Day trading is risky business. The stakes are high and there are many challenges to become successful. Here at TradingSim, we don't sugar-coat anything. Your chance of becoming a successful day trader is very slim. The learning curve is steep and narrow, and most traders drop out and lose money.

For over a decade, our mission here at TradingSim has been to shorten that curve and support more day traders on their path to success. We do this with the most realistic trading simulator on the market. But having the best tools for true day trading simulation isn't enough. Success requires developing a trading strategy using those tools.

In this post, we'll lay out the path to creating a successful trading strategy in a simulator, the mistakes to avoid, and how to build your confidence for longevity as a day trader.

Benefits of Using Day Trading Simulators

Day trading simulators are a fun and efficient way for aspiring traders to explore the stock market, learn new strategies in a risk-free environment, and build confidence through review. The biggest hurdles to success in day trading involve learning from your mistakes and becoming consistent with your trading decisions. New traders can go through this process in one of two ways: risking real money and blowing up in the markets, or training in a trading simulator risk-free.

Risk-Free Experimentation

A little curiosity can go a long way with any new endeavor or aspiration. We believe this lies at the heart of enjoying trading. If markets were as predictable as we wish they were, we'd all be rich. But the truth is that markets shift and move with uncertainty. For that reason, it takes time to understand the difference in cycles and price action associated with these cycles over time.

As part of that process of observation, exploration, and experimentation can often lead to lucrative discoveries in the market. However, the price to explore with real money is high. Regardless if you're a wealthy investor or a 9-5 worker trying to get ahead through trading, the most responsible traders understand the importance of capital preservation. Herein lies the value of a trading simulator.

As you grow in your understanding of markets, experiment with strategies you are learning, and build your intuition and rules for trading, simulation offers you a chance to do this while saving your hard-earned capital. Ask any seasoned professional trader what rule #1 is for trading and they'll tell you risk-management.

"The best traders are the ones who recognize mistakes, dispassionately cut their losses and move on, preserving capital for the next opportunity."

Mark Minervini

Market Navigation Practice

Simulators serve another purpose for budding day traders. They allow you to practice placing orders, reading level II data, playing with technical analysis tools, and managing positions using a charting platform. These are things you need to be comfortable with no matter what brokerage you inevitably choose.

For beginners, this can be one of the biggest hurdles -- navigating new software. In the heat of the moment, often seconds matter in day trading. You don't want to be figuring out how to place buy and sell orders on the fly. You should have all these questions answered. In fact, you should have your trading cockpit and software customized to your comfort so that it feels like driving to work: you know how to turn the radio on and off, answer calls hands-free, turn the heat on, find the turn signal, etc.

All these moving parts can seem clunky and confusing at first, but with time in a trading simulator, they'll become second nature, just like driving a car. At TradingSim, our simulator is as realistic as any broker's trading software. You'll be able to customize the screen, the charts, the indicators, order montages, and more.

Building Confidence

Contrary to popular belief, jumping into the market and learning to sink or swim using your hard-earned cash is not a recipe for building confidence. In fact, for most traders, it has the opposite effect. Trading with real money can create traumas that are difficult to overcome and often lead to drop-out.

The best way to build confidence in the market is through safe experimentation in a day trading simulator like TradingSim. You wouldn't feed a T-bone steak to a newborn baby, and you wouldn't expect a 16-year-old to get behind the wheel of a car without a year of driving with mom or dad, would you? The markets are no different.

Jumping into a game that you don't know how to play is a recipe for disaster. Psychology tells us that any performance sport requires practice away from the main event to become proficient at the game itself. Ask Lebron James or Messi how many hours they practice outside the real match. Don't believe us? The most prolific trading psychologist in the world has this to say about building confidence in a simulator:

Indeed, it’s often because of our need to make money and our overconfidence that we pursue shortcuts in our learning processes as traders and take too much risk. That leads to volatility of P/L and losses, which in turn trigger our nervousness, tension, stress, fear, and worry.

What I’ve long liked at TradingSim is the focus on learning trading–and doing that in safe ways where we can’t trigger and traumatize ourselves.

Dr. Brett Steenbarger Ph.D.

On that token, be sure to give yourself the time and experience in the simulator that you need. Eventually, you'll need to get in the real trading ring. But that doesn't negate the importance of returning to the sparring ring, where the environment is controlled and safe for learning. Trading simulation builds confidence. Jumping in head first to the stock market breeds failure.

Learning from Mistakes

How else can you build confidence? If you don't know what you did wrong, you'll repeat the same mistakes over and over again. Isn't that the definition of insanity?

