In this post, I am going to lay out the 8 things that I did to improve my intraday trading discipline. Please note I did not say make millions of dollars or buying flashy cars.

Trading is about a journey.

It’s about placing the right trades every day and trusting the process. Make no mistake about it, the process is what is going to make you successful.

The process is also something you need to guard like your life depends on it. You have to place safeguards which keep you on the straight and narrow.

Well, this is enough of a lead-in, let me share my process.

#1 – Identify Intraday Trading Strategy That Works

Morning Breakouts

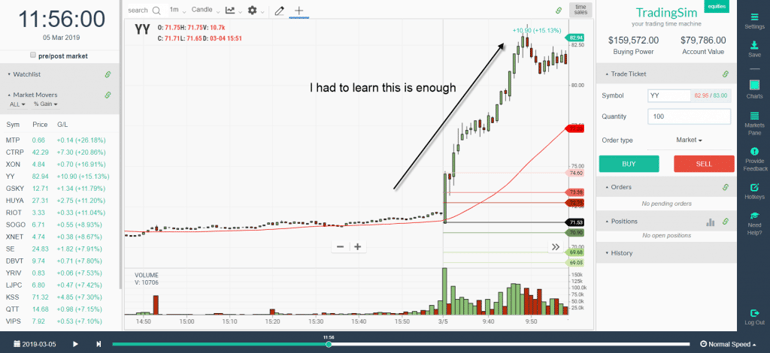

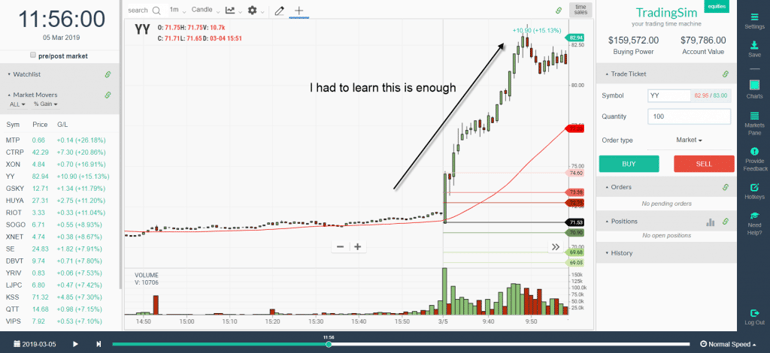

I have tried every trading strategy you can think of to see which aligns best with my personality. It has been a long and at times dark road. But the turning point for me was when I surrendered to the one setup I am really good at trading – the morning breakout.

This is the setup that makes me money consistently.

It’s to a point now that I can literally feel when the position is going to work even if it starts off on the wrong foot. I have had to let go of the idea that I am going to be able to trade all day or with penny stocks.

I’m just not wired to do either effectively.

So, find the one setup that makes you money. Do not try to be everything to everyone. Day trading is really hard and if you find one setup that works, stick with it.

#2 – Figure Out How Much You Can Earn Per Day?

How Many Intraday Traders Per Day

Look through your trades to see what your average gains and losses are per trade. You can use about a month worth of data to come up with a good figure.

From here you want to go trade by trade. You can subscribe to a service like tradervue.com which will do this for you automatically, but there is something about meticulously documenting each trade manually.

I know it’s a pain, but it will force you to confront your shortcomings.

What will emerge from this detailed study is a bell curve. Plotted on that bell curve will be all of your trades.

Out of this exercise, you will want to identify two numbers, the highest probability trade and value for each trade and for the day.

This will help you see limits on how much you can expect to make per trade and per day. It will help you tame the beast.

#3 – Figure Out How Many Trades Is Too Many?

The next painful exercise is to figure out how many trades is too many.

Depending on your trading style, you may place one trade per day or you may place 50.

So, how do you know when enough is enough? Again, this comes down to the data.

As you review your trades, this pattern will also emerge. For me, that number is 2 trades. I know it just as well as I know my name.

Now one could argue that it’s a self-fulling prophecy, but who cares. I know my number, so what’s yours?

#4 – Stop Once Your Daily Profit Target is Reached

Now that you know how much you are likely to make on each trade and per day, the next easy thing to do is stop trading.

Crazy concept right? Like why would you stop if you are having a killer day? Maybe you will blow out your previous record by 100%.

Maybe that penny stock you just bought will go up 10 fold?

These are all great theories, but it just doesn’t work out that way. Once you open up your mind to that level of possible gains, you will also open yourself up to an opposing level of risk.

Remember it’s about consistency, so if you are hitting your daily maximum gains, then you have done enough.

#5 – Stop Once You Hit Your Limit Down For The Day

What goes up must come down. Again, back to the numbers. You will notice there is a point where you are not going to turn your account from red to green.

It’s just a near impossibility and instead of clawing your way back, you are likely to do more harm than good.

#6 – Start Journaling

Journaling

Start documenting each and every trade you make. When I say document, I’m not talking so much about the technicals but more of what you were thinking.

What you saw in the trade that made you pull the trigger. By documenting this on a daily basis, you will begin to better understand your emotions and how these are impacting the management of your trade.

It’s also a great way to flush out the negative. Meaning the days you just don’t get it right. You can’t take it out on the gym every time or worst on those close to you.

At some point you will need to confront your mistakes and what went wrong.

#7 Review Your Day Trading Rules

Before you start each and every day, you need to review your trading rules. I’m not talking about some light cursory review.

You need to read each trading rule out loud and commit to the action.

#8 – Slow Down When Things Get Bad

The last thing I will leave you with is to slow down when things get ugly. If you are placing trade after trade and cannot find your way out of the dark place fewer trades.

If I find myself unable to feel the market, I will go down to one trade per day.

Slow Down

How Can Tradingsim Help?

Are you looking to build more discipline with your intraday trading? Test out the 8 items I listed in this article and see if these help you.

We have over 700 trading days in Tradingsim for you to test.

Photo Credit

Awesome Day Trading Strategies

Awesome Day Trading Strategies