, which previously enjoyed a stellar rally since early 2009 ended the year 2016 on a gloomy note, which spooked some investors. As the U.S administration changed guard, the health care sector was at the core of the issue.

In what seemed like one of the longest bull markets in recent times and often called the second largest bull market in U.S. history, the health care stocks were often seen at the front, riding the wave.

Despite the initial positive rally in the health care stocks, such as the iShares NASDAQ Biotechnology ETF (IBB), it closed the year 2016 in the red. While some investors saw this as a sign to exit the sector, others are hopeful that the decline last year was a good buying opportunity.

The health care stocks initially came under pressure by both the presidential candidates, Donald Trump and Hillary Clinton. Both the candidates said that they would take steps to bring down drug prices.

But Democratic presidential hopeful Hillary Clinton went so far as to suggest putting in place new rules and checks in the drug industry while also suggesting radical measures such as importing cheaper medicines from overseas. Obviously, the healthcare industry wasn’t a big fan of Ms. Clinton.

The Republican candidate, Donald Trump also toed the same line, but his views on the healthcare and the pharmaceutical industry was more mixed.

Trump, during his campaign trail promised to deregulate the industry by removing up to 80% of the federal regulations. He also proposed his idea of streamlining the Food & Drug Administration (FDA) approval process so that biotechnology and pharmaceutical industries would be able to introduce their products better and faster.

Last but not the least, repealing of the Obamacare act, formally known as the Patient Protection and Affordable Care Act (ACA) which was signed into law on March 23 2010.

Still, investors were cautious on President Trump especially after he maintained his views on drug prices. In an interview with the Time magazine, the president said “I’m going to bring down drug prices.” The healthcare stocks rose nearly 9% in the day following the Trump victory, in what is viewed as relief rally that Clinton’s proposed price controls on drugs would not materialize.