The market is a big mirror, forcing us to see our weaknesses: fear, greed, impulse, anger, revenge. It's all right there in the screen set before us. If we as traders don't learn to control these weaknesses, the market will get the best of us. The market is always right, and it always wins. We're either on the right side of it or the wrong side.

The best way to learn from our mistakes is to make them less painful until we understand our weaknesses. One way to do this is through a simulator. Sure, you can trade with a very small account if you want, but you'll be limited by the number of trades you can place due to the Pattern Day Trader rule.

Tradingsim offers an analytical tool that allows you to dial in your review process and analyze what is working with your trading strategy versus what isn't working. It's a great tool to keep track of your progress as a developing day trader. Every trade you take is uploaded automatically until you clear out your progress.

Developing Your Trading Strategy with a Simulator

Developing a new trading strategy has never been easier. There are a plethora of resources online: YouTube videos with free strategies, gurus offering their strategies on X, and resources right here on TradingSim.com.

We recommend starting with the basics if you're new to trading. Learn the different trading patterns, how to place orders, how to understand candlesticks and their patterns, etc. It's through this that you'll pick up on reading a chart, understanding the difference between bullish and bearish chart patterns, and the basics of exploiting these patterns with good risk management.

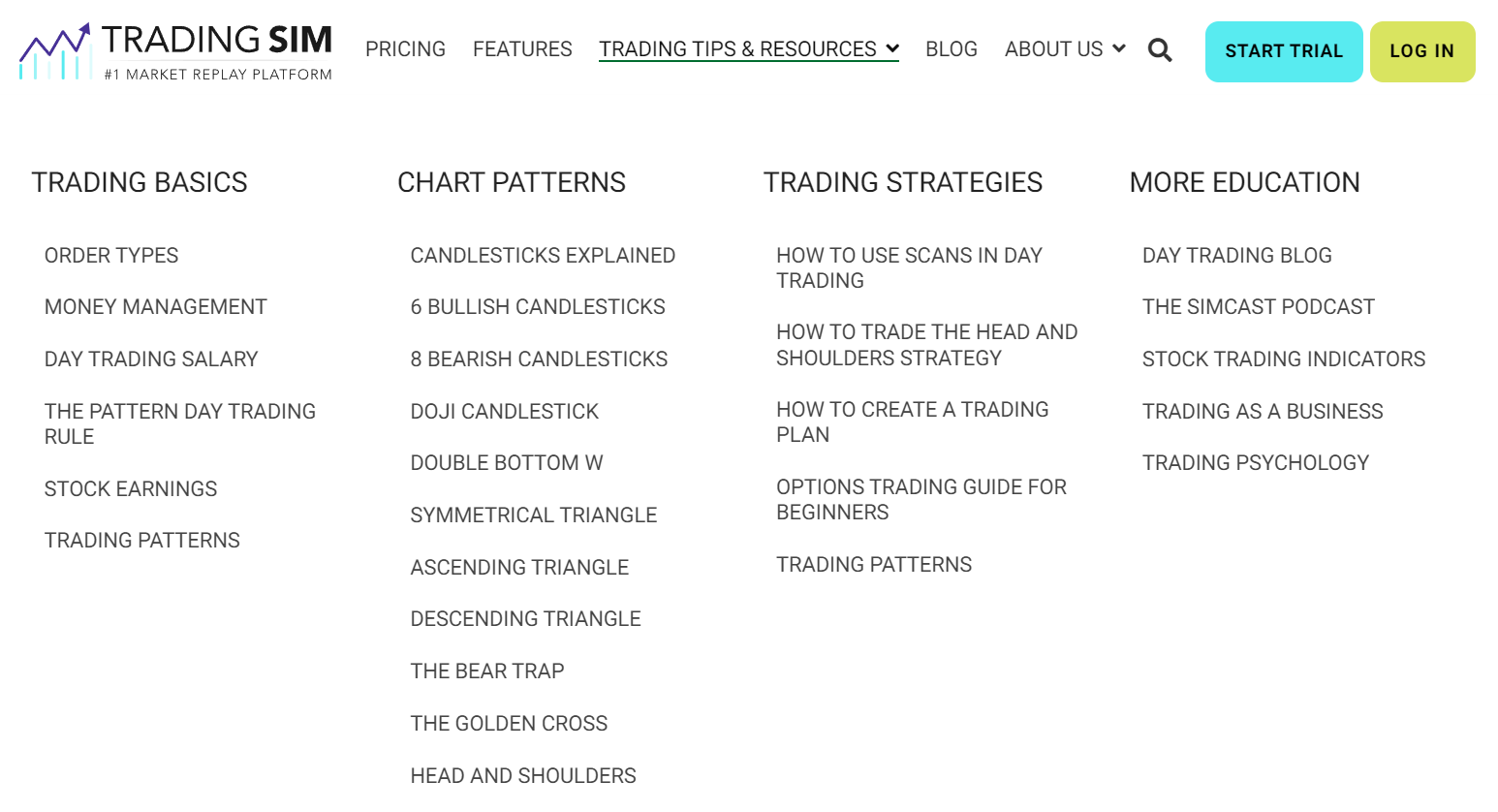

Once you have mastered these techniques, take a look at more advanced strategies that we have in our educational resources, like how to scan for opportunities in the market each day, how to create a trading plan, and more advanced trading patterns. Additionally, you'll want to add psychology tips to your daily technical analysis regimen. It's all right here in our Trading Tips and Resources.

