The gap has the amazing ability to take the breath right out of swing traders and long-term investors as they scramble to assess the pre-market and early morning trading activity.

In this article, we will discuss how to trade morning gaps on the open and how to take advantage of these chaotic situations.

The morning gap is one of the most profitable patterns that many professional day traders use to make a bulk of their trading profits. The morning gap is a byproduct of built-up trading activity that occurs overnight due to an economic number, earnings release, or company-specific news event. [1]

Day Trading Morning Gaps

Let’s now go deeper into the structure of the gap. If you listen to some of the “gurus”, they will begin to describe a host of gap types present in the market.

Like everything else on Tradingsim, we will take the simple approach when it comes to analyzing the market and focus on two types of gaps – full and gap fill.

Full Gaps

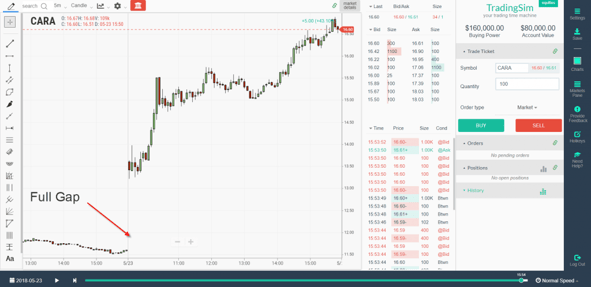

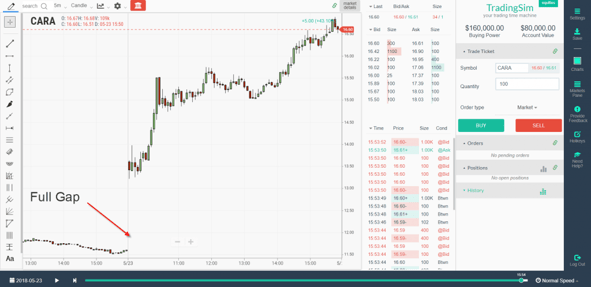

We have a full gap when the price never breaches its prior day's close.

Full Gap

Gap Fill

A gap fill occurs when the stock gaps on the open but at some point during the day overlaps with the previous day's close. [2]

Gap Fill QQQ

The majority of gaps do get filled at some point of the day. However, if a stock gaps really hard it can go days and even weeks before ever filling its gap. These are also referred to as breakaway gaps.

Gaps are really fun to trade if you know what you are doing. Conversely, if you are out there just swinging for the fences you can get your feelings hurt.

Gap Trading Techniques

Next, I’m going to list out 4 techniques I see at play every day and you can glean from them what you see fit.

Strategy #1 – Be Weary of the First Candle

The first 5-minute bar can tell you a lot about the strength of the stock. When I first started out I would just buy the breakout on the first 5-minute bar.

At times this worked lovely and I would be able to grab the lion share of a 15-minute or 30-minute run on the open.

King of the Market

This was the dangerous part in that I honestly believed each stock should perform like this on every buy. As you know from trading, things don’t always work out as planned.

While I would land a few of these in a row, at some point the nasty reversal would come to smack me in the face. Now, this is not a light smack, it is vicious.

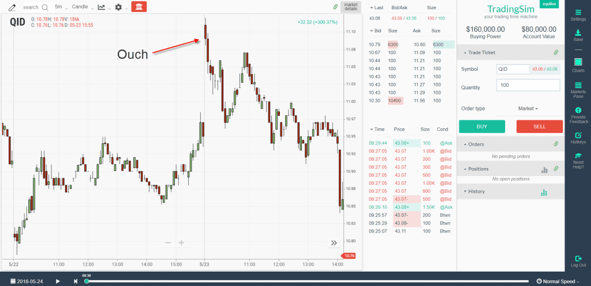

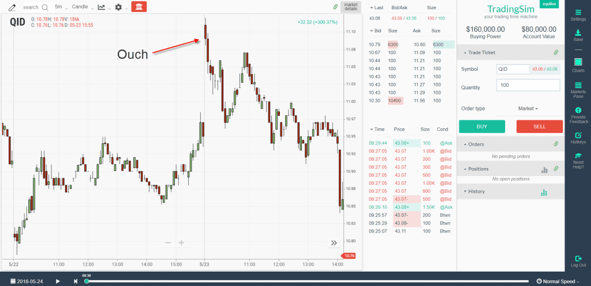

For example, take a look at the chart below.

Ouch

The hardest part is that the smack in the face comes after you have had some success. So, if you do not have a stop in place, this is where the hope comes into play as you are still living in the past.

So what to do?

I have learned to wait a little bit after the market to let the charts set up. I no longer rush out there looking to get into a position quickly. So, at times I may miss one that runs, but it also allows me to avoid the pitfalls of jumping in too early and then holding on for dear life as the stock drifts lower into the close.

