Just because you can, doesn’t mean you should; this is what I think of after-hours trading.

In this post, I am going to discuss the seven reasons I do not trade during the after hours.

Before we dive into the five reasons, let me first ground you on what is after-hours trading.

How Does After-Hours Trading Work?

After-hours trading is the trading of stocks after the regular session has ended at 4 pm and occurs between 4:00 pm and 8:00 pm on the U.S. exchanges.

This activity was originally open to the wealthy and large institutions. However, with the advent of the Internet, and Electronic Communications Networks (ECNs), the everyday trader now can post after-hours trades through their broker.

Most retail traders believe that some pending news or earnings release set for the next day will generate a move so that they will enter positions as well. The sad thing is, this is often a form of gambling and not truly investing.

If you are a trader contemplating after-hours trading, here are the five reasons I stay away.

5 Reasons I Avoid After Hours Trading

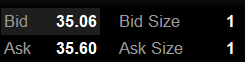

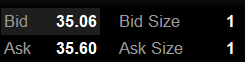

1. Huge Bid/Ask Spreads

Large Bid-Ask Spreads

After-hours the bid-ask spreads for stocks open up drastically. A $50 stock, for example, will have a spread of $50.18 by $50.46. What are you to do in this situation?

Can you honestly buy the stock at $50.46? Well, of course, you can, but you better know some pending news, or have a very long time horizon for the trade, as you could be down over a half of a percent the second you execute the trade. Large bid/ask spreads are a breeding ground for pain. If you are a trader that finds yourself often getting emotional about every trade you are in, large spreads are not for you.

The other key point of concern for me is that in after-hours trading you have to place limit orders. This means you can’t just hit sell at market and get out of our position. This means you may have to lower your asking price to attract buyers and guess what happens?

That’s right; potential buyers lower their bids.

What I’m attempting to illustrate here is that getting out of a position at your desired price becomes exponentially more difficult in the after hours.

