Single Stock Futures

In the futures markets, when one makes reference to the futures contracts, the obvious assets that come to mind are commodities such as energies, financials, and agricultural commodities and so on. However, being what they are, “derivatives” it is not surprising to know that there are also futures contracts for the global stocks as well.

If commodity futures trading aren’t satisfying enough, you can trade stock futures which offer a viable alternative while at the same time having exposure to the equity markets with the additional advantage of having some distinctive features that are ideally suited for hedging risk or for speculative purposes.

Referred to as Single Stock Futures or SSFs for short, futures traders can trade the underlying assets from the equity markets. Single stock futures are available for select stocks and spans across the US, UK, Europe and even Asian equity markets.

In this article, we explain what single stock futures are, including the details such as the margin requirements and how traders can use stock futures for different purposes. If you want to trade the stock futures, then it is essential to understand the finer details of this rather exotic trading vehicle which in turn will help you figure out if trading stock futures is the right choice for you.

What are stock futures?

As the name suggests, stock futures are derivatives or futures contracts that track the underlying asset, which in this case happens to be listed stocks. Stock futures have been around for a while especially in the UK and South Africa. In the U.S. stock futures were initially banned but was introduced and began actively traded since the year 2000 after the U.S. Congress passed the Commodities Futures Modernization Act of 2000 (CFMA). Therefore, stock futures are sort of relatively new assets in the financial markets and have been in existence for only 16 years. There were three exchanges that kick-started the stock futures trading in the U.S. but now, only one remains.

Single stock futures are defined as a financial derivate that provides delta exposure to the movements of the underlying asset, which is the stock in question. Delta exposure or dollar delta is used to measure the price sensitivity of a portfolio to the changes in the underlying securities.

Single stock futures track the stocks from the equity markets and behave similar to a traditional futures contract. Stock futures are essentially an agreement between two parties, a buyer and seller of the stock. The buyer promises to pay the specified price at a predetermined date while the seller is obligated to deliver the stock at the same predetermined date. You don’t need to buy shares before hand if you want to sell a stock futures contract as most of these are cash settled, meaning that there is no physical delivery of the stocks.

While this might seem similar in the nature of trading traditional stocks, stock futures differ in the fact that they are standardized, meaning that they have a fixed quantity or the number of shares each contract can control. More importantly, stock futures can be traded with low margin requirements.

The above conditions make for single stock futures as an additional trading asset worth considering if you are interested in the equity markets or looking for ways to minimize your portfolio exposure.

Stock futures or single stock futures are traded on an exchange which is the clearing house. The operational functionalities and the rules governing single stock futures trading remains the same. Some of the well known exchanges that offer single stock futures are:

- OneChicago electronic exchange. Currently there are over 1800 US listed securities on the OnChicago’s delta1 trading platform.

- Eurex Exchange: You can also trade the SSF’s on the Eurex Exchange which has a listing of 1022 SSF’s covering stocks from over 20 countries

- ICE Exchange: Lists SSF’s from mainly regional Europe such as Italy, Spain and the UK

- JSE: The Johannesburg Stock Exchange offers SSF products, primarily focusing on the South African equity markets

- London International Futures and Options Exchange (Liffe): Liffe is another well known exchange for trading the stock futures contracts, based in London. The contracts are available for both US and UK listed stocks.

