The concept of margin or margin trading is of utmost importance in the trading community, including futures and other derivatives markets spanning across different asset classes. Margin, in futures trading is basically a deposit made in good faith with the broker. It is nothing but the capital required to post or known as the deposit collateral required to control positions in a futures contract that you want to trade.

To put it another way, margin is a partial down payment required by the futures exchange on the full contract value of the futures contract that you are trading.

How much of this down payment you make, is determined by the futures exchange which sets the margin rates. Of course, depending on the retail futures broker that you trade with, the margin requirements can significantly differ from the margin requirements from the futures exchange. The amounts also change when you are swing trading the futures markets or just day trading.

There are instances where a futures brokerage can add some premium on top of the margin requirements set by the futures exchange in order to lower the customer’s exposure to risk.

Typically, the day trading positions are a lot less than compared to swing trading positions in the futures markets. For example, in order to day trade an e-mini S&P500 futures contract, the day trading margin ranges between $400 – $500 (as long as you close the position by or before the end of day).

When trading futures, it is very important that you understand the concept of margin and the implications on the e-mini futures contracts or just about any other futures contracts that you would trade.

#1. Margin is based on market volatility

Margin, in the futures markets is not fixed and can vary depending on the market volatility. However, margins do not change on a day to day basis but is monitored periodically. When market volatility or price deviation starts to increase steadily over a period of time, it can often result to increase in margin requirements from the exchange and/or from your futures broker.

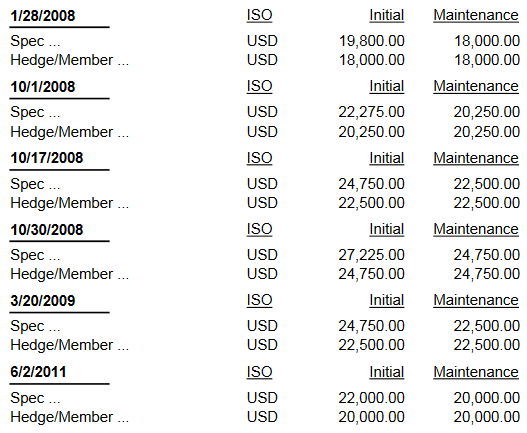

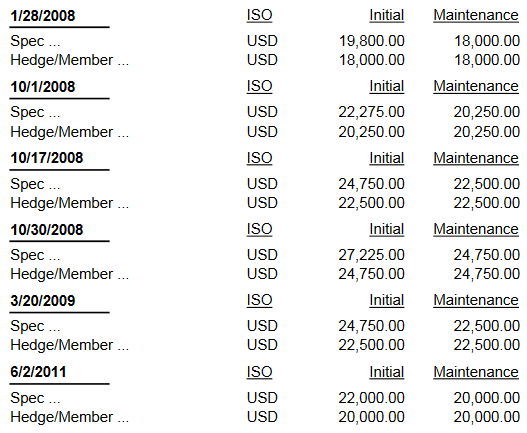

Historical margin requirement changes (Source – CME Group)

Any changes in the margin is well communicated ahead of time and do not change overnight. However, it is prudent that the futures day trader keeps track on any margin changes requirements either from the exchange or with the retail futures brokerage that they trade with.

Futures exchanges can also increase margin requirements ahead of time in anticipation of key market events that can influence the volatility which results in a change in margin requirements by the retail futures brokerages as well.

The margin requirements change in response to events such as:

- Changing volatility

- Shifts in supply and demand

- Changes in fiscal policy

- Major geopolitical events

- Natural disasters

#2. Initial margin and maintenance margin

Every futures position requires an initial margin known as a performance bond. This is the collateral that is paid to the broker or the exchange by the market participants. The initial margin or performance bond can vary from one futures contract to another and the amount of margin requirement can also change based on various market conditions described in the previous point.

Besides the initial margin, futures traders also need to post a maintenance margin. This is applicable for swing traders in the futures markets. Because futures prices are marked-to-market on a daily basis, any profits or losses made from the time of opening a futures contract to the end of day price is marked automatically. Therefore, a maintenance margin is a requirement especially for those who keep their futures trading positions open overnight. Any profit or losses are automatically added to or subtracted from the maintenance margin.

