In this article, we will review the 5 ways you can avoid the dreaded margin call. If you trade long enough, at some point you are going to get one.

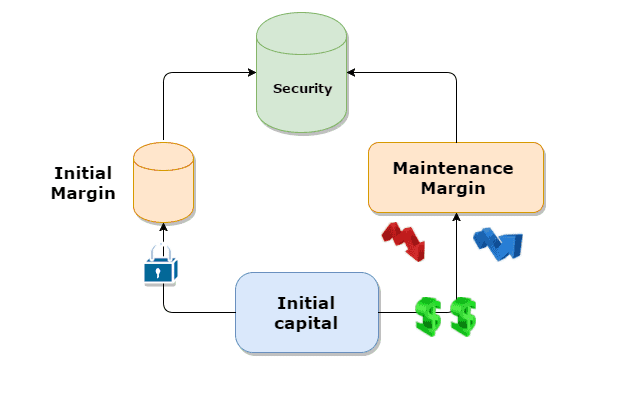

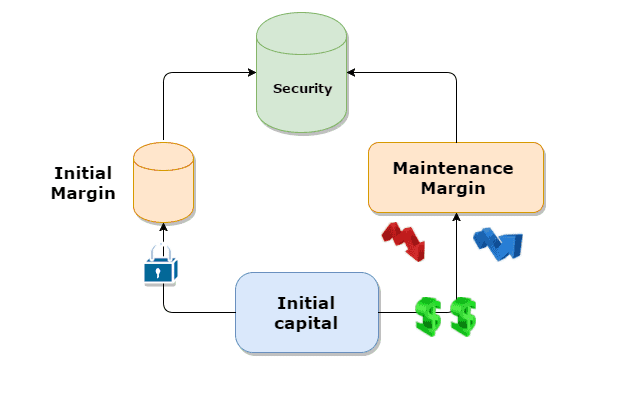

Before we dive into the methods, let’s first discuss how you end up in a spot where you are on the receiving end of a margin call

What is Margin?

Trading on margin is when you use borrowed funds to increase your trading capital. For overnight positions, the standard margin is two to one. If you are day trading the standard overnight leverage is four to one. This means if you have an account value of thirty thousand, you will be able to trade up to 120 thousand during the day.

Improper Use of Margin

When trading there are specific margin requirements for the type of security you are trading and for specific stocks.

This is the way the brokers protect themselves as you are using their funds to conduct your trading business. So, what happens when you decide to go to heavy into one position?

Or what happens when you short a penny stock that begins to explode shortly after the open?

These are just two examples of how you can improperly use the margin and things get out of hand. I personally only use cash as I am not in a rush and I know that given the right circumstances, I’m liable to do something stupid.

So, if you find yourself in one of these positions and things are getting out of hand, your broker will notify you with a margin call. This call is their way of communicating that there is too much risk in the position.

Now that you have an understanding of margin and how you can inadvertently misuse funds, let’s dive into 5 ways to avoid a margin call.

#1 – Have a Better Understanding of Margin Maintenance Requirements

Traders place a lot of focus on entry levels and trading systems. But few put emphasis on money management and this includes trading with margin.

Every security you trade will have margin requirements. Again, this will vary by security. The times where I have found myself in a jam were when I did not have a clear understanding of these requirements.

