The Organization of the Petroleum Exporting Countries, or OPEC as it’s more commonly called, plays a pivotal role when it comes to the crude oil futures markets. Although according to many experts, OPEC’s significance has been waning in recent times, the oil cartel still wields considerable influence on oil prices. This is especially important for crude oil futures traders as the OPEC influenced volatility can often see crude oil prices rise by an average of $4 a barrel within the day.

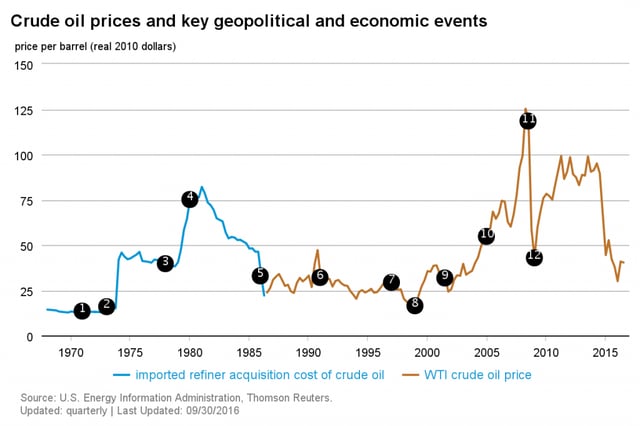

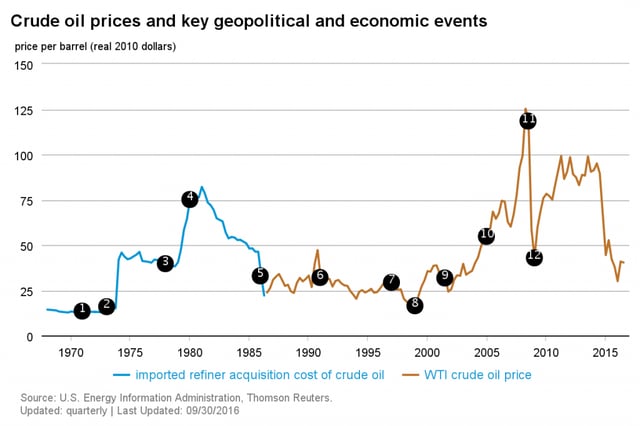

To understand the impact OPEC has on crude oil prices and also the broader geo-politics that is at the core of the oil markets, the chart below shows a brief timeline of the major events that occurred which had significantly impacted oil prices, from the 1970’s to the current day.

Crude Oil Prices and Key Geopolitical and Economic Events

| 1: US spare capacity exhausted |

7: Asian financial crisis |

| 2: Arab Oil Embargo |

8: OPEC cuts production targets 1.7 mmbpd |

| 3: Iranian Revolution |

9: 9-11 attacks |

| 4: Iran-Iraq War |

10: Low spare capacity |

| 5: Saudis abandon swing producer role |

11: Global financial collapse |

| 6: Iraq invades Kuwait |

12: OPEC cuts production targets 4.2 mmbpd |

For oil futures traders, it is essential to understand the influence of OPEC on oil prices, which includes both the West Texas Intermediate (WTI) and the international benchmark crude oil, Brent. To get a fair idea on where OPEC stands on oil production, the International Energy Administration (IEA) estimates that OPEC production is about 40%, while oil production from countries outside the OPEC or non-OPEC countries, accounts for 60% of the world oil production. But here’s the most interesting part. Despite accounting for just 40% of oil production, OPEC oil exports represents about 60% of the total petroleum traded internationally.

It is merely for this reason that OPEC countries are often known to, and can influence the oil markets. It is therefore imperative that oil futures traders should not only understand OPEC but also keep their ear to the ground. There are numerous instances where mere rumors from OPEC or the OPEC countries’ oil minister’s statements sparked volatility in the crude oil markets.

History of OPEC

OPEC Logo

The Organization of the Petroleum Exporting Countries was created in 1960 at the Baghdad Conference in September. The founding member countries of OPEC were Iran, Iraq, Kuwait, Saudi Arabia and Venezuela. Over time, the OPEC group increased as countries such as Qatar, Indonesia, Libya, UAE, Algeria, Nigeria, Ecuador, Angola and Gabon joined to make up the OPEC group (14 countries) as we know of it today.

OPEC was initially headquartered in Geneva, Switzerland but was later moved to its current headquarters in Vienna, Austria and is a recognized institution by the United Nations. The OPEC’s objective is merely to coordinate and unify petroleum policies among its member countries to secure a fair and stable price.

OPEC was born out of the dominance by the “Seven sisters” which was a group of seven multinational oil companies that was largely responsible for controlling international oil prices. It is estimated that the seven sisters controlled nearly 85% of the world’s petroleum reserves during its time.

The original seven sisters comprised of BP (formerly known as Anglo-Persian Oil Company), Chevron (formerly known as the Gulf standard oil of California and Gulf Oil), Texaco (merged with Chevron), Royal Dutch Shell, Exxon (formerly known as Standard Oil of New Jersey), Socony (formerly known as Standard Oil Company of New York).