Hypothetically speaking, if the initial margin on a corn futures contract is $1,000 and the maintenance margin is $700. The purchase of a corn futures contract requires $1,000 in initial margin or performance bond. After you open a position in corn futures, if the price of corn falls by 7 cents, or $350, an additional $350 in margin must be posted to bring the level back to the initial level.

The initial margin and maintenance margin are both unique to the futures markets, which is something every trader should know.

#3. Margin Call

When the maintenance margin falls below a certain level, the exchange or the futures broker can make a margin call, where in the futures trader will have to fund their account. Failure to do so could result in the position being liquidated.

A margin call is defined as when the value of your futures trading account is lower than the maintenance level. When this happens, it results in a margin call, typically the broker calling you to inform you about the fall in your margin and thus asking you to fund your account. Margin call now a days in electronic is mostly done by email alerts or SMS alerts.

To understand margin call, take the following example. You are currently trading five futures contracts for some market. This required you to post a performance bond or an initial margin of $10,000, while having to maintain $7,000 in maintenance margin in you trading account.

Now, when the total value of your trading account falls to $6,500 a margin call is triggered which will require that you deposit an additional $3,500 to return the account to the initial margin level. Failure to do so would result in automatic closure of the futures trading positions that you held.

#4. Margin requirements for futures changes based on the contracts being traded

As a comparison if you were to trade stocks, then a simpler arrangement would be that equity market participants are required to post a 50% margin. Thus for a starting capital of $100,000, equity traders can trade only up to $50,000 worth of stocks. In the futures markets however, the margin requirements are lower.

For a typical futures contract, the margin requirements can vary from as low as 5% to 15% of the contract’s value. Thus, the margin requirements vary depending on the contract that you are trading. In this aspect, it is easy to see why margin requirements for emini futures contracts are a lot cheaper compared to trading full contracts.

As an example, if you were to trade the standard Gold futures contract, the initial margin requirement is about $1000. However, the e-mini gold futures contract has an initial margin requirement of only $500, or the e-micro gold futures which has an initial margin requirement of just $250.

For day traders this means that sticking to the e-mini or micro futures contracts offers the best chance on account of low margin requirements.

#5. Calculating Futures Margin Requirements

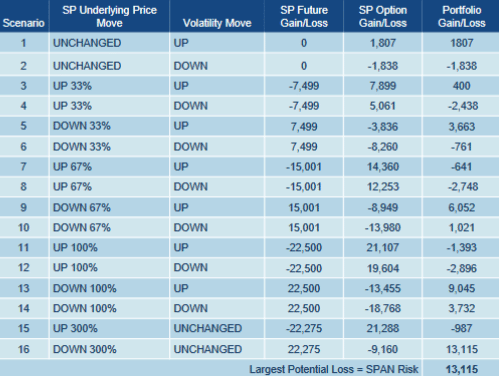

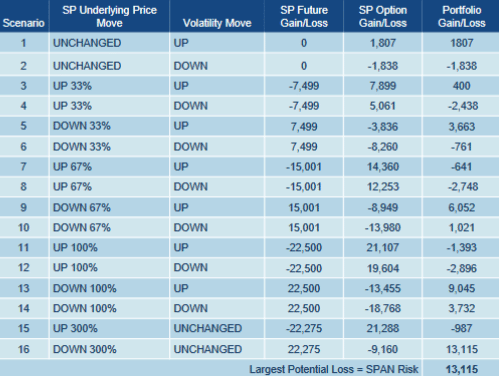

Futures trading exchanges implement margin trading rates based on a program called SPAN. This is an automated program that measures the many different variables at certain periods of time to derive at a final number which is then used as an initial margin and maintenance margin in each of the futures contracts from the exchange. Of the many different variables, volatility in each of the futures markets is the most critical with various futures trading exchanges changing the requirements based on different conditions.

Example SPAN Risk scan (Source – CME Group)

According to the CME group, SPAN is defined as market simulation based “Value at Risk” system which automatically assesses risks in the overall portfolio. The SPAM system allows for effective margin coverage while also ensuring preserving the efficient use of capital. This automated system for risk has been in use since 1988 and is approved by various market regulators and market participants.

For a more technical read up on SPAN, read this PDF document.

#6. Margin trading can be risky

Trading on margin is risky and profitable at the same time. While margin trading can give you the benefit of leverage and thus control large positions with only small collateral if not used wisely, margin trading can lead to significant losses.

