One of the most recognizable trading patterns in the world is the head and shoulders pattern. However, this pattern is mostly associated with shorting strategies based on a massive distribution pattern that looks like a head and shoulders. There is a mirror image of this pattern for long-biased traders, however. It is simply called the inverse head and shoulders pattern and is an accumulation pattern.

In this tutorial, we'll go into detail on what the inverse head and shoulders is, what happens after an inverse head and shoulders, and how to trade this pattern.

What is an inverse head and shoulders pattern?

The inverse head and shoulders pattern is a reversal pattern in stock trading. It gets its name from the visual representation it makes on the chart -- two higher lows on either side of a lower peak in price action in the middle. It is also the same as a head and shoulders pattern that flipped on its horizontal axis. Hence the "inverse."

The inverse head and shoulders typically comes at the end of a downtrend in price movement on a chart. As the first shoulder forms, you begin to see the downward momentum slowing. Then the head is formed when the price action breaks through the left shoulder and goes lower. Lastly, there is a rally and then a retest of the lows on the right shoulder that should not make a lower low.

What does inverse head and shoulders indicate?

The inverse head and shoulders pattern typically indicates that a stock, cryptocurrency, future, or other asset is about to reverse a downtrend. There is a possibility that an inverse head and shoulders can form during a pause in an uptrend, but these are typically called cups, or cupst with handles.

