The U.S. Commodities Futures Trading Commission or CFTC as it is commonly called, is an independent agency of the U.S. government with the responsibility for regulating the futures and options markets.

US Commodity Futures Trading Commission

The CFTC was established in 1974 with the enactment of the Commodity Futures Trading Commission Act, signed by the then U.S. President Gerald Ford. The CFTC was established nearly 126 years after the Chicago Board of Trade was founded as a cash market for grains.

After the 2007 global financial crisis, the Dodd-Frank Act has pushed the CFTC to transition to implementing more strict regulations and bringing more transparency to the futures markets.

For futures traders, it is essential to know the role played by the CFTC in the futures markets and also understand the key functions of the establishment. The CFTC is tasked for the purpose of avoiding systemic risk while also protecting the market participants’ funds and from fraud and manipulation.

The CFTC has offices in New York, Chicago and Kansas City and the commissioners are appointed by the president with the consent of the senate. The main office is headquartered in Washington DC.

A total of five commissioners are appointed with a fair split, with no more than three commissioners at any point in time may be from the same political party. The president designates one of the commissioners to serve as the Chairman. The commissioners serve staggered five-year terms. The current Chairman of the CFTC is Timothy Massad who was appointed on June 3, 2014.

The staff of the chairman of the CFTC is directly responsible for providing information about the commission to the public. The staff is made up the Office of the Inspector General, responsible for audits and the Office of International Affairs which coordinates with other global regulatory bodies. The chairman’s staff also interacts with other governmental agencies and the Congress and prepares and disseminates the commission’s documents. The staff is also responsible for attending to the requests filed under the Freedom of Information Act.

The Commodities Futures Trading Commission is organised around four main categories:

- Clearing and Risk: Includes overseeing the derivatives clearing organisations and other market participants

- Enforcement: Investigation and prosecuting alleged violations of the Commodity Exchange Act and CFTC regulations

- Market Oversight: Conducting trade surveillance and overseeing the trading facilities such as futures exchanges

- Oversight: Includes overseeing the registration and compliance by self-regulatory organisations (SROs), such as the futures exchanges, the National Futures Association, and registration of swap dealers and major swap participants

The six main divisions of the CFTC include:

- Division of Clearing and Intermediary Oversight,

- Division of Market Oversight,

- Division of Enforcement,

- Office of Chief Economist,

- Office of the General Counsel,

- and Office of the Executive Director.

The government watchdog offers protective measures which allow for freedom and security for traders in the futures markets. The CFTC ensures that the rigorous and sometimes risky markets of futures trading are a level playing field regardless of institutional traders or the retail trader.

History of the CFTC

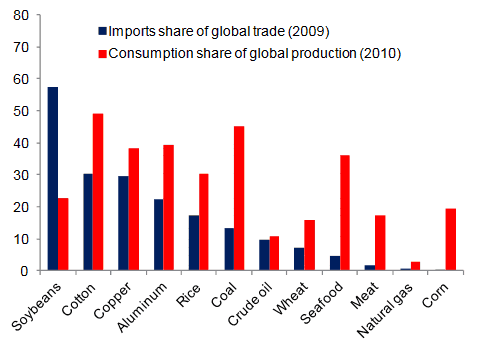

Commodities have been traded in the United States for over 150 years starting primarily in agricultural commodity trading. Since 1920’s commodity trading was regulated under the Federal law and in 1922, the Grains futures act established the central authority, known as the Commodity Exchange Act enabled in 1936. Over time, the CFTC’s oversight expanded to include contracts on energy and metals as well as financial contracts such as interest rates, stock indexes and currencies.

As futures trading began to expand rapidly and going beyond the traditional agricultural commodities, the CFTC was eventually created which replaced the U.S. Department of Agriculture Commodity Act.

In the year 2000, the U.S. Congress passed the Commodity Futures Modernization Act which expanded and renewed the CFTC mandate. It also included the Security Exchange Commission (SEC) to partner with CFTC in development of joint regulation for other futures contracts such as the single-stock futures which began trading since 2002 and also overseeing the $400 trillion swaps markets.

Key Functions of the U.S. Commodity Futures Trading Commission

The CFTC defines its mission as “to foster open, transparent, competitive and financially sound markets, to avoid systemic risk, and to protect the market users and their funds, consumers and the public from fraud, manipulation and abusive practices related to derivates and other products that are subject to the Commodity exchange act.”