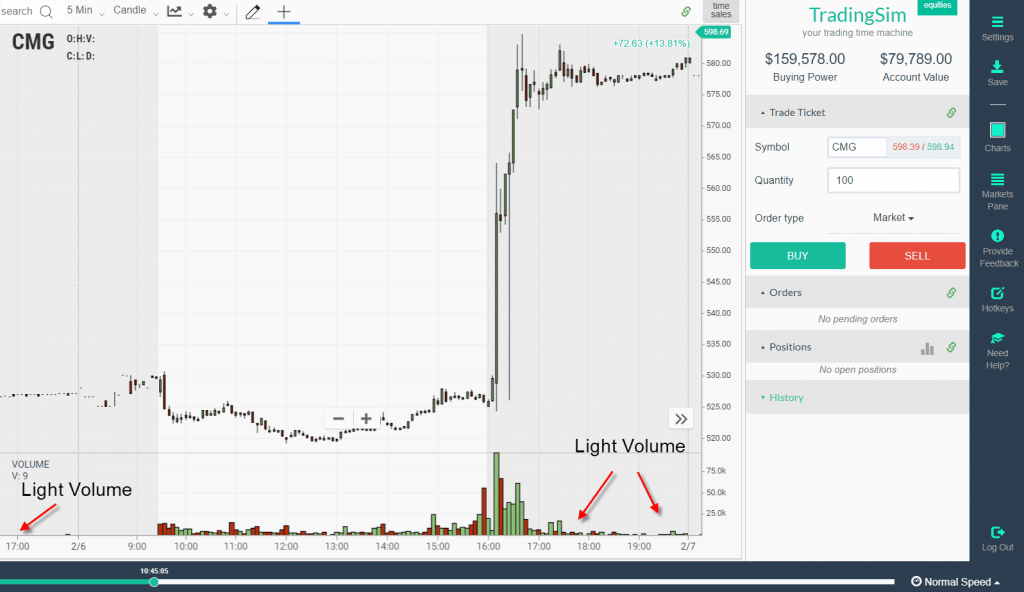

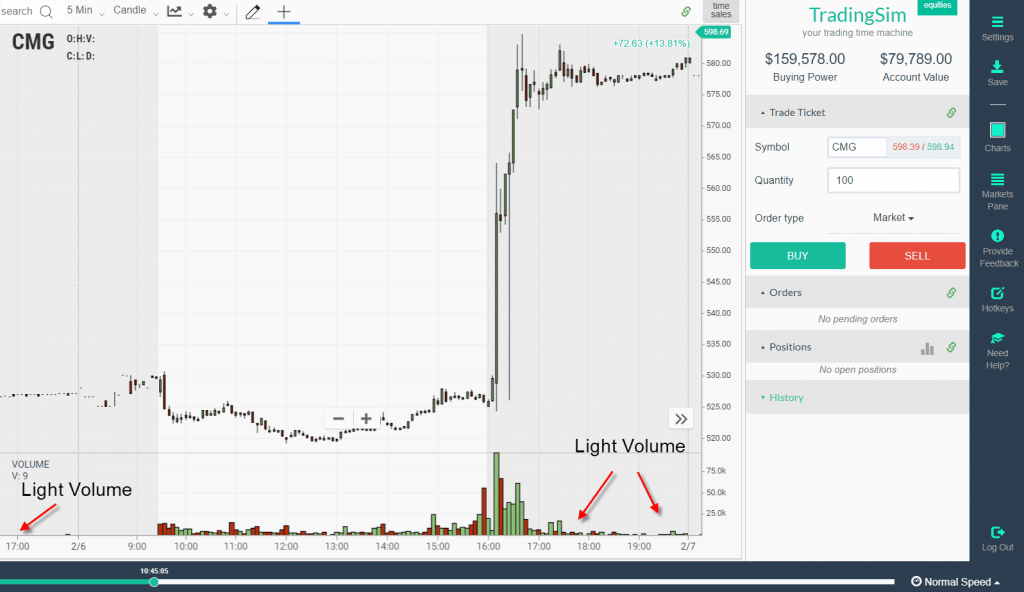

2. Light Volume

A light volume security is not a good thing for active traders. The key to the game is being able to get in and out of positions as quickly as possible. After-hours trading generally has lighter volume than during the regular session.

What will often happen is a huge volume spike on the news release right after 4 pm, then the volume will dry up dramatically within 30 to 60 minutes. So, you are not only faced with a large bid/ask spread, but you are now faced with light volume which further restricts your ability to exit the position.

Are you beginning to catch my drift?

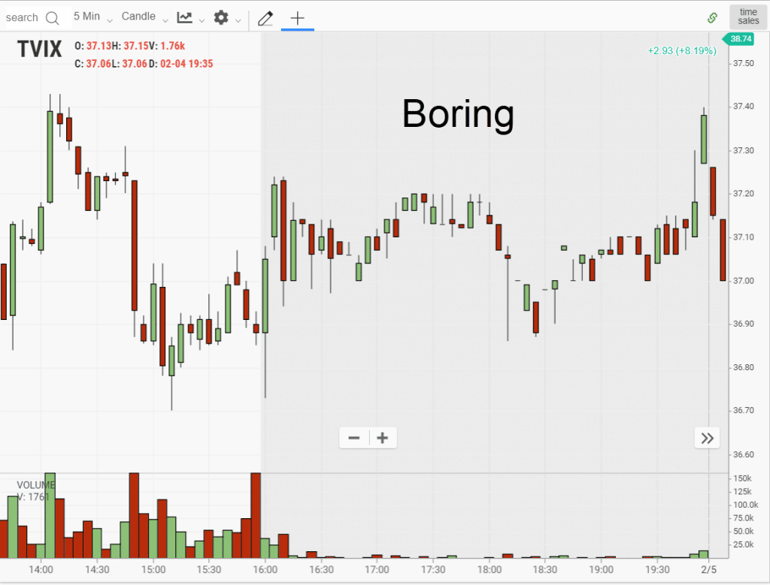

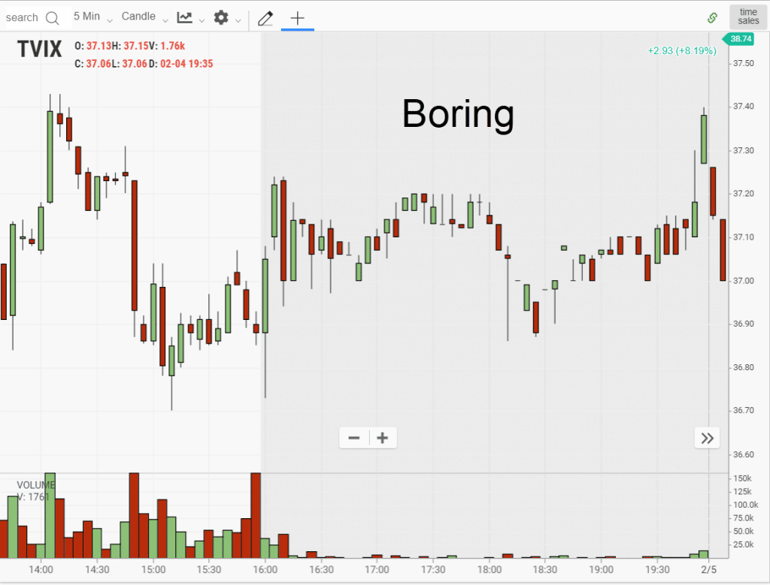

3. Low Price Volatility

Boring After Hours Trading

So we’ve discussed the large bid/ask spreads and light volume trading. What do you think these two factors lead to? Your first guess would be wild price moves.

Wrong.

