The Nasdaq 100 futures are part of the index futures contracts offered by the CME Group. They are one of the popular index futures with different versions, but the e-mini Nasdaq 100 futures tops the list in terms of volume and popularity. Similar to the E-mini S&P500 or the $5 Dow futures the Nasdaq 100 futures contract tracks one of the leading stock indexes in the U.S., namely the Nasdaq 100 index.

Compared to the S&P500 e-mini (ES) index futures contracts, the e-mini Nasdaq 100 contracts are a bit cheaper when you compare the tick value. For example, a 0.25 index point move in S&P500 is valued at $12.50, while the tick value for the e-mini Nasdaq 100 contract is $5.00. The Nasdaq 100 futures contracts also exhibit some characteristics which sets it apart from the other index futures contracts.

Besides some fundamental and technical differences, the Nasdaq 100 futures contracts allows day traders and investors to trade the contracts with relative ease, either for speculative purposes or to hedge the risks from the underlying market. The Nasdaq 100 futures contracts are all financially settled and there is no physical delivery of the underlying asset.

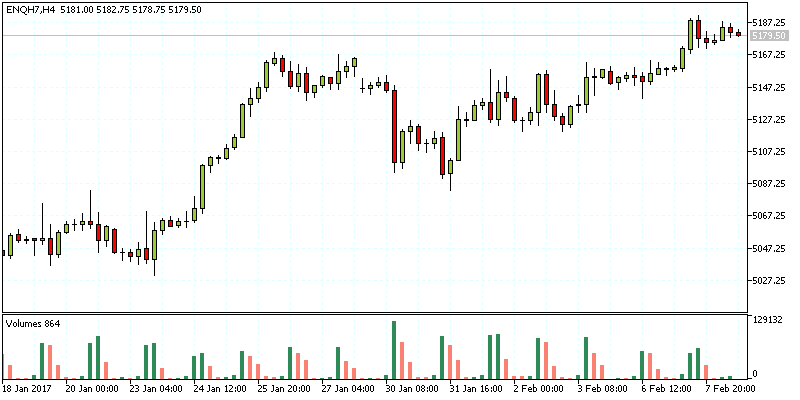

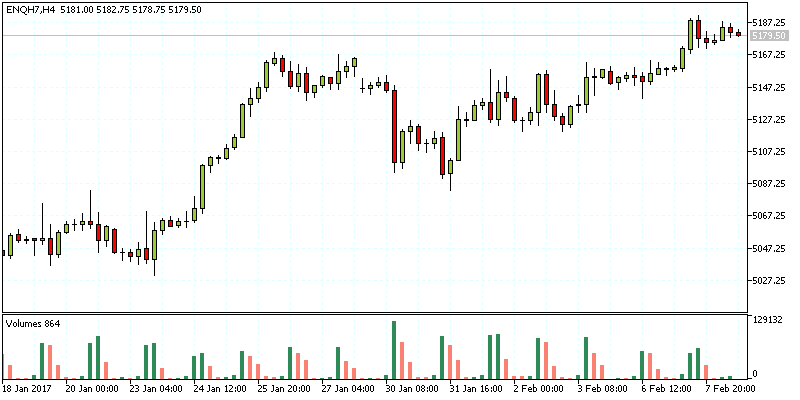

(NQ) – The Nasdaq 100 Futures Price Chart

Besides futures, traders can also gain exposure to the underlying market via options contracts as well. Although the Nasdaq 100 futures contracts might look similar to other index futures contracts, there are some subtle differences that set it apart. Before you trade, here are five things every day trader should know before you start trading the Nasdaq 100 futures contracts.

1. The Nasdaq 100 Index

The Nasdaq 100 futures contract is the derivative instrument tracking the prices of the underlying asset, the Nasdaq 100 stock index. The Nasdaq stock index is made up of 107 companies and not 100. Interestingly, the financial companies are excluded from the Nasdaq 100 index making it unique from the Dow Jones or the S&P500 Index. The Nasdaq 100 index’s components are based on a capitalized weighted index.

The Nasdaq 100 index is relatively newer compared to the Dow Jones or the S&P500 index, but the Nasdaq exchange itself is the second largest in the world and is owned by Nasdaq Inc. which was founded in 1971. Nasdaq is an abbreviation for “National Association of Securities Dealers Automated Quotations.”

The Nasdaq 100 was launched in 1985 with a base price of 250 and had to be reset a few times early on. Besides the futures, traders can gain exposure to the Nasdaq 100 by trading the ETF equivalent such as the PowerShares QQQ ETF and of course options.

