Discover the power of ESG investing to drive both financial gains and positive change. Learn about sustainable investment strategies, the latest trends, and how to make an impact with your portfolio.

ESG investing stands for environmental, social, and governance investing. It's an acronym that encompasses a set of criteria for investing that includes many of the popular political and social agendas of today. Much of what is considered ESG investing measures the impact of an investment on the environment or social consciousness. Just a few examples of an ESG investment could include ventures in climate change, community development, company leadership and accountability, or any other type of ethically or morally motivated endeavor.

In this post, we'll discuss ESG investing and the impact it is having on the financial landscape. We'll discuss the strategies, funds, and latest trends to help you make informed decisions in your portfolio.

Understanding ESG Investing

ESG investing is any investment that considers the environment, social impact, and governance as part of its strategy or focus. These principles are a type of "ethical" or "moral" investment that is gaining popularity as corporations, citizens, and governments seek to lessen the impact of human growth on the planet. Seen by investors as a type of philanthropic or social duty, the principles of ESG investing include several impactful obligations.

For example, ESG-focused corporations may consider their influence on the environment and how the company's actions affect climate change, pollution, or depletion of natural resources. Or, a company may consider the social influence of its products or message and what that implication is for society's progress and broader social equality. This could include cultural awareness and inclusion, how it manages relationships within the company, and how that extends to its customers, communities, suppliers, and others. Lastly, the governance component of ESG investing is based on the integrity of corporate leadership and can include standards for oversight and accountability.

In general, ESG is a movement towards investing in the values that many see have deteriorated in the world at large. As a departure from the material aspect of markets, it places more emphasis on the intrinsic value of the underlying motives of investments and how those impact the world around us.

The History and Evolution of ESG Investing

According to MSCI, ESG Investing began back in the 1960s. Back then, it was more of a form of political activism as investors avoided stocks and portfolios that included tobacco products, for example. Apartheid was occurring in South Africa at that time as well, and many investors eliminated investments in corporations that did business with that regime.

As the ethical considerations of ESG have evolved, many financial institutions and investors still consider the political implications of their portfolios. However, as the concept has grown, it is more than just an opportunity for political activism. It has become a values-based component of traditional financial analysis that is seen more as a complementary investing strategy that carries less "activist" connotations. This, of course, comes as more and more younger generations enter the world of investing seeking more ethical and sustainable goals for the future -- and are willing to put their money where their mouth is.

The Rise of ESG Funds

ESG funds are a great way to get involved in ESG investing without having to do a lot of research. As the popularity of green investing has increased over the past few decades, many of the larger financial institutions have created exchange-traded funds (ETFs), which allow investors to "pool" their money into a fund that offers a diverse grouping of ESG stocks.

Advantages of ESG Funds

- ESG ETFs offer the simplicity of exposing your portfolio to a diverse group of companies with an ESG ethos.

- Funds are managed by financial managers with years of experience at large financial institutions.

- Most funds offer a low cost of ownership, anywhere from 0.09 - 0.25% expense ratio annually.

- Many different ESG funds exist, giving you a choice for portfolio exposure and values alignment.

Notable ESG Funds

USA Today has compiled some of the more popular ESG funds trading in today's markets. Many of the big players are Vanguard and iShares. When considering investing in an ETF, it's important to consider a few criteria.

- Expense Ratio

- Total Assets

- Fund Return History

Here are a handful of potential ESG ETFs as compiled by USA Today:

These funds were screened according to the type of fund, sufficient assets, broad diversification, and whether or not the fund is passively managed.

Environmental Investments (E-Factor)

The E in ESG stands for "Environmental" investments. That is corporations that focus on sound environmental practices or preservation as part of their company's mission and ethos. These can include any environmental topics from natural resource preservation, avoiding or preventing animal cruelty, pollution, energy conservation, climate change, and recycling.

As the world population continues to grow, concerns over greenhouse gases, plastics, and many other environmental issues are of paramount importance to many investors today, especially younger generations. Environmental investments seek to fund those companies whose policies and actions point to a better future through better stewardship of our natural resources.