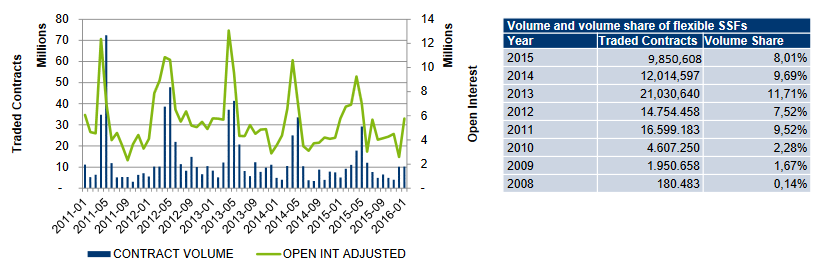

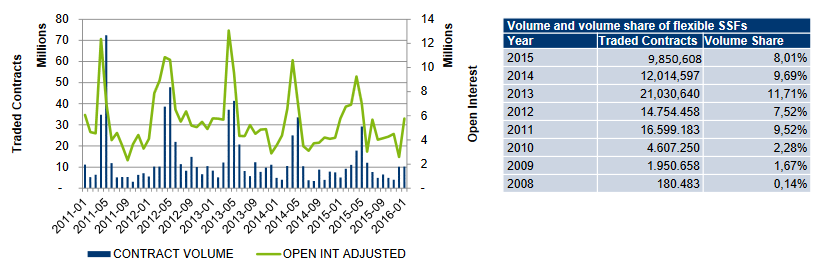

SSF Volumes at Eurex Exchange – Source Eurexexchange

Using single stock futures, traders can trade some of the well known underlying stocks listed in the S&P500 such as Apple Inc., IBM, Wal-Mart to name a few.

Just as with traditional futures, the single stock futures come with contract months, ideally on a quarterly basis.

Stock futures are available in two formats:

- No Dividend Risk (NDR) or Dividend Neutral Stock Futures (DNSF)

- Traditional SSF

Although both these types of stock futures track the same underlying asset, which is the stock in this case, the No Dividend Risk type of single stock futures removes the risk of dividend forecasting. The DNSF or NDR type of stock futures contract brings together the single stock future and the dividend futures contract.

As with most futures contracts, the single stock futures are cash settled, meaning that there is no physical delivery or transfer of shares involved unless you explicitly prefer to hold your contract you maturity. Most brokers often notify you before the expiry date and in many cases, the positions are automatically closed if they are still open.

The terminology and the symbol contracts are nearly the same for single stock futures contracts as with any of the other futures contracts.

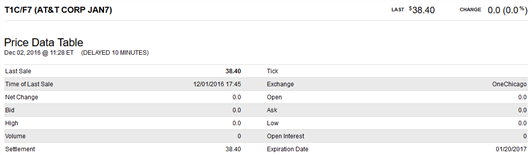

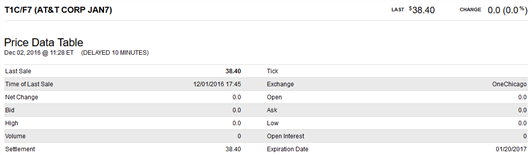

For example T1C/F7 indicates the single stock futures for AT&T Corp with F7 representing the contract month which is January 2017.

Example Price Table for a Single Stock Future

Below is a summary of the single stock futures contracts:

- Contract Size: 100 shares of the underlying

- Expiration: Quarterly (March, June, September, December) but there are additional serial months

- Tick size: 1 cent x 100 shares or $1

- Trading hours: 8:15a.m. – 3 p.m.

- Margin: 20% of the stock’s value

Example of a single stock futures trade

An SSF is a contract between the buyer and the seller for the underlying stock. Each contract is for 100 shares in a specific exchange listed stock. The contract pertains to the underlying share price at which it is traded and the date on which the future trade is to take place, also known as the expiry date of the contract.

As with any futures contract, the buyer and the seller are mandated to post an initial margin. This is set to 20% of the stock’s value but on average it is around 15% – 30%. Despite being fixed at 20%, the margin is calculated on a daily basis which needs to be monitored as the contracts are marked to market.

