Explore the world of day trading with Webull in our in-depth review. We cover the benefits and drawbacks of using Webull for your day trading needs, offering detailed insights into its features, tools, and usability. Whether you’re starting out or are an experienced trader, this article is your go-to guide for understanding how Webull can fit into your trading strategy.

Beginner’s Guide to Webull

In the world of stock trading, many brokerages provide the tools and software traders need to succeed in the markets. More than ever, traders are looking for software that is intuitive, reliable, and efficient. However, not all brokers and platforms measure up. The trading industry has settled on a handful of solid brokers and platforms since breaking into the retail space with E-trade many decades ago.

That being said, Webull is a relatively new financial company in this space. As an innovative retail broker with impressive software, does it measure up to the playing field, or is it taking stock trading to new levels? As a beginner, it has been touted as a great alternative to platforms like Robinhood.

In this post, we review Webull for you as a beginner trader. We'll cover the following topics to help you decide whether this platform is right for your trading needs:

- Beginner’s Guide to Webull

- Webull Day Trading Review

- Pros and Cons of Webull

- Day Trading with Webull

- Webull Trading Tools

- Webull for Experienced Traders

- Understanding Webull Features

- Webull Trading Platform Analysis

- Webull Trading Strategies

- Evaluating Webull for Day Trading

Webull Day Trading Review

Webull is a "financial company with the customer at heart, the internet as (their) foundation, and technology as (their) lifeblood," according to their website. Their focus has always been on creating software so that individuals can access the markets and the information they need to make informed trading and market analysis decisions.

Webull offers a suite of tools for traders to analyze and trade the US stock market. Here is a short list of what you can expect, taken from their website:

- An all-in-one self-directed investment platform that provides excellent user experience

- Zero Commission

- Free Real-Time Quotes*

- Multi-platform Accessibility

- Full Extended Hours Trading

- 24/7 Online Help

*Free real-time quotes provided are NASDAQ Last Sale.

Having used their platform off and on since 2019, we'll dive into the Pros and Cons of trading and day trading with Webull, plus share some insights you might find useful.

Pros and Cons of Webull

|

Pros of Trading with Webull:

- Intuitive, customizable user experience

- Advanced fundamental analysis tools

- Guided investment advice for beginners

- Options trading simplified

- Level II order montage and Time and Sales

- Extended trading hours

- Multiple order types (stop, limit, market, chart)

- Web, desktop, and mobile apps

|

Cons of Trading with Webull:

- Charts can be awkward to customize

- Data feeds can be unreliable

- Social media overload

- Steep learning curve for beginners

- Order slippage

- Access to HTB stocks for shorting

- No order routing options

- Delayed customer service

|

Generally speaking, Webull has provided a positive trading experience over the past 5 years. In 2019 the software was a bit more buggy, but they have done a quality job of smoothing the rough edges. That being said, certain aspects of Webull would not suffice for specific traders.

Day Trading with Webull

As a day trader, you'll likely find the software lacking in many of the areas you might need. For example, day traders often rely on order routing through multiple clearing firms in addition to locating Hard-to-Borrow short shares. Many of these traders need more specialized trading software that allows for these types of trades.

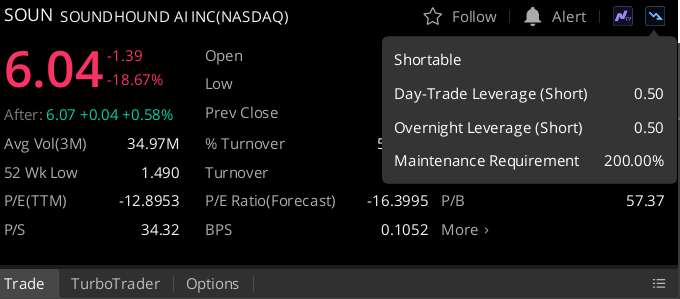

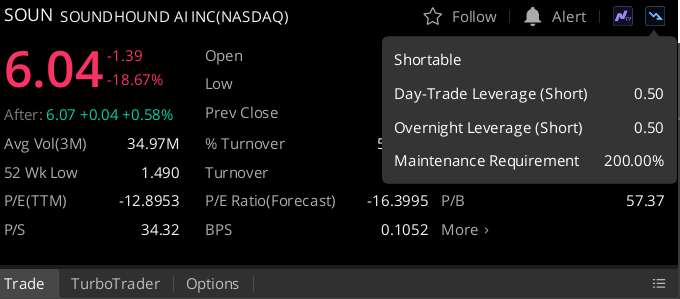

While Webull offers some HTB stocks, they are more akin to the larger brokerage houses which have limited shares of these stocks. In addition, there is no guarantee or indication as to what stocks will be available until you try to place a trade. The only indication you'll see is in the notes section of each ticker, which looks similar to this:

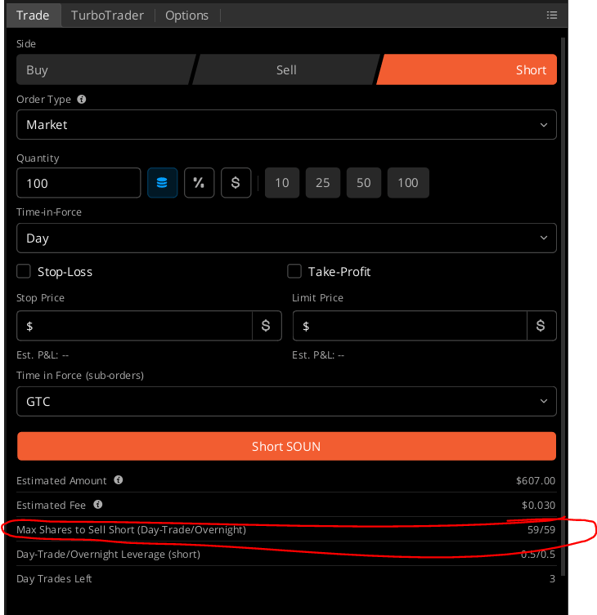

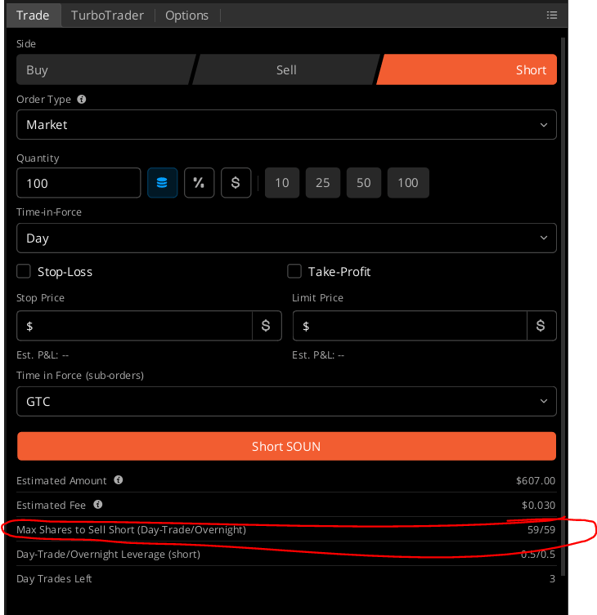

Here you might find whether or not the symbol is shortable, what requirement it will cost you to place the short, and how much leverage you can use with it. This is available on the desktop application. The application will also tell you how many shares you have available to short based on these calculations. It will show you this in the order montage:

That being said, unlike other brokerage firms, you cannot reserve shares for shorting as a day trader. Instead, you will only be able to short what Webull has available. If the short position executes, then you'll know it worked. If not, then you wasted your time at best, or missed the trade entirely at worst.

Day Trading Benefits of Webull

Despite not having multiple order routing options or quality short locates, Webull does offer hotkeys and level II data. For this reason, many day traders will find Webull a decent choice for day trading. If microseconds and HTB stocks don't matter as much and you're trading larger, more liquid names, you'll find Webull could work for your needs as a day trader.