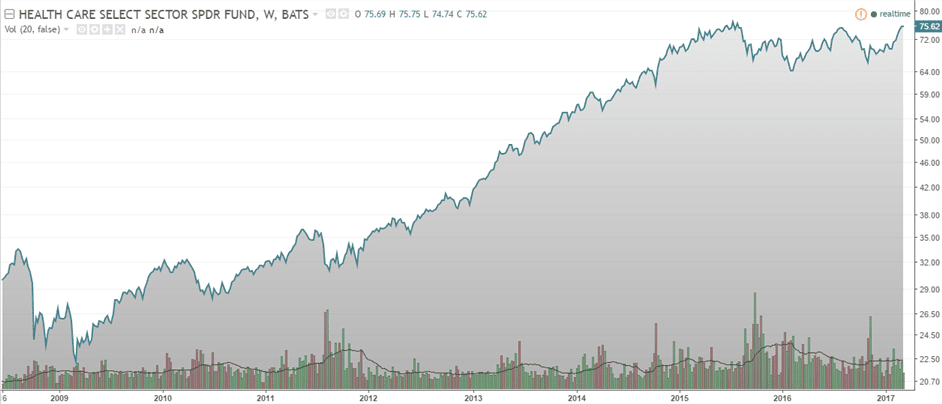

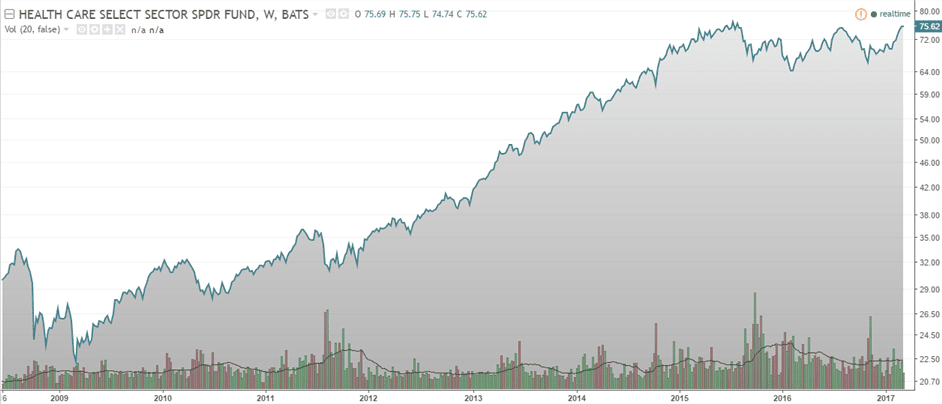

The chart below shows the Health care select sector SPDR Fund (XLV) since 2010, which speaks volumes on how the health care stocks have fared under the Obama administration, boosted by the bull market and of course Obamacare.

It is a similar story elsewhere as well, across other health care stock trackers such as iShares U.S. Health care providers ETF (IHS), the iShares U.S. Medical Devices ETF (IHI) and Vanguard Health care Index Fund (VHT).

XLV – Health Care Select Sector SPDR ETF

What are the characteristics of health care stocks?

The health care stocks are made up of companies that have a wide functional role in the health care sector. Companies that are involved in production and delivery of medicine, providing health care related goods and services make up a major portion of the health care stocks.

Health care stocks are characterized by their stability, making such stocks less sensitive to the business or economic cycles. These stocks are also known to perform better in the later stages of the business cycle and additionally offer investors, exposure to the innovative biotechnology industry as well.

Most of the companies in this sector have solid balance sheets and many even offer attractive dividend yields. After all, there is always demand for health care product and services.

Some sub-sectors of the healthcare stocks posted strong gains between the years 2010 and 2015 and started to see a pull back since early 2016. The gains and the declines in part came as a result of Obamacare and the benefits these stocks received due to wider insurance coverage for health care.

The health care economy continues to remain in a stage of transition, progressing from a consumer driven industry to a value based industry. The increased cost for health care is seen pushing the burden of health care mostly onto employees, which has led some companies to provide new services to help consumers to make better choices.

There are already some new companies that target the gig economy such as Uber drivers with customized health insurance products, which only goes to show that the sector is likely to continue to chug along, regardless of the political undercurrents.

Despite the short term ripples from the repeal of the Obamacare act, health care stocks that have underpeformed last year look more appealing on a valuation basis, according to Fidelity Research.

What type of stocks can be classified as a health care stock?

As an example, the health care sector can be made up of a pharmaceutical company, a medical device manufacturing company, a health insurance company and a real estate companies dealing with developing of hospice and hospitals.

Unlike other sectors where an investor is more inclined to go through the balance sheets and in valuations of the company, in the health care sector, the investor must pay equal attention to the regulations and government policies.

Because health care is so primary, it often falls to the government to deal with issues, which can at times in a whim overturn old laws that could eventually impact the health care stocks in question.

Still, the amount of impact a new government order has on the health care stock depends on the type of stock in question as obviously a pharmaceutical company’s stock will behave differently to that of a health insurance company’s stock.

Health Care Select Sector SPDR Fund (XLV) for example tracks stocks in the Health care and Biotechnology sector. This ETF is one of the cheapest ways to get exposure to the health care and Biotechnology stocks with an expense ratio of just 0.15%.

Some of the big names included in the XLV ETF include, Johnson & Johnson, Pfizer Inc., Allergan PLC, Celgene Corp.

What is Obamacare or the Affordable Care Act?

The Affordable Care Act was seen as one of the biggest overhauls to the U.S. healthcare system since 1965, when Medicare and Medicaid were introduced. The goal of the ACA was to increase the quality of health insurance and to also make it affordable.

One of the goals of the ACA was to ensure that it would lower the uninsured rate and did this by expanding the insurance coverage and also by reducing the cost of healthcare.

Under the Obamacare act, the law required health insurance companies to accept all applicants, including those with known pre-existing conditions and covered specific list of illnesses and sought to bring out uniformity in pricing.

The Obamacare act also set up insurance exchanges and offered subsidies such as refundable tax credits to households with incomes between 100% and 400% of the federal poverty level.