The OPEC website features more details about the history of OPEC and it makes for an interesting read.

How OPEC works?

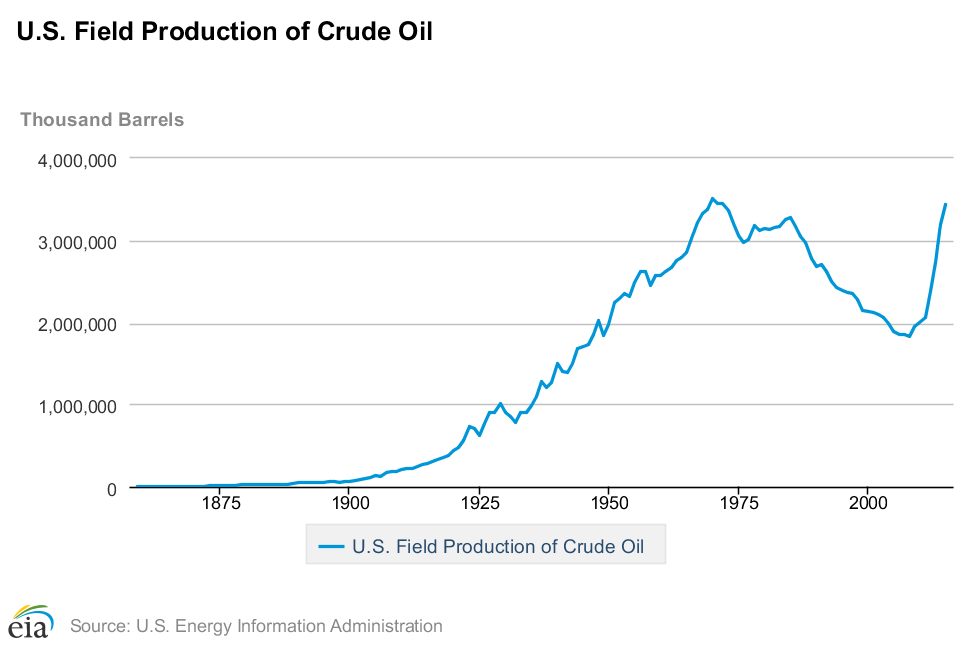

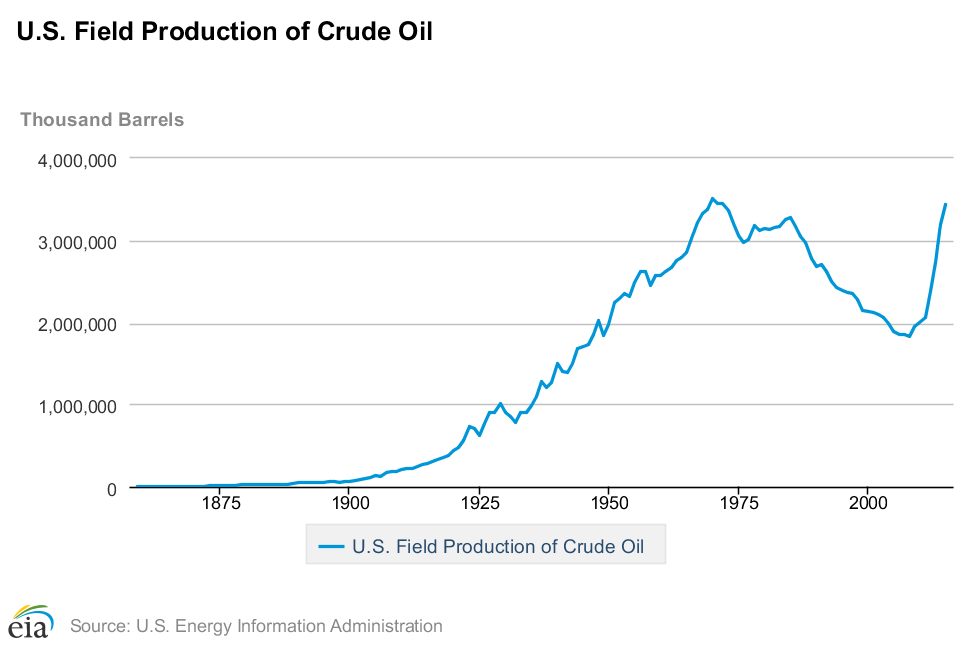

OPEC’s mission is quite straightforward, which is to ensure the stabilization of oil markets in order to secure efficient, economic and regular supply of petroleum to consumers. The biggest leverage for OPEC is oil output quotas. As a general rule of thumb, when OPEC cuts production, oil prices rise and vice versa. However, after the well known oil embargo of 1970, non-OPEC production has steadily increased, reducing the world and especially the West reliance on OPEC oil.