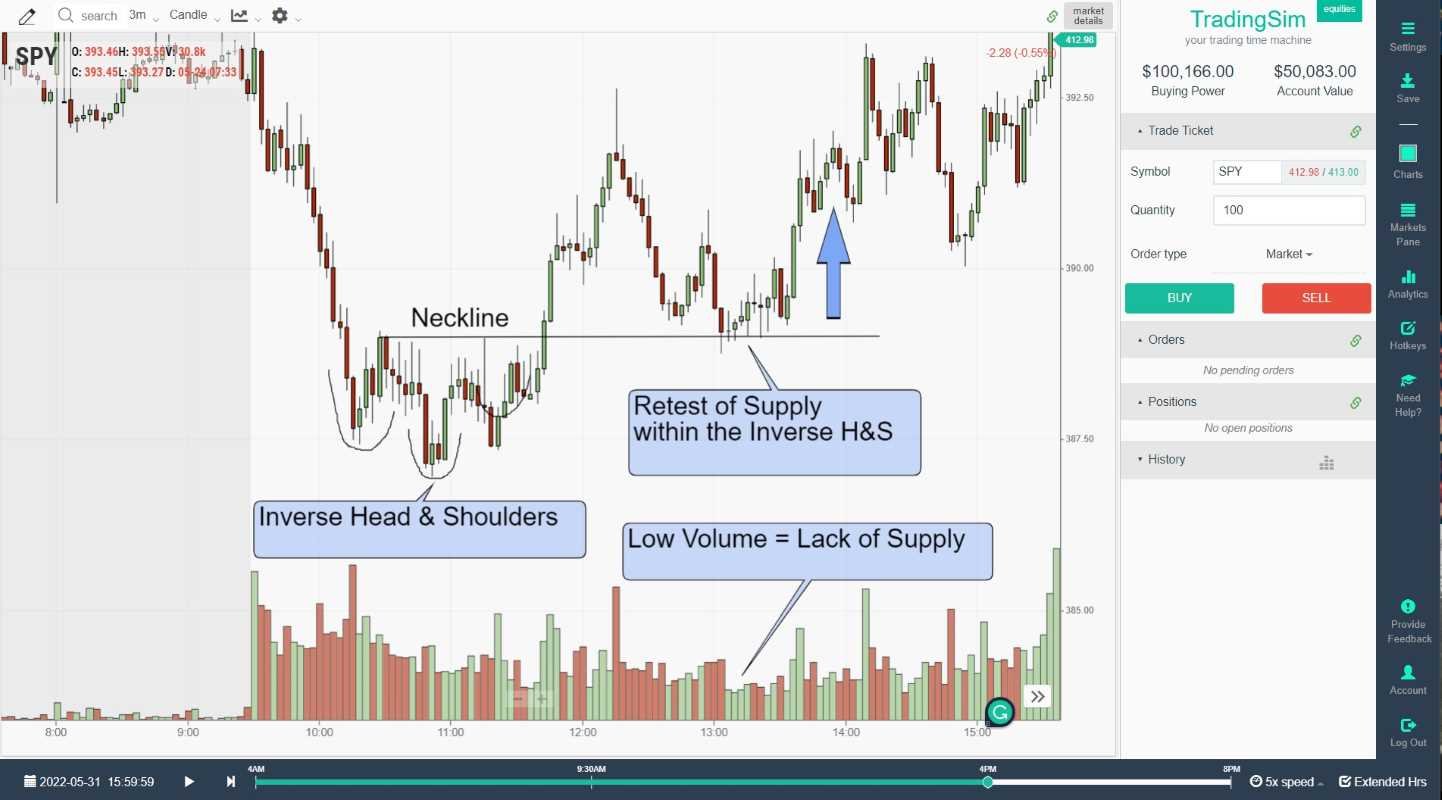

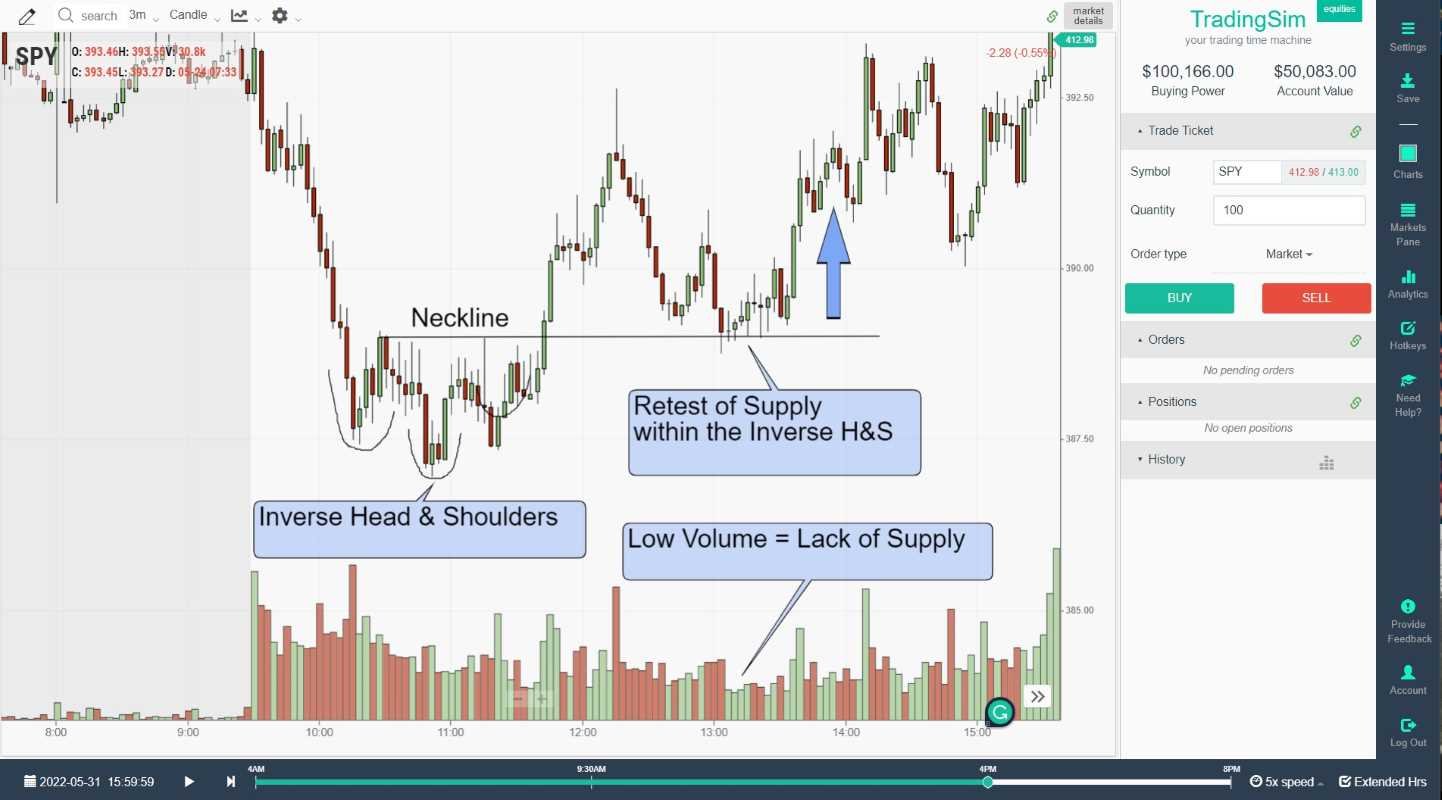

The reason the inverse head and shoulders indicates a reversal is because it is an accumulation pattern. As you can see in the image shared above, the downward momentum of the stock is diminishing. With each successive move down, it get harder to make new lows. In fact, the right shoulder of the pattern indicates a new "higher low," something considered very bullish when trading.