While Obamacare managed to bring insurance to the wider audience, the main beneficiaries were hospital chains as well as drug stores and managed care among other sectors that now had to deal with a lot more insured customers.

Despite Obamacare making insurance affordable, there were some downsides as health-benefit providers that were losing money were estimated to have received only around 12% of the funds that were requested; the so called risk-corridor that was put in place to protect losing health-insurers.

Also, the rapid costs in the premiums paid last year, which was due to the closure of more than half of Obamacare approved healthcare cooperatives suggested that there was little being done to control the cost of inflation despite bringing down the rate of uninsured persons.

Some of the stocks that gained the most, on the back of Obamacare were:

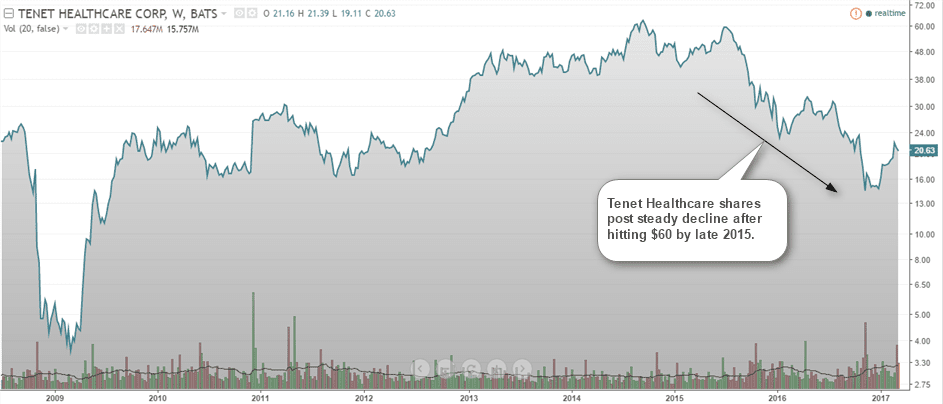

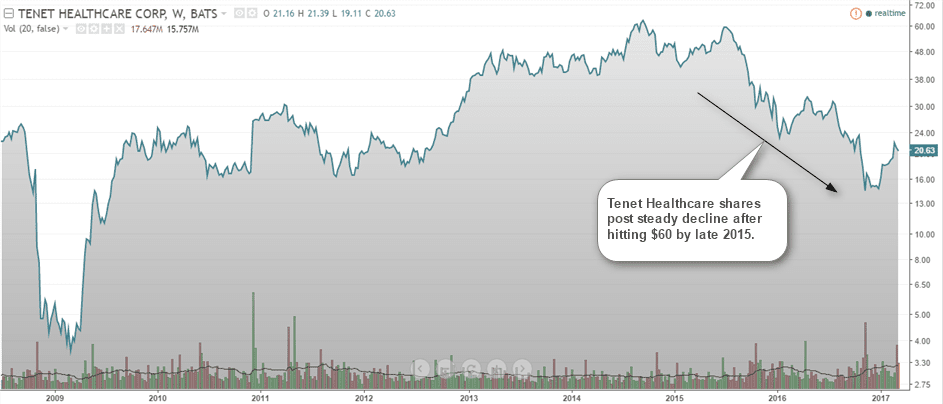

Tenet Healthcare Corp (THC), which is one of the biggest for-profit hospitals in the U.S. The enterprise owns over 77 acute-care hospitals alongside 173 outpatient centers with over 13.2 million licensed beds in 10 states. Tenet Healthcare is undoubtedly one of the biggest stocks that gained as the ACA insurance coverage brought about more insured patients.

Shares in the company were seen rising steadily adjusting for a one-for-four reverse stock split and posted a high of $63 by late 2014.

Tenet healthcare Corp (THC)

Tenet healthcare Corp (THC)

Another stock worth mentioning is Walgreen Boots Alliance (WBA), a large retail drug store chain, revenue-wise and boasting of over 8,500 drugstores also saw its stock price appreciate just as strongly as a result of the ACA. But the outlook remains mixed although hopeful that with the aging U.S. population, demand for the health care sector will still be strong.