Prior to 1985 when the Nasdaq 100 index was launched, the exchange itself was referred to as over-the-counter. However the exchange managed to attract high growth companies such as Microsoft, Apple, Cisco, Oracle and Dell, modernizing the way IPO’s were floated.

The Nasdaq 100 index is not to be confused with the Nasdaq composite index. The main difference between the Nasdaq 100 and the Nasdaq composite index is that the latter tracks all the companies listed on the Nasdaq stock exchange, whereas, the Nasdaq 100 tracks only the top 107 companies listed on the stock exchange on the basis of market capitalization. The Nasdaq also has other indexes such as the Nasdaq 100 financial index which specifically tracks the financial sector companies based on market capitalization.

The major distinction though is that the Nasdaq 100 is a sub-index of the Nasdaq composite and they also have different tickers. The Nasdaq composite has the symbol ^IXIC, while the Nasdaq 100 has the ticker ^NDX. The futures contract for Nasdaq 100, tracks the prices of the Nasdaq 100 from the underlying cash markets.

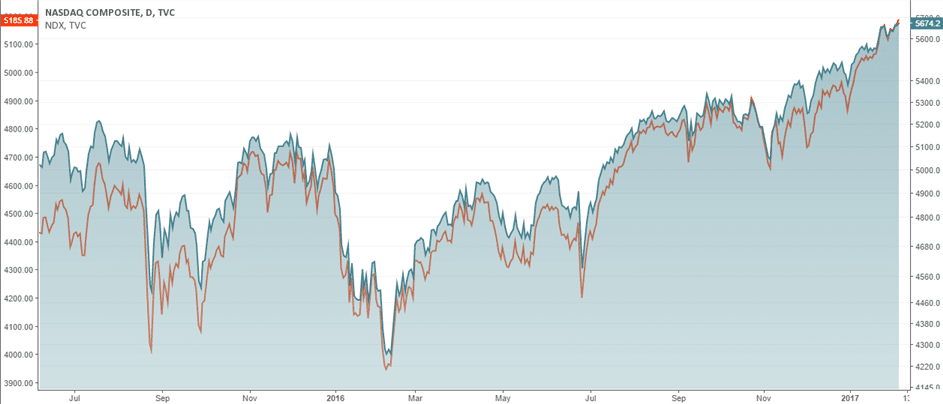

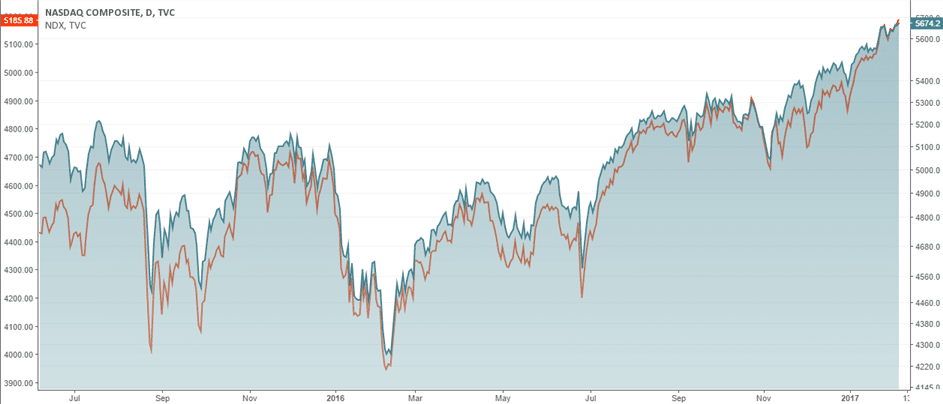

The chart below shows a comparison of the Nasdaq 100 and the Nasdaq composite index. You can see that there is only a small difference in the pricing between these two indexes while the dips and rallies are almost identical.

Nasdaq 100 (NDX) and Nasdaq Composite (IXIC) index

2. The different types Nasdaq 100 futures that you can trade

When you talk about the Nasdaq 100 futures market, the E-mini Nasdaq contract often comes to mind. There are many other contracts that futures traders can choose from, including a Nasdaq Biotech futures contracts as well as the standard or big Nasdaq 100 futures contracts.

Here is a quick overview on the different Nasdaq contracts that you can trade.