As short sellers are taking profits into the lows of the pattern, bulls begin speculating on the oversold condition of the stock -- taking advantage of lower prices. While the pattern matures, short sellers begin to see a potential reversal. This may lead to more short covering, which creates demand for the stock.

Despite any added supply, the downward pressure eventually recedes and is absorbed by demand. Thus, the inverse head and shoulders results in a reversal of the original downtrend.

Is inverse head and shoulders bullish?

Generally speaking the inverse head and shoulders is bullish. This does not mean that every inverse head and shoulders will result in a successful long trade. We'll discuss what a failed inverse head and shoulders pattern looks like in a moment.

Suffice it to say that because this pattern is seen as a reversal pattern in a downtrend, traders are looking to trade it as a bullish pattern. In order to trade it successfully, you must adhere to some strict entry and risk management criteria.

Inverse head and shoulders pattern rules

In order for an inverse head and shoulders to qualify as such, it must create two "shoulders" and a "head". In other words, the second low in the pattern must be lower than the first and third low. Without this, it is merely a triple-bottom or some other pattern.

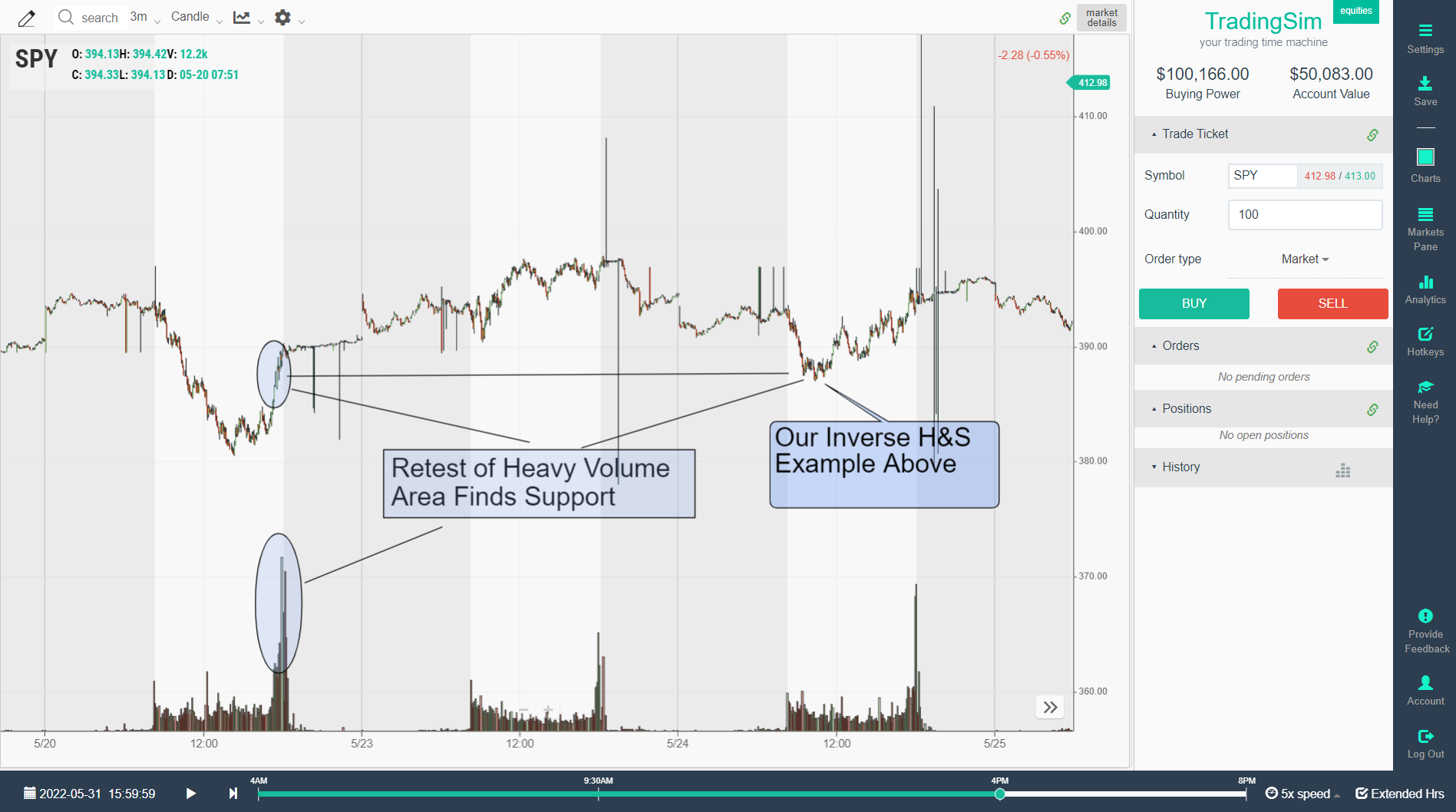

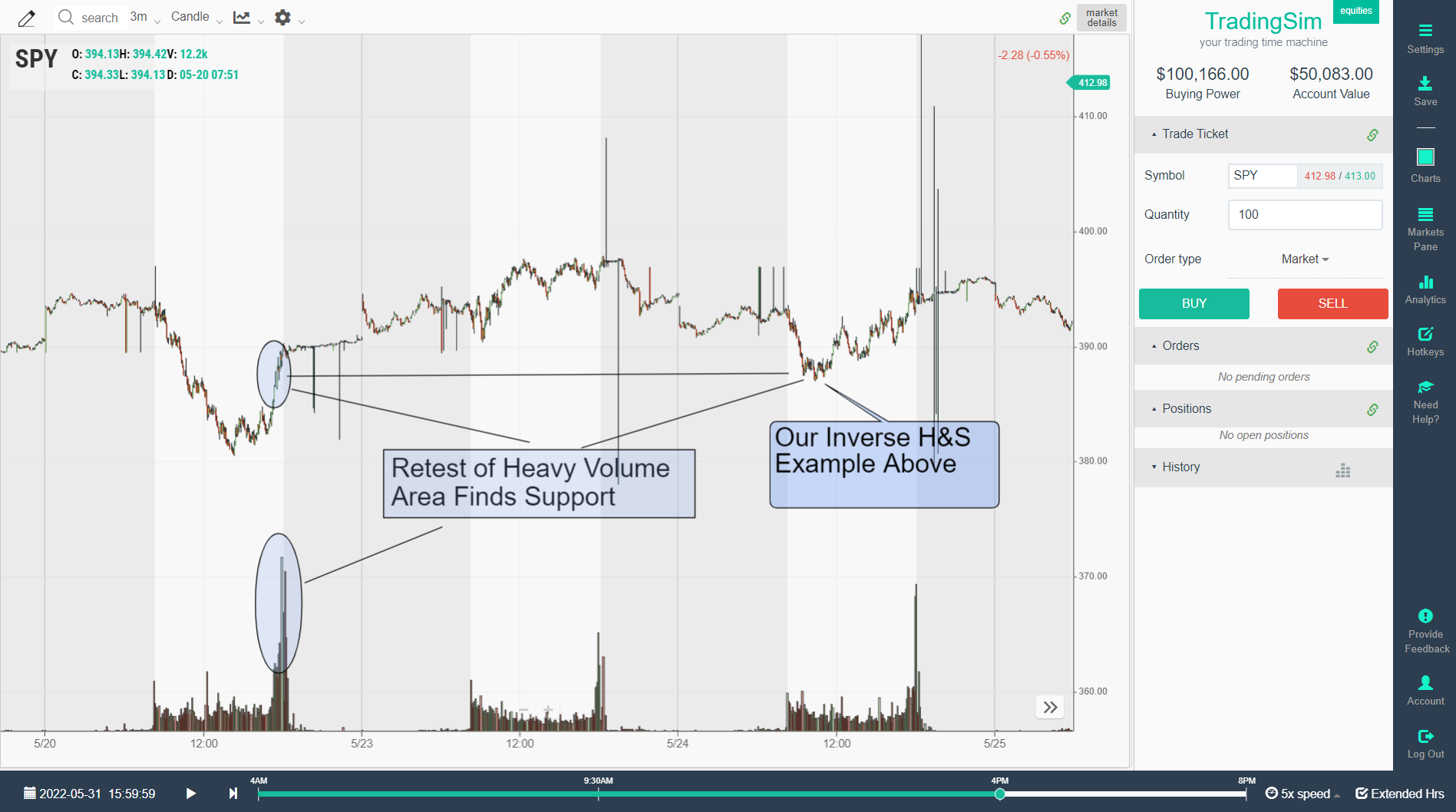

Likewise, there must be climactic price action associated with the pattern. Ideally, you'll want to see heavy volume along the lows of the pattern, indicating that someone is capitulating their shares, which are being absorbed by buyers. Notice in the image below that the volume spikes each time the price action reaches a low in the pattern:

Lastly, the pattern isn't complete until the neckline is broken and a breakout from the pattern occurs. Ideally, you'll want a move higher that is at least as high as the pattern was deep. Often, you'll get a retest of the pattern neckline area later before price moves higher or fails.

So to recap the rules for an inverse head and shoulders pattern:

- A left shoulder that displays a stopping action of the downtrend

- A lower low than the first shoulder

- A third low that is higher than the second low

- Increased volume signature along the lows of the pattern

- A solid breakout of the neckline on increasing volume

Stick to these rules and manage your risk levels accordingly, and you should find a successful outcome with the pattern over time.

what happens after inverse head and shoulders pattern?

While anything can happen after an inverse head and shoulders pattern, for the pattern to be a success you must see a solid rise in prices for the stock you are trading. Ideally, volume will increase as the price of the stock breaks out from the neckline and moves upward on momentum.

That being said, it is possible to see a retest of the upper range of the head and shoulders pattern. It is not uncommon for stocks to return to an area of consolidation in order to retest the supply levels and check for demand. As long as the demand is still present and stronger than supply, you will likely see another move higher in prices.

If you are scalping the pattern, you might simply measure the move according to the depth of the original pattern. Once you reach your target on the breakout, you can take profits. However, if you want to hold for a larger move, you might wait for the retest of the pattern to add back any sells you might have made for a bigger move.

How to trade inverse head and shoulderS Chart

The inverse head and shoulders chart is a very basic, but popular chart pattern to trade. In order to trade it properly, you need to understand the basics of the trading strategy and the pattern. Many traders will try to anticipate the trade before the pattern is complete. While we don't recommend this, we'll offer a few cheat entries for consideration.

In order to trade the head and shoulders pattern properly, you can do a few things to time your entry.

- Buy the "head" of the pattern as it rallies back through the first shoulder's low (but you will have to wait out the right shoulder formation and set your stop below the head of the pattern)

- Buy the right shoulder if it finds support along the same area as the first shoulder, but doesn't make a new low below the "head".

- Place your stop below the second shoulder or below the head.

- Buy the break out of the neckline - which could result in a higher success rate, but makes it difficult to define where your stop out will be.

Let's look at these examples on the chart, now:

As you can see, a proper head and shoulders can offer multiple "cheat entries" if you are trying to layer into a position in anticipation. Just understand that if you trade this way, you can easily get stopped out if the pattern fails. Always be sure to respect your stop-outs.

Inverse head and shoulders failure

Not all inverse head and shoulders pattern will work like a charm. In the event of a failure, you need to be disciplined in order to stop out and cut your losses. Here are a few things that can cause an inverse H&S pattern to fail:

- Lack of demand along the lows of the pattern or the breakout

- Not oversold enough

- Redistribution and heavy supply

We always encourage traders to find as many reasons for the trade to work as possible. For a head and shoulders pattern to work, you might want to consider any longer-term support and resistance levels, or multiple time-frame charts, like an hourly, daily, or weekly chart. If you can find that a stock is getting supported along the lows of a daily chart, then it retests on a selloff only to present an inverse head and shoulders, you might be in for a bonafide rally.

Conversely, if you are in the beginning of a new downtrend, you might find that the supply levels are too heavy and the stock fails.

Notice in this example below that the SPY was trending downward strongly. We never saw the heavy volume signatures that we saw in the successful example above. Consequently, this head and shoulders failed as prices continued lower.

Inverse head and shoulders summary

As with any strategy, you want to practice, practice, and practice some more. We are huge proponents of backtesting and outcome testing so that you know the odds you're stacked up against before you ever put your hard-earned cash at risk in the market. Be sure to test out the inverse head and shoulders in our simulator and trade as many examples as you can find while studying your analytics in our analytics page.

Keep in mind that not every inverse H&S will work. Write up your criteria and find the best way to find a confluence of variables that will give you success while trading it.

Here's to good fills!

Day Trading

Day Trading