While hospital and drug stores managed to ride the wave on Obamacare, health insurers did quite manage to hop on board but only to get off quickly.

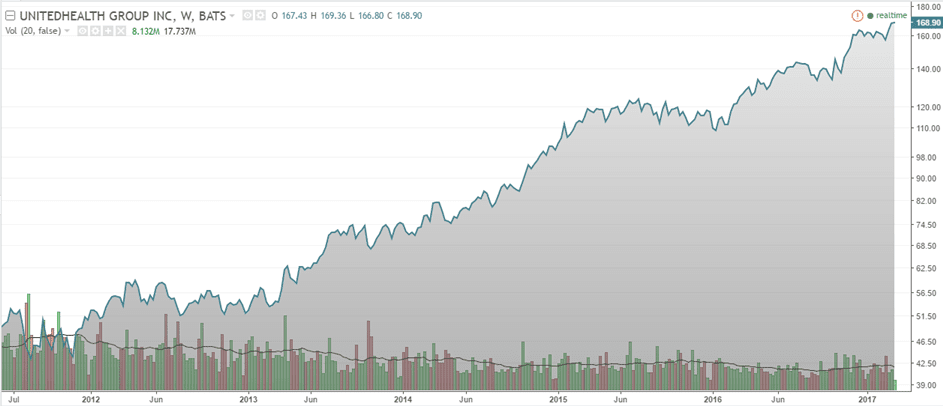

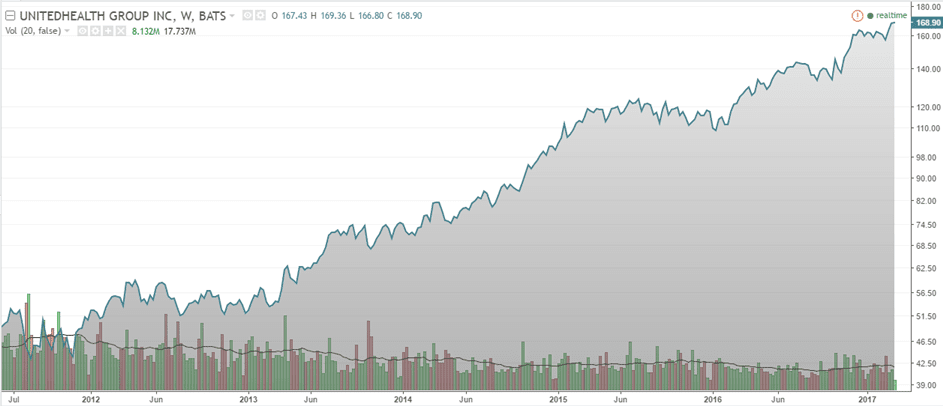

In April 2016, United Healthcare (UNH) announced that it was pulling out of Obamacare exchanges in 16 states as the company announced losses of $125 million in the fiscal year 2016 and said that the company will not have any financial exposure to the Obamacare exchanges from 2017 onwards.