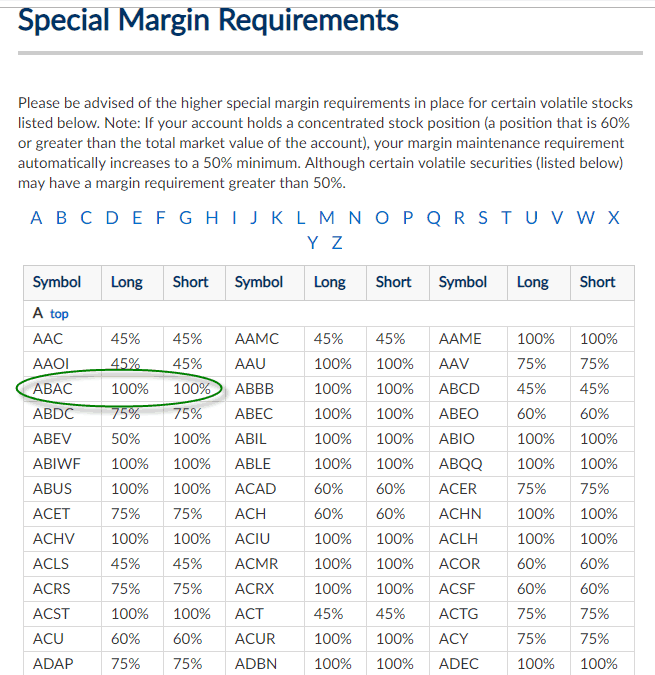

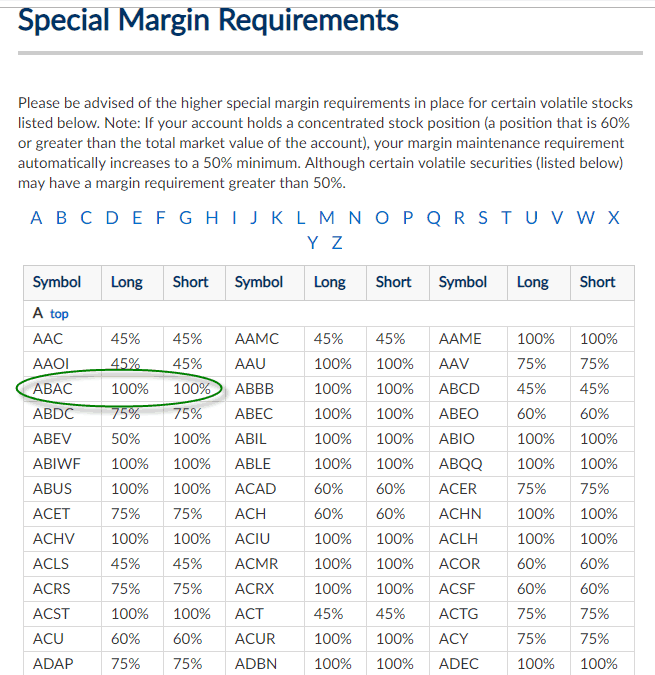

These stocks that go beyond the standard margin terms are listed on the special margin requirements sheet. Every broker will have one of these lists public on their website.

If you plan on trading high volatile stocks or penny stocks you will need to do a spot check of this list if you plan on using more than your cash on hand. Below are some general maintenance requirements across all brokerage firms you should be aware of. These are requirements set by the government.

Example of Special Margin Requirements

Here is an example of special margin requirements from the brokerage firm First Trade.

Special Maintenance Requirements

Notice in the above list how some of the stocks have 100% cash requirements. This means you need dollar-for-dollar cash on hand in order to hold the position.

Another key point to notice is that for short positions, you will need to cover more of the position as the brokers need to protect themselves from unlimited upside risk.

You will need to pay close attention to these lists.