Webull Trading Tools

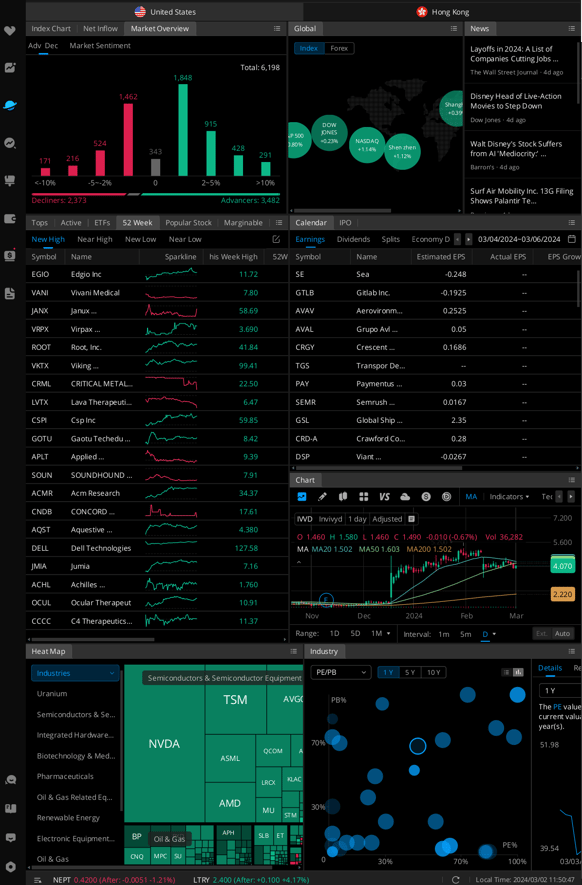

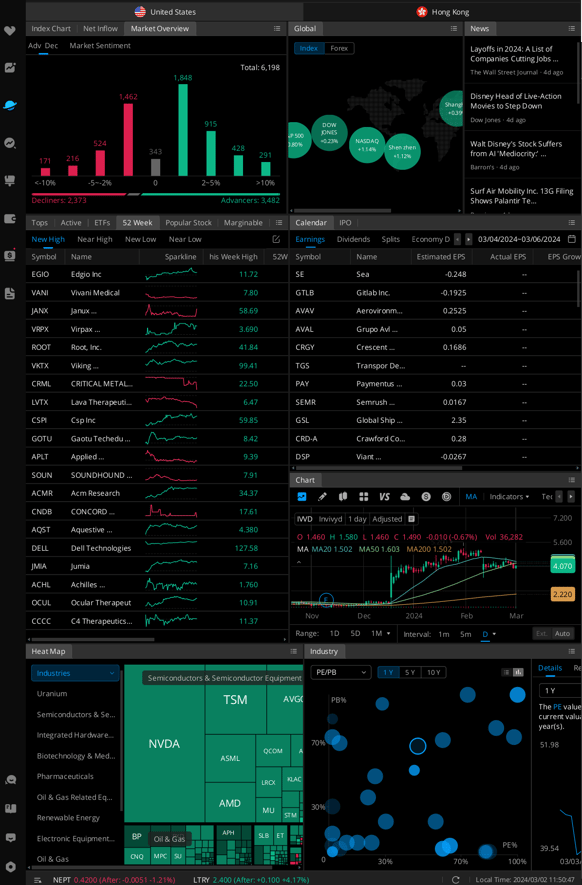

Some of the tools we like on the Webull platform are located on the Markets landing page where you can get a solid glimpse of what is going on in the market, which stocks and industries are moving, and what news is pressing.

One of our favorites is the built-in scanning tools, like Tops, Active, ETFs, 52 Week, and Popular. These built-in scans show you the top gainers for each day, the stocks most actively traded, stocks making 52-week highs, etc. It's a great starting place to get a pulse on the market and generate ideas for the day.

In addition, you'll find a heat map, Industry PE scatter plots, Inflow and Outflow data on the major indices, Earnings Calendar, and IPO data. The market overview is also customizable.

One more tool that is useful, especially on the go, is the Sparkline chart. This is similar to the ThinkorSwim spark chart, which shows a small chart next to the ticker in your watchlist. It's a great way to check on swing trades and see what the daily chart looks like without pulling up a detailed chart.

Webull Tools for Experienced Traders

For more detailed analysis, Webull offers multiple chart displays along with news, financial data, order flow, and other metrics. You'll be able to pull up corporate actions and releases with just the click of a button with each stock you view. Many advanced traders like to analyze a company's SEC filings and earnings reports before making a trade plan. Webull allows you to do that quickly.

As you can see, the intuitive interface and quick access to data is a big plus for experienced Webull users. It eliminates the need for multiple searches on bamSEC and or other information services.