Once you have your strategies refined, you'll want to track your results in the sim using these strategies. Take notes on when they work and when they don't. Identify the broader market conditions for each day you trade. Make adjustments as necessary, and most importantly, never stop learning or adapting to the markets.

6 Steps To Remember When Developing a Trading Strategy

Here's a breakdown of steps you can take to use a simulator to develop a trading strategy:

1. Research Different Trading Strategies:

2. Choose a Strategy to Test:

- Select a single strategy to focus on for your initial testing phase.

- This allows you to isolate the effectiveness of the chosen approach.

3. Set Up Your Simulator:

- Input your chosen strategy parameters into the simulator platform (e.g., moving average lengths, RSI thresholds).

- Familiarize yourself with the simulator's features, including order types, data analysis tools, and charting options.

4. Simulate Trading:

- Begin making simulated trades based on your chosen strategy.

- Track your results, including entry and exit points, gains/losses, and win/loss ratio.

- Aim for a realistic trading experience by using a simulated starting capital amount.

5. Analyze and Refine:

- Regularly review your simulated trades and analyze their performance.

- Identify areas where the strategy worked well and where it might need adjustments.

- Refine your strategy parameters based on your findings (e.g., adjusting moving average lengths or RSI thresholds).

6. Test and Iterate:

- Continue testing your refined strategy in the simulator environment.

- Track your progress and make further adjustments as needed.

- Once comfortable with the strategy's performance, consider paper trading (simulating trades with real-time data but no real money) before venturing into the live market.

How TradingSim Can Help

TradingSim is a comprehensive online trading simulator. Our web-based platform is used by thousands of traders all over the world to help develop their trading strategies. The platform is not only realistic with actual market data feeds, but it allows you to rewind that data for up to three years of historical market replay. It's like getting to relive the markets for as many days as you want.

Why is that important?

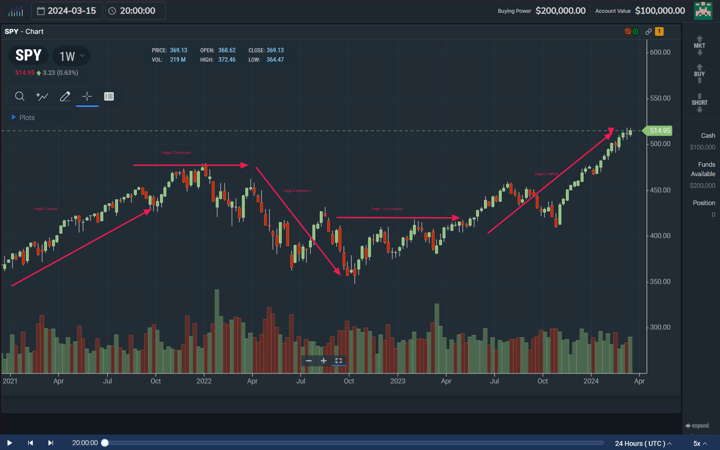

Backtesting is a buzzword in the trading simulation world. While we think it can be useful, most traders fall into the category of discretionary traders -- traders who make decisions based on intuition from prior markets. We call this proxy trading. And there is no faster way to build your repertoire of knowledge on day trading markets than by replaying them.

Imagine downloading the information that many professional traders have into your head. You'd be able to see patterns repeating from many years in the past. This allows you to take advantage of new opportunities, recognizing them in real-time when they happen. Backtesting data can help with this, but it won't train your "chart eye" to see it in real-time. Tradingsim allows you to do just that.

Relive the markets through Tradinsim. Flex that implicit memory, and be ready for the next big opportunity.

Conclusion

The importance of using a day trading simulator for developing a trading strategy is one of the most underrated hacks in the stock market. This valuable tool has saved hundreds of new traders from the pain and trauma of losing money in the markets. How? Through risk-free, realistic simulation that trains you the way training is meant to be.

We invite you to sign up for a free trial of TradingSim and explore our invaluable features today! What do you have to lose? (Think about that one..).

Day Trading

Day Trading