Companies Shifting to Better Environmental Practices

As green activism becomes more and more a part of the mainstream narrative, many companies are embracing best practices for avoiding toxic waste in their products, adding recycling components, or generally lessening their impact on the planet. Here is a short list of some companies taking broader measures to become more environmentally friendly.

Patagonia:

Patagonia is outdoor clothing and activewear brand that is extremely eco-conscious. Instead of focusing on manufacturing more and more products, they have invested in repair centers to mend older clothing and apparel items, essentially lowering their carbon footprint and extending the life of their products.

Apple:

Apple has been moving more and more towards sustainability through initiatives to run data centers, offices, and stores off of solar or wind farm power. They are also committed to reducing the use of toxic metals and chemicals in their phones, while at the same time running programs to entice consumers to return their old phones when they decide to purchase a new one. The resources in the old phones then get recycled.

Seventh Generation:

Seventh Generation prides itself on using plant-based cleaning agents and sustainable, recyclable materials in its packaging. They have an aggressive agenda to become a zero-waste company by 2025. As part of the plan, they are reducing their waste footprint by shipping products in environmentally friendly containers in the same manner as the products themselves.

Disney:

Disney has been on a mission for many years to lower its electric, water, and waste impact. It plans to be 100% carbon-electric neutral by 2030 and has already taken many measures to reduce its consumption of electricity. It is practically a sustainable company when it comes to waste and recycling.

Socially Responsible Investments (S-Factor)

The social aspect of ESG investing focuses on the social responsibility and influence of corporations. These responsibilities can include education initiatives for suppliers and employees, inclusion efforts, and even sustainable and equitable farming practices.

As younger generations enter the world of investing, they are often seeking to invest in companies that put fairness and equity over profits. Part of this includes taking care of the communities and constituents that help make the products a reality.

Companies with Exceptional Social Responsibility

Warby Parker:

Warby Parker is a well-known eyeglass manufacturer who has distributed over 10 million pairs of glasses. It is part of their Buy a Pair, Give a Pair program. The program partners with nonprofits to donate free glasses to those in need.

Dr. Bronner's:

Dr. Bronner's has become one of the largest organic and fair-trade body care products in the U.S. As a family-owned and run company, they make socially responsible products by dedicating part of their profits to educating and advancing topics like human rights and healthcare. They also support their farmers worldwide through fair-trade practices. Not to mention, their products are environmentally sustainable.

Sprout Social:

Sprout social represents thousands of companies all over the world with its social media management product suite. Each year, it donates upwards of $500,000 to fight discrimination and support underserved communities. In addition, they promote diversity in gender and race at the executive level of the company, reporting that at least 55% of that team is diverse.

Governance Investment (G-Factor)

The G in ESG investing places importance on transparency and accountability within corporations. Much of this revolves around the topic of accounting methods, diversity and inclusion in leadership, as well as integrity and accountability to shareholders.

Part of governance stewardship includes the expectation for executives and board members to avoid conflicts of interest, preferential treatment through political contributions, and illegal conduct. A practical approach to governance transparency includes staggering board elections and ensuring that the CEO is not also the chair of the board.

Why does strong governance matter for investors, you might be thinking? It's the principle of aligning corporate values with Main Street values. Again, ESG has an ethical and moral underpinning that guides the investment strategy over and above any technical aspect of the investment. The thought process is that strong ethical governance will lead to a prosperous corporation.

Impact Investing

Impact investing is just another name for ESG investments, for all intents and purposes. As it suggests, impact investments carry the intention of generating "impactful" and measurable progress in social and environmental causes throughout the world.

Like ESG, impact investors hope to make a financial return while supporting sustainability, conservation, equality and fairness, education, and other initiatives.

Examples of Impact Investments

According to the Global Impact Investing Network (GIIN), there are several successful impact investment campaigns. One case study involves companies LeapFrog and BIMA. Together, the two corporations combine some of the world's leading technologies in mobile-delivered health services and insurance.