The e-mini Nasdaq 100 futures contracts are no doubt the most popular. These contracts trade with the ticker NQ and the margin requirements are the lowest, enabling many day traders to choose NQ contracts over others. In terms of tick size, The E-mini Nasdaq 100 futures contracts have a minimum tick of 0.25 index points, priced at $5.00 per tick. The day trading margin for the e-mini Nasdaq100 futures contracts are just around $1000 and vary from one futures broker to another. The CME requirements are however $3500 for the performance bond and $2800 for the maintenance margin.

The next most popular contract is the standard E-mini Nasdaq futures contracts. These contracts trade under the ticker QCN. They are almost similar to the E-mini Nasdaq 100 (NQ) but differ in terms of the tick size and value. The QCN Nasdaq 100 contracts are double the E-mini, meaning that the minimum tick size of 0.50 index points with a value of $10.00 per tick.

Due to the higher tick size and tick value, the performance bond requirement from CME group is about $4000 and maintenance margin of $3200.

The big Nasdaq 100 futures contracts are definitely not popular among retail day traders. As the name suggests, these are large contracts and more suited for institutional or hedge fund traders. Trading under the ticker of ND, these large Nasdaq 100 futures contracts have a minimum tick size of 0.25 index points valued at $25.00. The CME Group’s margin requirements are $17,500 in performance bond and $14,000 in maintenance margins.

Finally, there is the specialized Biotech futures contract called the E-mini Nasdaq Biotechnology futures contracts. Trading with the ticker symbol of BIO (Globex), these futures contracts track the Nasdaq Biotechnology index (IBB). The tick size for the Nasdaq Biotech futures are 0.10 index points valued at $5.00. The performance margin from CME Group is $3750 with a maintenance margin of $3000.

3. The E-Mini Nasdaq 100 Futures are the most popular contracts

For day traders, the E-mini Nasdaq 100 futures (NQ) futures are the most popular and attract the highest volume of trading. This level of engagement with the Nasdaq futures contracts means that the contracts are very liquid making it easy to buy/sell without influencing the prices.

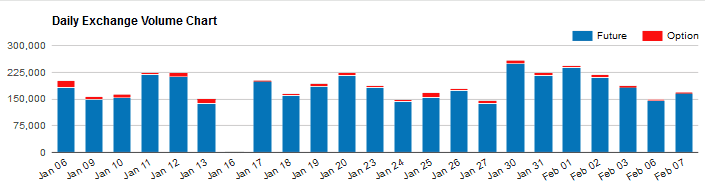

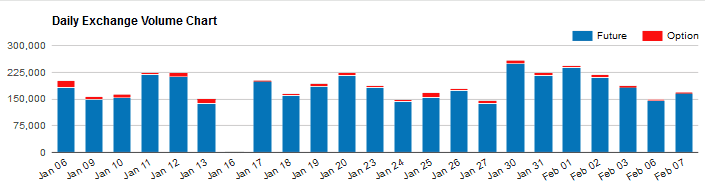

E-mini Nasdaq 100 Futures average daily trading volume

Volume in the E-mini Nasdaq 100 futures picks up during the start of the official U.S. trading hours and quite often leads to strong price action in the opening hours of the session. Many retail day traders tend to use this volatility to trade the Nasdaq 100 futures during the first hour of the U.S. trading session to capture profits with only little efforts.

As with all index futures, the Nasdaq 100 contracts are available on a quarterly basis with March, June, September and December contract months. Traders should be aware of the quadruple witching days which occurs four times a year on the quarterly expiration of the derivatives contracts and can bring undue volatility to the futures markets.

Below is a summary of the Nasdaq 100 e-mini futures contracts.

| Contract Unit |

$20 x NASDAQ-100 Index |

| Trading Hours |

Sunday – Friday 5:00 p.m. – 4:00 p.m. CT with a 15-minute trading halt Monday – Friday 3:15 p.m. – 3:30 p.m. CT and a 60-minute break each day beginning at 4:00 p.m. |

| Product Code |

CME Globex: NQ |

| Listed Contracts |

Five months in the March Quarterly Cycle (Mar, Jun, Sep, Dec) |

| Min. Tick |

0.25 Index points |

| Tick Value |

$5.00 |

4. E-Mini Nasdaq 100 futures have a tax benefit advantage over tech stocks or ETF’s

Futures have a tremendous tax benefits compared to stocks or even ETF’s, which are designed to be tax efficient in the long term. Besides the inherent tax advantage, as a futures trader you are not bound by the rules such as the day trading rules which apply to other markets and more importantly you don’t have to maintain the minimum $25,000 in your account for day trading purposes.