U.S. Field Production of Crude Oil

As one might guess, the price of oil is dictated by supply and demand, where supply was largely determined by OPEC. There are two ordinary meetings held a year but an “extraordinary meeting” can be held at the request of a member country. The two ordinary meetings are held during July and November and it is in these meetings that oil production quotas are formalized as well as the organization giving its own forecasts for the near term demand and supply estimates.

In terms of the structure of OPEC, every member country is represented by a Governor on the board serving a two year term, known as the Board of Governors. The ministerial monitoring committee monitors the oil market and gives its recommendations to the OPEC conference.

The supply glut (Since 2014)

After nearly five years of stability in the oil markets, where a barrel of crude oil was priced around $100 a barrel, in November 2014, at the OPEC general body meeting in Vienna, the member countries decided to boost production. The news sent oil prices crashing as the supply taps were wide open.

Since that decision by OPEC in November 2014, crude oil prices fell by as much as 62%, at one point trading near historical lows of $30 a barrel. What was initially called a “disagreement” between the OPEC members was in fact a strategic play by Saudi Arabia, OPEC’s largest oil producer.

Crude Oil Futures Chart

In a bid to shake out the weaker players in the markets, especially the US shale oil producers, OPEC decided to crash prices to put the shale oil producers out of business. The decision was hard as it hit the budgets of many OPEC member countries including non-OPEC countries such as Russia. Most of the oil producers back then had budgeted for a $100 oil price but within a few months; oil prices fell by over 50%, putting some countries at the risk of a default.

The decision by Saudi Arabia, while being strategic has led to a splintered OPEC, with even Saudi Arabia now feeling the pinch of weaker oil prices as it battled to bankrupt the US shale oil producers. With the US lifting sanctions in Iran, there are widespread disagreements between the two nations in a battle for market share as Iran maintains a strong stance of keeping oil production at record highs to make up for its lost market share over the years during the height of the US sanctions on Iran.

The internal bickering between the OPEC countries only goes to show how fractured the organization is, but at the same time, as an oil cartel, OPEC still echoes in the crude oil futures markets.

How can you prepare for trading Crude Oil?

To be able to better trade the oil markets while also accounting for the intermittent volatility spikes, the oil futures trader must have the ability to act swiftly on the news, especially if you are a short term trader.

The following points should however help you to prepare yourself against any surprises.

- Understand the trend: Crude oil markets move in trends and it is not very often that trends will switch overnight. Understanding the prevailing technical trend can help oil futures traders to better position themselves. You do not want to be caught on the wrong side of the market, especially during periods of volatility. Even weak positions within the trend can be at risk. Therefore be thorough in your technical analysis when trading crude oil futures

- Commitment of Traders Report: The CFTC’s weekly CoT report is a great place to start when you are yet to initiate a position. The general rule of thumb being that when speculative positions are at the extreme, oil prices tend to snap out of their short term trends, which can be a great place to start building your positions or to take short term trading positions as well

- Weekly Inventory Reports: Oil traders must mark their weekly calendars. Tuesdays and Thursdays generally see’s a lot more volatility in oil as the American Petroleum Institute (API) releases its weekly inventory report on Tuesday, followed by the official inventory report by the US energy information administration department (EIA) on Thursday. These two reports tend to shape the short term trends in the oil markets and is important for short term oil traders

- OPEC Chatter: While it is hard to anticipate an upcoming unscheduled event, keep an eye out on remarks and comments by any of the OPEC country’s oil ministers. The Reuters Commodities page is ideal to keep track of the day to day developments in the oil markets. Alternately, com is another dedicated resource that brings you up to date information on the fundamentals and the politics shaping the oil markets.

- Get the big picture: Oil markets often tend to follow the narrative of the broader context with sub story lines keeping the intraday volatility alive. For example, in the current scenario, oil markets are all about the upcoming OPEC meeting on November 30th where the organization is expected to curb production levels, based on an information agreement reached at an oil summit in Algeria in October. This means that the markets are preparing for a rally in oil markets, but also comes at a risk of a failure to reach an agreement, especially between Iran and Saudi Arabia.

- The Middle East Politics: Oil and politics go hand in hand. To be a better trader at crude oil, it pays to pull your head out of the charts and have your pulse on the geo-politics that has an impact in the Middle East. It is easy to lose oneself in the mammoth information on politics, but having a cursory glance on the top headlines can better equip you to deal with the volatility.

Remember, the oil markets are one of the most dynamic futures markets and it requires the trader to react swiftly to the news. Oil prices move for a variety of reasons. From unrest in the Middle East to geo-political decisions that can impact policies and the current narrative of the supply glut. Although OPEC’s decisions might not be as significant as it was a decade ago, the oil cartel still has the influence in the crude oil futures markets.

As an oil futures trader, it is not just the technical and fundamentals that you should keep an eye on but also closely monitor the political landscape as well. With all this said the oil futures markets are no doubt exciting to trade. If you prefer to trade a market that is dynamic and lively and you don’t really mind the volatility, then oil futures are just the right commodity futures for you to trade.

Commodity Futures

Commodity Futures