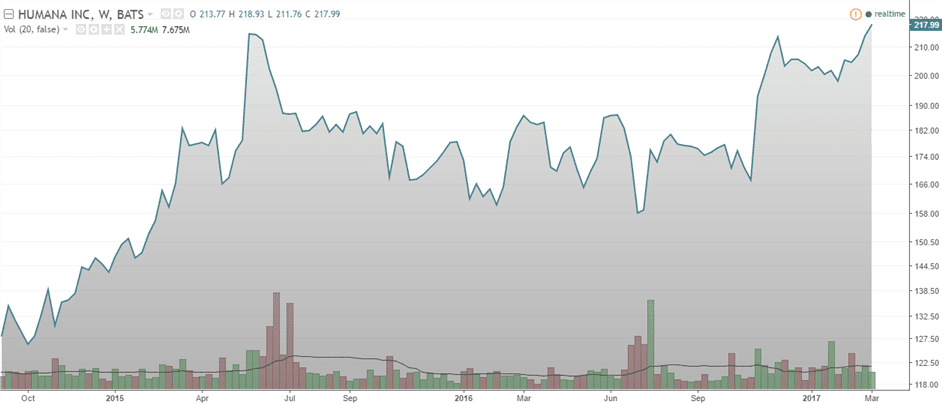

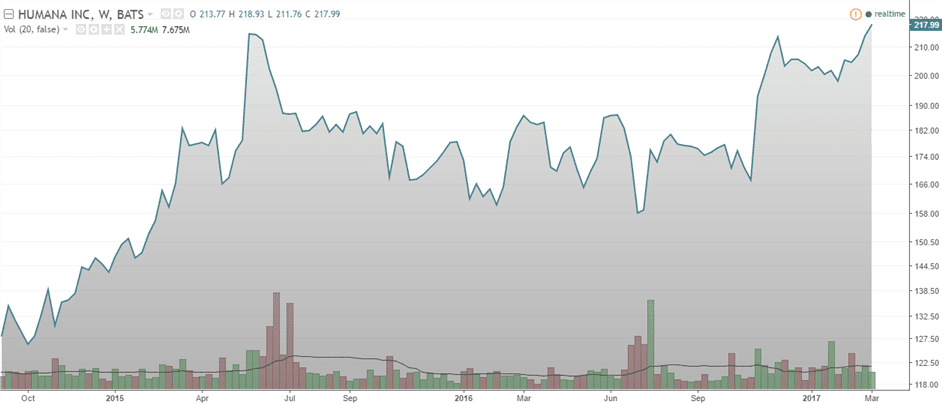

It was a similar story among other health insurers, with another big name, Humana (HUM) pulling out from the Obamacare exchanges in eight states. Again, this was attributed to the company losing close to $1 billion on account of its participation in the health care exchanges.

Humana Inc (HUM) shares fall in 2015, pulling out of Obamacare

On the contrary, while hospital stocks are expected to see some volatility if the Affordable Care Act is repealed, the aforementioned health insurance providers are expected to reap the benefits.

Shares of United Healthcare (UNH) are already braced for the repeal of Obamacare and the stock price looks to have made some benefit off the early stages of the ACA and is now expected to gain on a potential repeal of the ACA.

The stock has already been reaping the benefits of Medicare since over a decade while at the same time the company also sells individual insurance to drive up profits.

United Health (UNH)

One of the biggest benefits facing health insurance companies in a post-Obamacare era is the fact that pricing for health insurance becomes opaque once again, meaning that big insurers such as United Health are able to take advantage of their market share and size compared to other competitors.

Depending on how the new health care law looks like, insurance companies are likely to make a gain, especially if it also means being given back the choice to pick and choose and deny cover to customers with pre-existing conditions.

This is likely to spell some weakness for the hospital stocks which will need to eventually crawl out from the Obamacare benefits.

It is still early to tell, but the rocky start to the year with the Health Care Select Sector SPDR ETF losing over 8% has kept some investors to sit on their hands. While some argue that this is just a taste of things to come, others such as Ethan Lovell, co-manager, Janus Global Life Sciences fund is bullish.

“Health care is positioned to perform quite well,” Lovell told in an interview with Barrons.com, citing that the sector remains near its historical lows relative to the rest of the market.

He also expects that the sector will see a 20% move or of a similar magnitude and remains optimistic despite the rollback of Obamacare now starting to see the light.

According to Lovell, the undercurrents from repealing the Obamacare could be felt in the hospitals which he says benefited from the Affordable Care Act. However he expects the managed-care industry as well health insurers to gain an advantage as they will be able to meet the wider demands for customers shopping for insurance coverage.

While on one hand it is easy to draw a correlation between the health care sector and more importantly the hospital stocks and other similar stocks that have benefitted directly due to Obamacare, the real litmus test will come once the Affordable Care Act is repealed and replaced.

Awesome Day Trading Strategies

Awesome Day Trading Strategies