In fact this is one of the reasons why Nasdaq 100 futures are more attractive compared to trading the equivalent tech stocks or even tech ETF’s. With the Nasdaq 100 futures, you can easily go long and short on the futures contracts with no restrictions or any additional margin requirements beyond what is required.

The day trading margins for Nasdaq 100 futures are cheap and even for swing traders who want to trade the futures positions overnight, the maintenance margins are very small compared to stocks or ETF trading. The low capital requirements and the fact that futures contracts are leveraged, makes Nasdaq futures one of the best ways for traders to gain exposure to the technology and growth stocks which can yield tremendous gains in a relatively short period of time.

Given the different tax structure for the futures markets, day traders can find that trading the futures markets is a lot more beneficial than compared to stocks or ETF’s, which in any case are more cumbersome and comes with the risk of getting improper fills in the market. The fact that the futures markets trade round the clock makes it appealing for day traders from around the globe and not just U.S. based traders. This almost round the clock trading time ensures that traders can capitalize on any events that happen outside of the U.S. trading hours. Of course while liquidity might not be that high, the fact that traders are able to place trades without affecting the market too much is in itself an advantage.

5. Factors that influence Nasdaq 100 prices

The Nasdaq 100 index is made up technology and bio-technology stocks, and excludes financials. Some of the stocks listed in the Nasdaq 100 stock index are also included on the Dow Jones and the S&P500 Index. However, due to the exclusion of financial stocks, such stocks which are part of the Dow and the S&P500 (ex: JP Morgan, Goldman Sachs) are not listed on the Nasdaq 100 exchange. As a result, the Nasdaq 100 is usually not bothered by the volatility in the financial sectors.

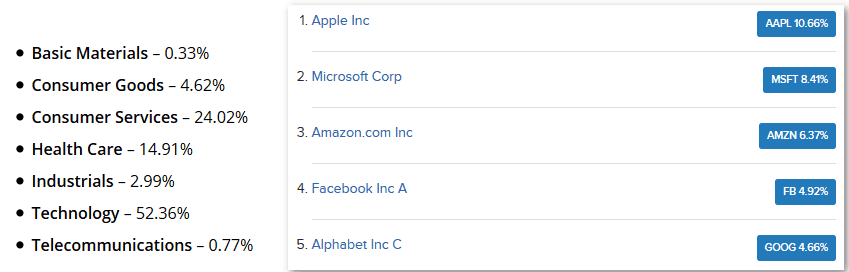

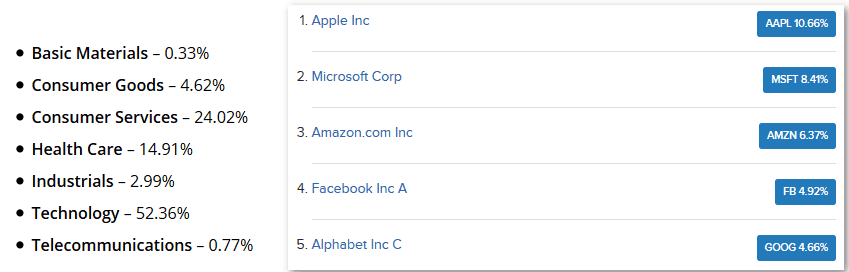

Nasdaq 100 Sector Weightage and Top 5 Companies

When trading Nasdaq 100 futures, traders should pay attention to earnings reports from the company listed and general industry trends. Among the 107 components of the Nasdaq 100, the top five companies are Apple, Microsoft, Amazon, Facebook and Alphabet.

The index is of course subject to volatility from the broader economic factor such as interest rates, monetary policy and other general economic indicators, but the effects are limited. Because interest rates have a direct influence on the financial sector, the Nasdaq 100 index tends to weather any adverse news on interest rates better than its peers. Because technology and biotechnology are two fast moving industries, one can expect to see a lot of volatility represented in the Nasdaq 100 as a result.

Still, when trading Nasdaq 100 futures, traders should focus on the general markers such as the company earnings, the economic factors in the U.S. as well any outliers that could influence investors’ risk sentiment.

The Nasdaq 100 futures contracts might not be as popular as the E-mini S&P500 futures contracts or even the $5 Dow futures contracts. But the Nasdaq 100 contracts offer something unique for the futures trader who wants to trade these contracts for purposes other than hedging their exposure. Due to the fact that the Nasdaq 100 futures contract does not account for any financial stocks, the underlying market can be quite unique to the Dow or the S&P500; this allows traders to look at various ways to spread their risks across the other two stock index futures which behave almost similarly.

Futures

Futures