Understanding Webull Features

Generally, Webull offers a pretty comprehensive list of features and trading tools that most traders will appreciate. All of this is packaged into a very user-friendly interface that makes sense for traders. To understand all the Webull features, their website compares the different products that they offer:

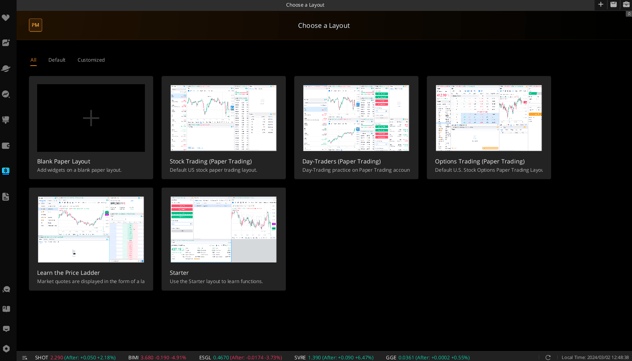

Another great way to understand Webull features is to simply download the product and play around with it. Webull has a paper trading application built into their software that allows users to give the platform a try using virtual money.

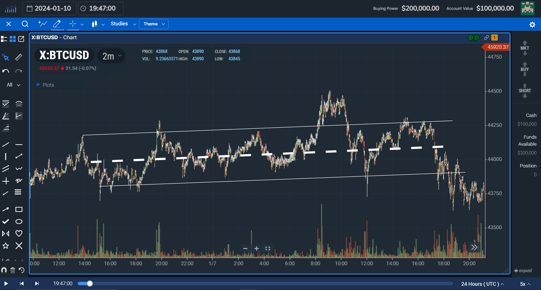

Webull Trading Platform Analysis: Paper Trading on Webull

In our experience, using the Webull trading platform has been positive. Within the platform, there is a paper trading simulator that allows users to analyze the platform safely. It's a great way for beginner traders to better understand the features that Webull offers without risking any money.

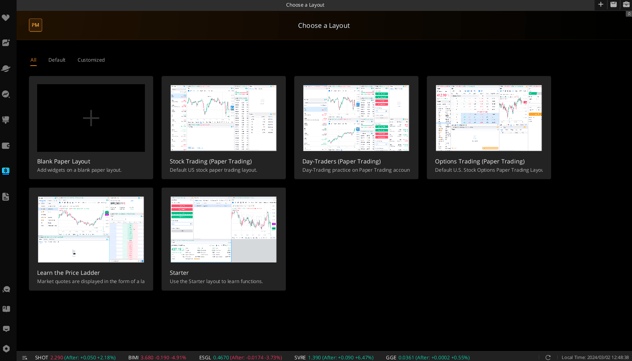

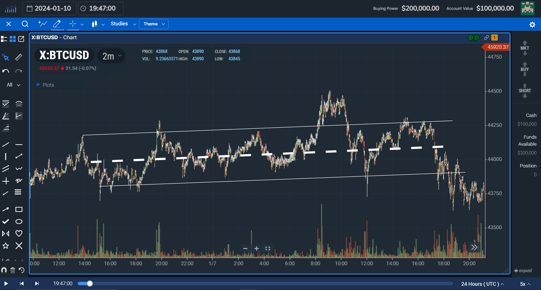

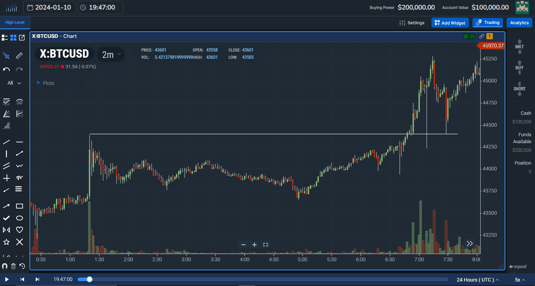

When using the paper trading mode to analyze the software, users are first prompted to choose from multiple layouts. This gives you an opportunity to try multiple chart and montage order positions on your screen. You can even choose from a layout designed for day traders, swing traders, or options traders, as you can see below:

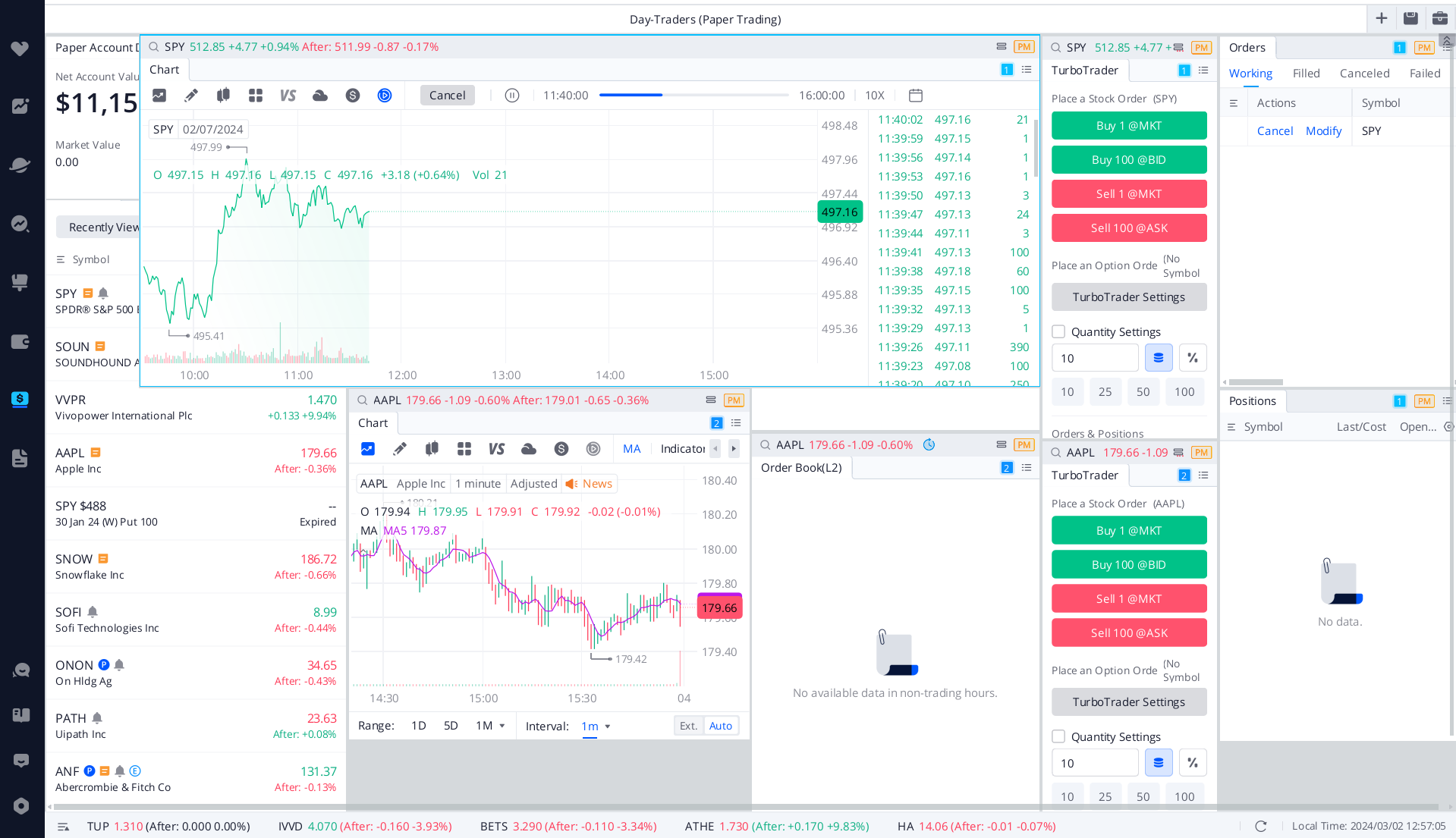

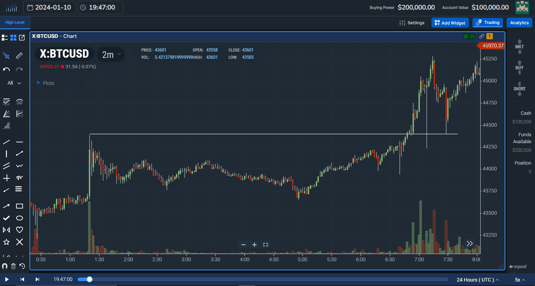

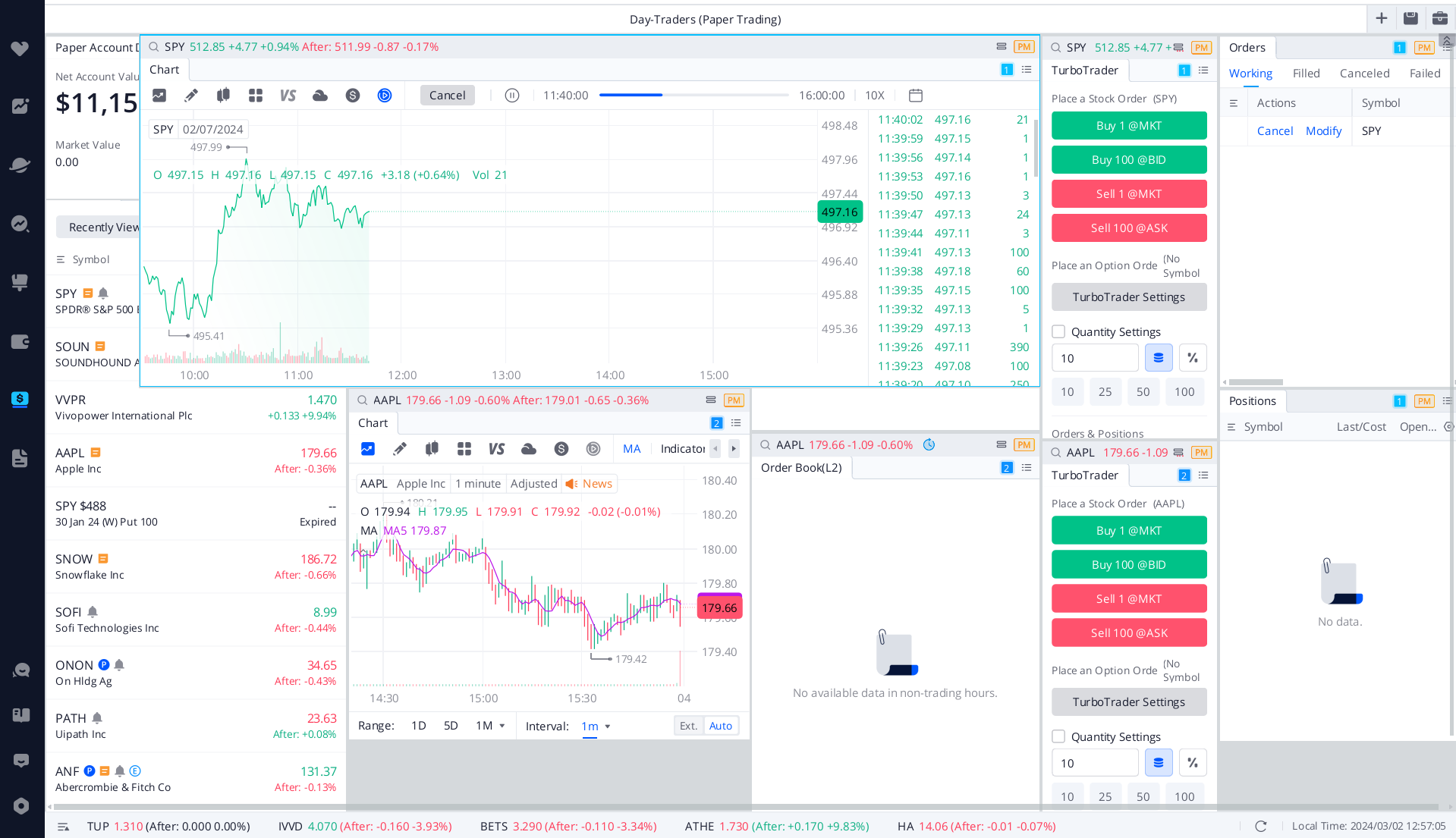

For the purpose of this review, we chose the day trading layout. In this layout, you get a solid view of multiple charts that can be customized, a watchlist, order montage, level II data with time and sales, as well as your current positions and orders. Charts can be moved around and adjusted for size and tethered together to a specific order montage or other windows.