But what does this mean for futures traders and what role the CFTC play in the futures markets. The main functions of the CFTC are as follows:

#1 – Market review of contracts

One of the key functions of the CFTC is to ensure integrity in the futures markets. Therefore, the CFTC regularly reviews the terms and conditions of the futures and options contracts the commission also reviews any new futures or options contracts by assessing if the new financial instruments comply with the requirements of the Commodity Exchange Act (CEA) and the commission’s regulations such as whether the contract terms reflect the commercial trading practices and to assess if the contracts can be susceptible to market manipulation.

This means that every futures and options contract that is available to trade from a regulated exchange must be approved by the commission.

For example, in April 2012 the CFTC quashed a proposal to allow options contract on the U.S. Presidential elections. The proposal was put forth by North American Derivatives Exchange (NADEX), which wanted to list the options contracts tied to the election outcomes in 2012 presidential elections race.

#2 – Surveillance and maintaining market integrity

The CFTC also conducts daily surveillance and can, in some cases order a futures trading exchange to take specific actions or to restore orderliness in the futures contract in question.

Under the daily surveillance program, the CFTC monitors all the active futures and options contracts with the surveillance staff monitoring the daily activities from large traders including assessing key price relationships between the futures and the cash markets and supply and demand factors.

May 2010 Flash Crash Caused by Futures Traders

The most recent high profile case being the investigation of a 37 year old, London based futures trader who pleaded guilty for the 2010 stock market crash by spoofing the futures contracts.

High frequency trading, which is often considered a nemesis by retail traders also came under the scrutiny of the CFTC. Some of the more recent changes including the proposed rules known as “Regulation Automated Trading” or “Regulation AT” designed to reduce the likelihood of automated trading disruptions and increase transparency measures and introducing other safeguards.

#3 – Large trader reporting program

The CFTC’s Large trader reporting program offers a confidential reporting system from firms and large traders. Under this program, clearinghouses, foreign brokers and FCM’s (futures commission merchants) are required to file daily reports with the commission. The reports show the futures and options positions of the traders who have their positions at or above the specific reporting level set by the commission.

The reporting levels vary from one commodity contract to another, but to give an example for crude oil, 350 contracts is the levels specified by the CFTC while 200 contracts are set as the reporting level for gold futures contracts. Below are some of the most commonly traded commodities and their reporting levels.

| Commodity |

Contracts |

| Gold |

200 |

| Natural Gas |

200 |

| Crude Oil (Light Sweet) |

350 |

| 30-day Fed funds |

600 |

| S&P500 Stock price index |

1,000 |

| Coffee |

50 |

| Corn |

250 |

| Cotton |

100 |

| Soybeans |

150 |

More details on the reporting levels can be found here.

What this means is that if a reporting firm has a trader with a position at or above the commission’s reporting level in any single futures or option expiration month, the firm is obligated to report the trader’s entire position in all futures and options expiration months in that commodity.

The CFTC aggregates all this information and publishes it on a weekly basis is what is known as the Commitment of Traders report. The CoT report is one of the most widely used market sentiment indicators to show the general speculative money positioning in the markets covering energy, metals and currencies.

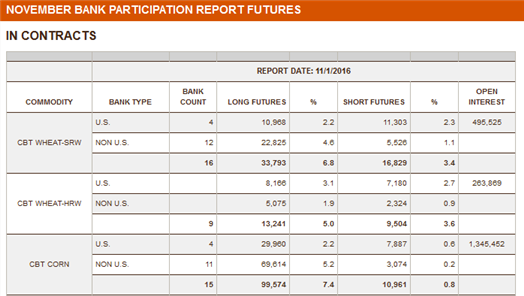

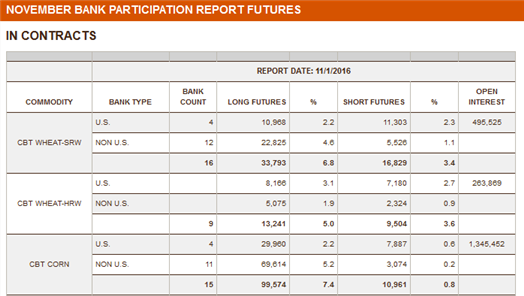

Besides the CoT report, the CFTC also published other market reports such as:

- Weekly swap reports

- Bank participation reports

- Net position changes

- Cotton-on-Call

CFTC Bank Participation sample report – Source CFTC

#4 – Regulation of Futures Professionals:

The CFTC also has compliance rules in place to protect the interest of the general public. The commission enforces this by ensuring that firms or individuals who manage customer funds or give trading advice should register with the National Futures Association (NFA). The NFA is a self regulator organization that is approved by the CFTC.