Well, it’s the exact opposite. The big moves don’t come in until 8 am. You may get a little pop from 4 to 4:30, but it quickly fades until 8 pm.

4. I’m Tired by 4 pm

The regular trading session is from 9:30 am to 4 pm. However, my day with the market starts as early as 8 am with me tracking premarket movers to gauge stocks in play.

I only trade the first hour, but even then that means it’s a solid two and half hours of focusing on charts. At this point, you probably are calling me a big cry baby and to get over myself for having to work less than three hours.

Remember, if I make one mistake I can lose big money. So when I say I am focusing, I mean it.

I can’t imagine going back into the market at 4 pm and then sitting through possibly another four-hour session until 8 pm. As we mentioned earlier, there is no guarantee you are going to be able to jump in and out of the trade quickly.

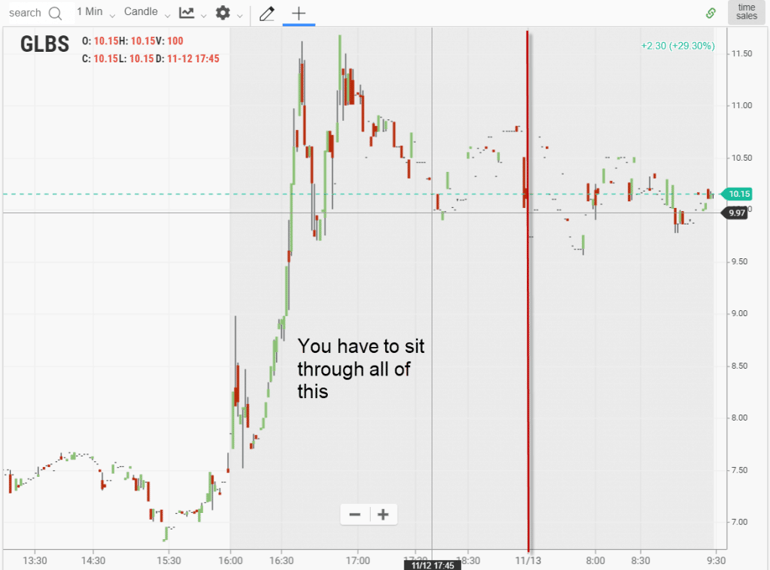

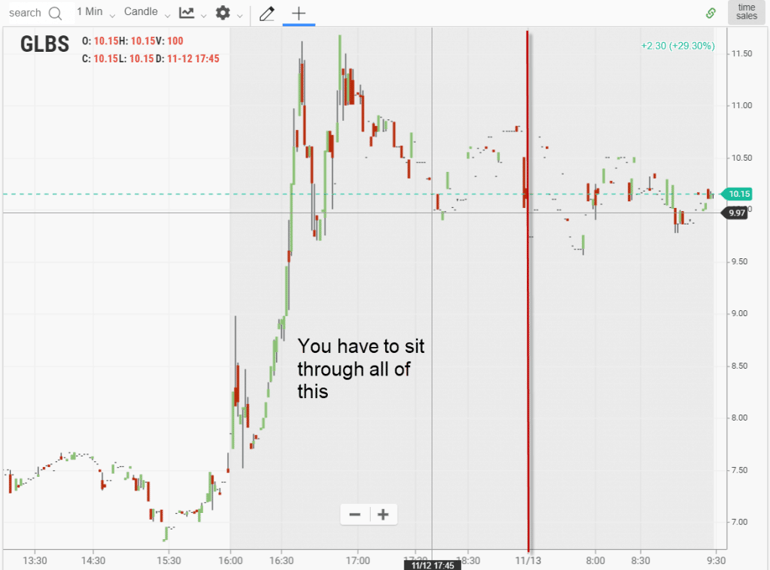

5. Charts Are Not Clean

Four More Hours of Charts

As you can see in the above chart, right after 4 pm the liquidity for high movers may still be in play. This is a one minute chart of GLBS that had a strong move, but imagine sitting there from 6 pm to 8 pm watching those small candles print.

This choppy low volume action continues at 4 am when the premarket opens and doesn’t end until 8 am.

Then something happens around 6 pm where the volume dries up. You then get these low volume candles of 100 shares and it’s just impossible to make sense of it all.

How are you supposed to find clear chart patterns to trade with any level of accuracy? The key to day trading is knowing your patterns and assessing your risks based on clear pivot points or indicators on your chart.

Due to the light volume and lack of overall interest after hours, anyone out there with 50k or more can completely annihilate a pattern you have been waiting for hours to develop.

How Can Tradingsim Help?

In Tradingsim we display both premarket and after-hours data. You can then replay thousands of charts to determine if there are any patterns that give you an edge.

To learn even more about after hours stock trading, check out this study from the SEC which covers ECNs and after hours trading.

Photo Credit

Photo by Victor Freitas from Pexels

Basics of Stock Trading

Basics of Stock Trading