Additionally, within the paper trading mode, there is a replay function that allows you to replay prior market days.

In our experience, the replay functionality is very limited and doesn't allow you to place a trade during replay mode to test or backtest strategies. It is also limited to line charts in replay mode. For this type of functionality, we recommend none other than our very own TradingSim, which was built from the ground up to allow aspiring traders to replay and trade markets with live functionality on up to three years of historical market data.

Regardless, if you want to test out and better understand the features of Webull, there is no better way to do it than through the paper trading portal on the application.

Webull Trading Strategies

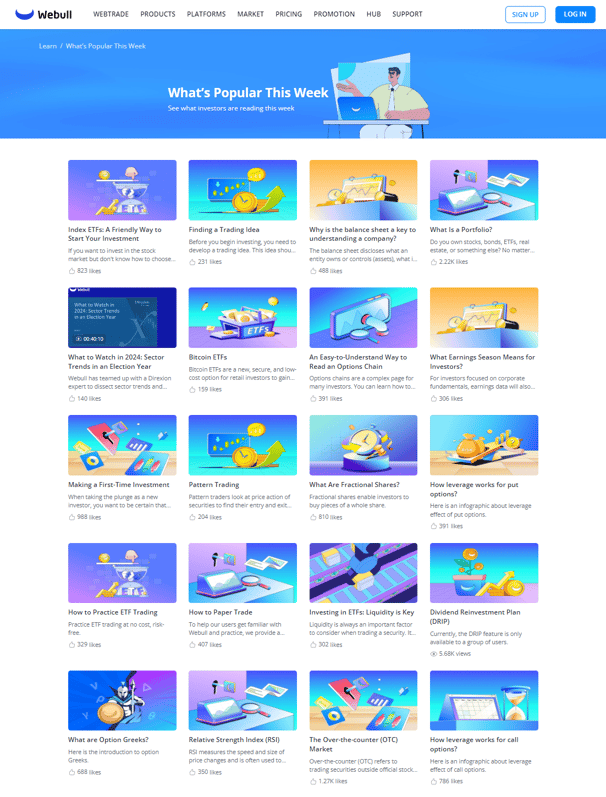

Webull has an education section of its website dedicated specifically to understanding popular trading strategies. On this page, you might find useful resources on idea generation, portfolio management, ETFs, options education, and more.

One great way to find trading strategies that you could use on Webull is to study markets in general. For example, here at TradingSim, we have a ton of great, free resources for new traders. Practice these methods in the simulator first, then when you're confident you can make money with them, you can put them to work with real money in Webull.

Here are three of our best strategies that we discuss in depth at TradingSim that can apply to Webull or any other brokerage platform:

- Focus: This strategy identifies and capitalizes on established trends, buying in uptrends and selling in downtrends.

- Tools: Moving averages, trendlines, and volume analysis are commonly used.

- Pros: Relatively simple to understand and implement, can capture significant gains in trending markets.

- Cons: Can miss out on countertrend moves, suffers during choppy markets.

- Focus: This strategy assumes prices tend to revert to their historical averages and exploits deviations from these averages.

- Pros: Can be profitable in ranging markets, offers defined entry and exit points.

- Cons: Reversal timing can be tricky, and requires patience and discipline.

- Focus: This strategy identifies and attempts to profit from price breakouts above resistance levels or below support levels.

- Tools: Chart patterns, volume analysis, and volatility indicators are often used.

- Pros: Can capture large moves if the breakout is sustained, offers clear entry and exit points.

- Cons: False breakouts can lead to losses; requires quick reaction to confirmation signals.

Final Evaluation of Webull for Day Trading

Although Webull has some limits for serious day traders and short sellers, it is a clear winner in the hobby trading retail space. We give it an overall rating of 4.8 stars based on the most important criteria being met. With the exception of short locates, multiple routes, and comfortable charting, it is a very good option for retail day traders.

We hope you found our review of Day Trading on Webull helpful. If you're an aspiring trader who wants to learn how to trade in a safe environment, without risk, we encourage you to try our trading simulator free for 7 days. No purchase is necessary. There's no better place on the web to relive the markets, tick by tick, than at TradingSim.com.

Day Trading

Day Trading