According to the rules, the CFTC requires all NFA registered firms and individuals to clearly disclose the market risks and past performance information to potential clients. Other rules include maintaining customer funds in an account that is separate from the one maintained by the firm for its own use and also requires customer accounts to be adjusted to reflect the current market value by the close of each trading day.

If the above seems like technical jargon, then there’s a simpler way to explain this. If you have been a trader or have been following the markets, you might have come across the CFTC’s 4.41 rule which can go by other names such as the CFTC disclosure that alerts you to the risk of financial trading, this is nothing but CFTC’s regulation in practice.

Your average Commodity Trading Advisor (CTA) is also part of the CFTC’s regulation where only certified CTA’s are able to manage your trading capital or give investment advice.

#5 – Regulation of Designated contract markets

Designated contract markets of DCM’s are required to operate under the regulatory oversight of the CFTC, according to second 5 of the Commodity Exchange Act. A Designed Contract Market are boards of trade or traditional futures exchanges which allow access to their facilities by all types of traders.

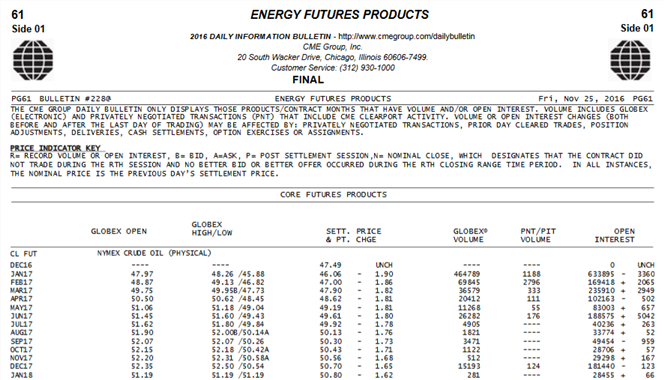

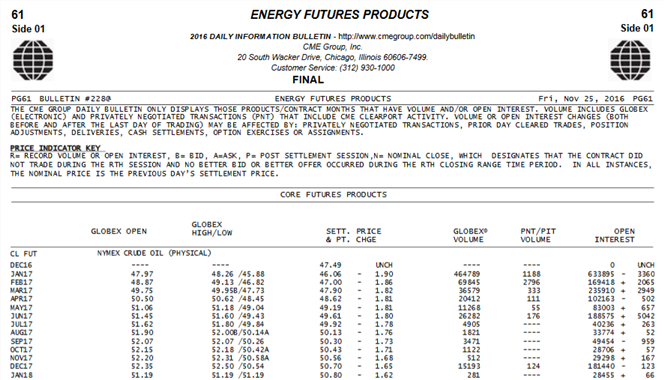

Sample Daily Market report published by CME Group – Source CME Group

Any exchange or trading facility that offers trading futures and options on commodities need to apply to the CFTC to be a designed DCM. The DCM’s are required to comply with the CFTC’s rules and the 23 governing principles, some of which are:

- Contracts not readily subject to manipulation

- Daily publication of trading volume

- Trade information

- Financial integrity of transactions

- Dispute resolution

- Conflict of interest

The CFTC undertakes regular reviews of the DCM to ensure the ongoing compliance with the commission’s rules. You can also view a full list of the DCM or in other words check if an exchange is regulated by the CFTC by clicking here.

To conclude, the Commodities Futures Trading Commission is a financial watchdog tasked for the purpose of maintaining the financial integrity of the markets. For retail traders this means having access to a transparent markets and the ability to trade the futures contracts that are regulated by the CFTC. Last but not the least, trading with a CFTC regulated exchange and a broker is often in the best interest for the retail traders as it offers additional advantages such as the regulatory oversight to ensure fairness in the futures markets.

Basics of Stock Trading

Basics of Stock Trading