With this dynamic combination, BIMA has helped many clients throughout the world. One such case came in 2018 when a Cambodian woman named Mov lost her husband to a brain hemorrhage. Discovering later that he'd applied for a life insurance policy through BIMA, she received the cash to allow her two children to continue in school instead of entering the workforce early.

Intuitive mobile technology makes these impact investments more adoptable in underserved countries. GIIN has this to say: "As BIMA expanded to countries around Africa, South Asia, and Southeast Asia, the company’s innovative approach made it possible to reach previously unreachable customers, like Mov."

ESG Strategies and Implementation

Investing for the purpose of environmental, social, and governance policy can be a bit tricky. Most financial decisions are made on the premise that a company has a solid product with solid returns. In the case of ESG, this isn't as cut and dry, as the impact of the company is often weighted in the decision to invest or not.

That being said, several standard investing practices can be applied to ESG-centric companies. Harvard has published at least seven criteria to use when considering an ESG investment strategy. Let's take a look at the top four:

- Negative Screening: Avoiding the worst-performing companies can go a long way in investing. After all, you don't want bad returns dragging your portfolio down. To that end, exclusionary screening can also help you determine your goals for the portfolio. If companies who are wasteful of natural resources don't fit your investment goals, exclude them. Then narrow the results again to the best performers.

- Positive Screening: Just as it suggests -- filter for the best companies with the best track record for ESG compliance and progress. It will be up to you to determine the performance measures you screen for, but these could include the best companies with low carbon footprints, renewable energy power, or any other factor you consider important.

- Portfolio Tilt: Perhaps you want a portfolio that isn't exclusively ESG companies, but you want exposure that fits your values. To this end, you may "tilt" your portfolio to a more heavily weighted list of ESG investments. You may find this better fits your risk personality as it ensures diversity across the spectrum of investments, but with a comfortable weighting toward impact investing.

- Sustainability-Themed Investing: Similar to positive screening, you may want extra exposure to a very specific industry within the broader ESG-themed investment universe. For example, if saving the the turtles is nearest and dearest to your heart, you might focus intentionally on corporations doing clean up work of the oceans -- removing plastics, reducing pollution, and creating innovative products that lessen that burden on the environment.

ESG Investing and the Bottom Line

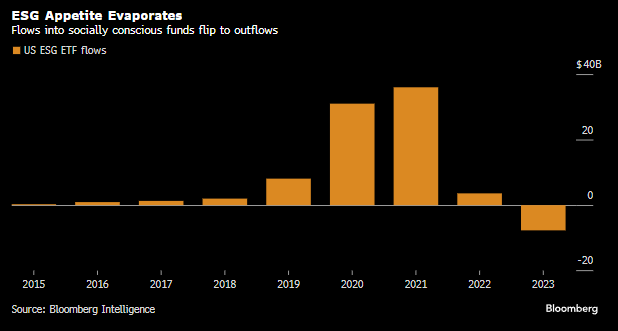

While investments in social, environmental, and governance projects have skyrocketed in recent years, you should take careful consideration of the type of investment you'll be making. There appears to be a departure from the frenzied rush to these investments in 2020 and 2021. In fact, according to some research, the ESG movement is currently experiencing a considerable outflow of liquidity in 2023.

That doesn't mean that ESG is dead, however. Simply consider the type of investing you want to make and do your due diligence to ensure it makes financial success. At a minimum, we encourage you to learn more about ESG investing, sustainability, and creating a profitable portfolio before putting your money to work. There are often more ways than one to make an impact.

Also, be sure to align your financial goals with your strategies. As GIIN's research indicates, more often than not, investors want a solid return, even when investing in ESG investments:

"Impact investors have diverse financial return expectations. Some intentionally invest for below-market-rate returns, in line with their strategic objectives. Others pursue market-competitive and market-beating returns, sometimes required by fiduciary responsibility. Most investors surveyed in the GIIN's 2020 Annual Impact Investor Survey pursue competitive, market-rate returns."

Good luck, and here's to good fills!

alibaba

alibaba