Take the example of trading a gold futures contract where each contract is for 100 ounces of gold. With an initial margin of $1000 you can buy one contract of gold at $1270 and sell it at $1275 for a $5 profit. At 100 ounces, this results in $500 profit (not accounting for exchange or brokerage fees).

In terms of the profit made on the trade, that would amount to 50% returns ($500/$1000) on the margin. But in reality if you had actually purchased gold at $1270 and sold at $1250, your return would have been 0.39% ($5/$1270).

As you can see from the above, futures trading on margin can give you high returns, but it also opens the risks of significant losses as well.

Futures tracing exchanges constantly monitor the market risks and change the margin requirements accordingly. Margin, although risk is one of the basic points that holds the futures markets together as it allows the market participants to trade with confidence that all the buyers and sellers will meet their obligations at all times.

#7. Why emini futures contracts are better to trade on margin

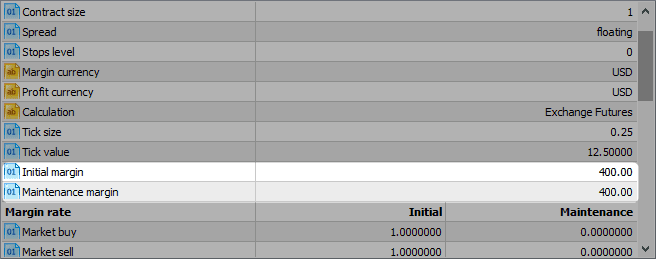

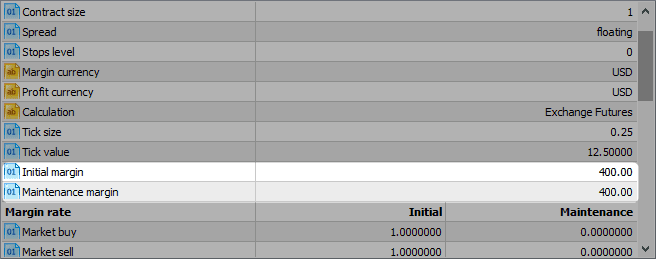

By now it is evident that the margin requirements change from one futures contract to another. Furthermore, the large contracts such as the big S&P500 futures, or gold futures contracts attract higher margins. For the futures day trader with deposits of $10,000 or less, it is essential to trade futures contracts that offer a balance of the tick size and the margin and maintenance margin requirements.

In this aspect, the emini futures contracts are best suited. For example the standard S&P500 emini futures contracts have an initial margin requirement of around $400 – $500 with the same amount required as maintenance margin.

Example of emini S&P500 futures contract margin requirements

This amount is already locked in towards margin for trading one contract. You can see that, the more contracts you trade, or different markets that you trade simultaneously, the lower your trading capital becomes as the margin requirement starts to build up, which results in very small breathing space for your trades and heightens the risks of a margin call very quickly and especially when market volatility rises.

By taking a disciplined approach and trading not more than a few number of emini contracts that are manageable, futures day traders can build a disciplined trading approach with good risk management into their trading system. Although the e-mini futures contracts control smaller positions, they can still return fairly decent amount of profits over time, while also ensuring that you can adequately control your trading risks in case a trade moves against your position.

In conclusion, margin is nothing but an initial partial payment on the full value of the contract that you want to trade. Trading on margin allows the exchange or the counter party to become the buyer or the seller on the contracts that you trade. Margin trading guarantees anonymity because the exchange becomes a counter party and thus eliminates any credit risk from the transaction on either ends.

Due to the CFTC regulations, futures exchanges are required to be well capitalized and be liquid in order to meet all obligations. This liquidity comes from the margins that are collected by all market participants in the futures exchange.

Trading on margin is risky as only a small percentage of the total contract value offers a powerful leverage to maintain large positions. While margin trading can offer traders the potential of making big profits, the losses can also be equally devastating. In order to carefully manage margin trading on futures accounts, traders should first have a good starting capital to trade with followed by managing good risk management principles and a trading strategy. For beginners, it is always best to stick to the e-mini or e-micro futures contracts which have the lowest margin requirements thus allowing traders to be able to adequately trade on the emini or emicro futures contracts on leverage and still be able to sufficiently manage risks.