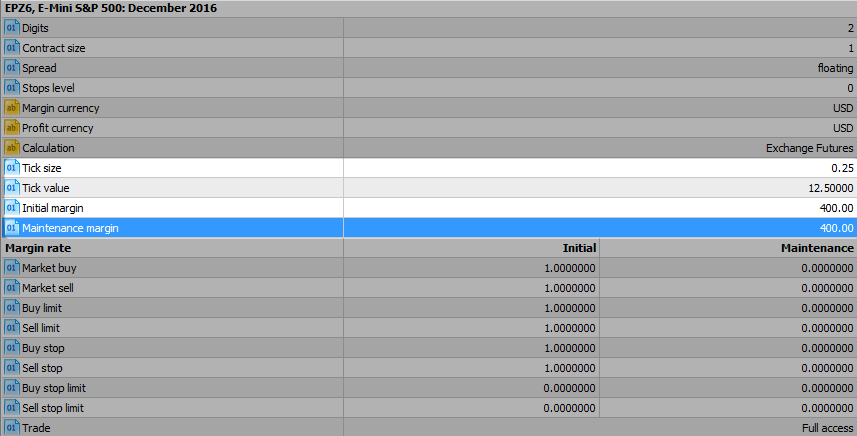

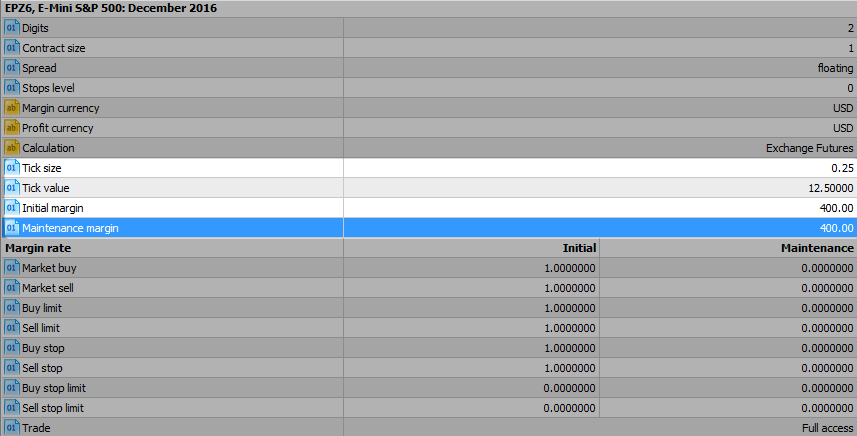

#2 – Know the Margin Requirements for All Open Orders and Positions

Knowing the special margin requirement for a security is a great start. But unless you plan on only trading one position, you will need to know the margin requirements for the pool of stocks you plan on carrying.

For example, you can have two active positions and one open position with a stock that has a significant margin requirement. Now, ideally your broker would reject the order before it executes, but that doesn’t always happen.

So, you can end up in a situation where if the last order is executed you will immediately be in a tight position and with a few wrong ticks forced to close or reduce your position sizes.

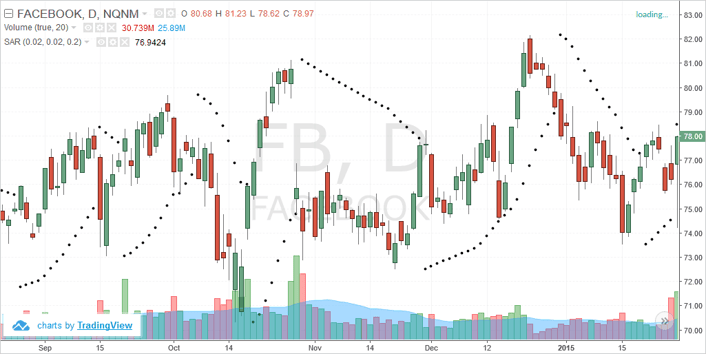

#3 – Use Trailing Stops or Stop Loss Orders to Avoid Margin Calls

In addition to using sound money management techniques, you can also use stops to manage your portfolio.

The simple point is that you do not let positions go against you so far that you can get into a situation where you fall below the maintenance requirement.

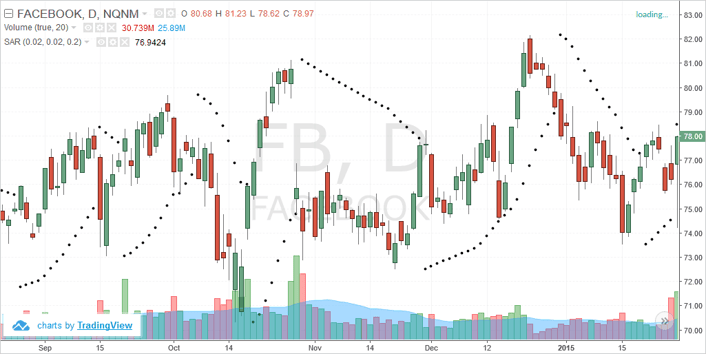

Using Parabolic SAR for trailing stop

You will need to make sure you honor your stop, regardless of the method for this to work.

The worst situation you can find yourself in is if you are short a stock and it starts to go against you in a parabolic fashion and you do not put a stop to it.

#4 – Scale Into Your Positions

You may feel inclined to just go at a position full tilt with no regard for your well-being. You just see that opportunity and jump on board with little to no hesitation.

This can lead to overexposure even before the stock has had a chance to prove itself.

One approach you can take is to build up your positions in thirds. You can add a third each time the stock continues to go in your favor. This way if the stock begins to fail you, you are not in a spot where the dreaded margin call is right around the corner.

#5 – Don’t Trade with Margin

This is the most obvious way to stay out of trouble. Jus trade with cash.

This is my personal method for trading the markets. I am not concerned with the additional cash margin can bring my way. When does it end?

Let’s say you are trading with $50,000 dollars and with margin can go up to $200,000. So, what happens when you grow your account up ot a million? Do you now use 4 million in margin?

Do you see where I am coming from? If growing an account comes down to the time, then why not just take your time and let things play out.

How Can Tradingsim Help?

You can practice trading with margin in Tradingsim to see if you are able to maintain the required funds to avoid a call.

Paper Trading

Paper Trading