The last thing I will say on this is that buying the first candlestick after the gap poses the challenge also of where to place your stop. You can place it below the low of the candlestick and that works at times.

I would get into trouble if the stock closed near the low of the candle. I would freeze up because I needed to get out, but that half a second hesitation would lead to losses on the day.

The other option you can take is to short this level of weakness when it presents itself in the morning. I don’t personally take this approach, but see if it works for you.

Strategy #2 – Wait for the Flag

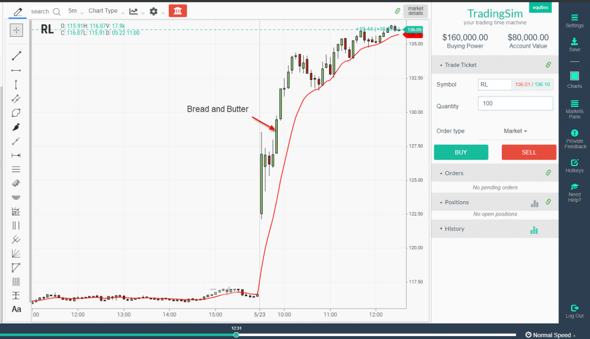

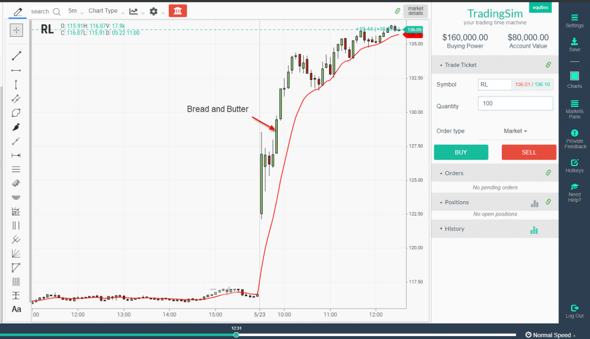

This is my favorite goto for the morning setups. I essentially wait for a stock to gap up and then I like to see consolidation near the high. This consolidation should take place over 4 to 8 bars.

I also like for the stock to not retreat much into the strong gap-up candlestick. The last thing I like to see is for the stock to stay above the 10-period EMA so that it’s clear the stock is still trending hard.

This for me presents a beautiful chart with clean candlesticks.

I then wait for the stock to make a run for the high of the day, but it has to do it between 9:50 and 10:30 at the latest. Once you go beyond 10:30 stocks tend to drag along with no clear direction.

Bread and Butter

Strategy #3 – Wait for the Gap Fill

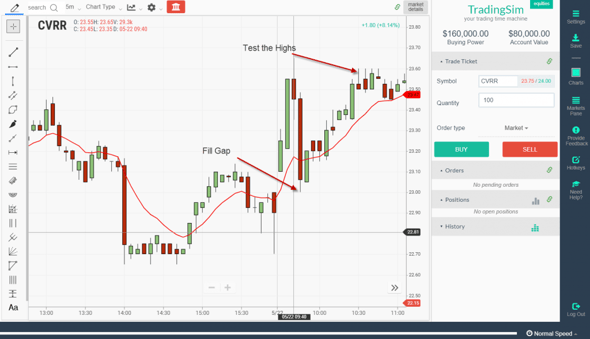

This is another strategy that works for other traders but I have yet to master.

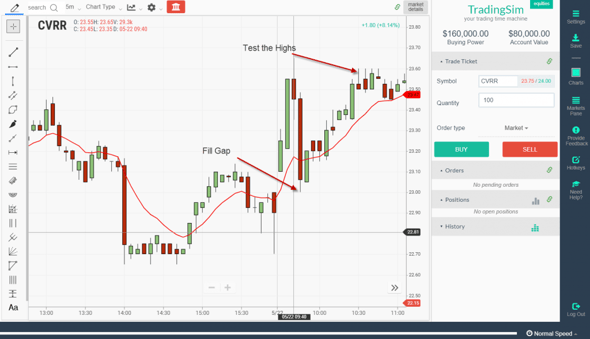

This is where you wait for a stock to pull back to its prior days close and fill the gap. You then wait to see a sign of strength and enter the position on that move.

You then place a stop below the low of the candlestick.

The hard part of this strategy is setting your price target. I have noticed that these pullbacks exceed the high or low of the morning by much.

Most professional traders buy the pullback and then sell the retest of the high of the morning.

Gap Fill Strategy

How Can Tradingsim Help?

Trading gaps is not an easy feat, as it requires an enormous amount of discipline, because you are trading the most volatile period of the day.

You can practice trading these three setups in Tradingsim to figure out which system fits you the best or you can work on creating your own.

External References

- Rockefeller, Barbara. 2004. Technical Analysis for Dummies. Figure 7-3 Price Gap. Wiley Publishing Inc.

- Gap Pattern. Wikipedia

Day Trading Basics

Day Trading Basics