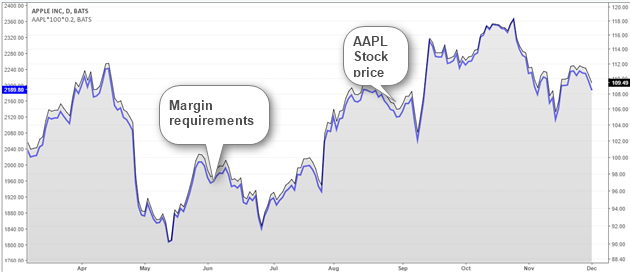

For example, if you were to trade the single stock futures for Apple Inc. and if the share price was trading at $100, then the notional value of Apple’s single stock contract is $100 x 100 = $10,000. A futures trader would be required to post an initial margin of $2000 which is 20% of the value of the contract.

If the buyer of the single stock futures contract decides to sell the contract after holding it for a few days and the price of Apple rose to $120, then the buyer would get back $2000. Note that the buyer of the single stock futures did not take any ownership of the shares and merely profited on the speculative trade made possible by futures trading.

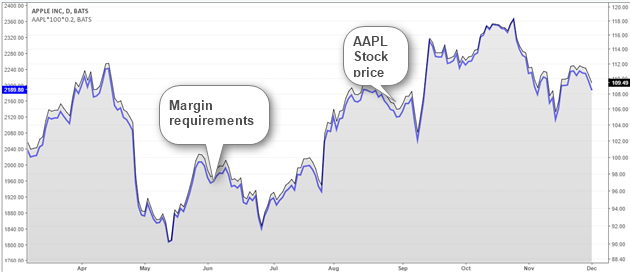

The chart below shows an overlay of the Apple stock price and the daily margin requirements fixed at 20%, but changes according to the price fluctuations.

Stock Price and Margin Requirement Changes

On a mark-to-market basis, the initial margin continues to change and the addition or subtraction from the margin for the stock futures contracts changes accordingly.

Why would anyone trade stock futures?

Single stock futures are widely popular across the globe with various exchanges from Moscow to Thailand and Dubai offering single stock futures trading.

You can trade single stock futures if you merely want to make profit from the price volatility of the underlying market. But there are a lot more benefits than just this.

Some of them include:

- Trading on leverage: With only 20% margin requirements, it is a lot cheaper to trade stocks via the single stock futures than to own the stocks directly

- Speculative purposes: The single stock futures are the ideal instruments to trade especially if you want to speculate on the prices without caring for delivery of the underlying asset

- Hedging: Investors who own shares in a company’s stock can also trade the single stock futures additional to protect their original investments. Because it if difficult to short sell stocks, the single stock futures offer advantages for the investor to hedge their portfolio exposure

- Exchange traded contracts: The single stock futures are exchange traded and standardized contracts. Thus it is marked by regulatory oversight as well as being liquid, making it easy to either go long or short on the underlying asset or stock

- Lower transaction costs: Compared to trading the stocks outright, trading single stock futures also offers the benefit of lower transaction costs, including other factors such as the leverage requirements

- Lower taxes: Because single stock futures are futures contracts, the gains from your futures trades are taxed at a different and lower rate than when you trade the outright stocks.

Trading single stock futures also has some drawbacks:

- Changing margin requirements: Because each contract’s tick size is $1, price gaps that are common in the stock markets can put the futures positions at risk, especially when adjusted for the daily margin requirements. For example a $5 gap in AAPL’s share price could mean adding or deducting $100.

- No stock holder privileges: When you trade the single stock futures, you do not get any stock holder privileges, meaning that there are no voting rights or dividends if the stock pays out

- Risk of losing more: Because single stock futures trade on leverage, there is a risk of losing more than what you initially invested into the futures contract. This therefore requires that you monitor your single stock futures positions frequently.

While single stock futures do have its own set of advantages and short comings, it is not suited for anyone. Trading SSF’s are ideal for managing your equity market risks and to make short term profits especially if you day trade the SSF’s. The margin requirements of the stocks being traded under the SSF’s can also be a limiting factor for most traders. The higher the stock price is the lower number of contracts that you can trade due to the margin requirements. Still at 20%, this isn’t a limiting factor.

Awesome Day Trading Strategies

Awesome Day Trading Strategies