What is a gamma squeeze?

By now we’ve all heard about what a short squeeze is and how they happen in the stock market. If we take a short squeeze one step further, we get the gamma squeeze. A gamma squeeze is a rapid escalation of a stock’s price, due to a large amount of call option buying for the underlying stock. The term gamma refers to a rate of change in the price of the delta of an option contract. The delta is the change in price of the option contract given a $1.00 change in price for the underlying stock.

To understand a gamma squeeze a preliminary knowledge of options trading definitely comes in handy. When a trader buys a call option contract for a stock, they are anticipating that the stock price will rise to a specific price by a specific date. If the price of the underlying stock meets that specific price, or strike price, by the expiration date of the call option the trader can either exercise the option or sell the contract for premiums. If the price of the stock is below the strike price, the call options will expire worthless.

In the case of a gamma squeeze, traders can buy call option contracts to force the hand of market makers and short sellers. When call options are bought, market makers are forced to buy shares to hedge against a potential squeeze. At the same time, short-sellers also buy out-of-the-money call options to hedge against their own short position. As they buy more call options, market makers have to buy even more shares. This results in a cascading wave of buying pressure for the stock, which of course, leads to a major surge in the price.

What is a gamma squeeze vs. a short squeeze?

A short squeeze deals primarily with short sellers buying up shares of the stock to close out their short position. While a short squeeze can involve options buying, the squeeze in the stock’s price is typically caused by buying pressure on the underlying stock. Short sellers aren’t necessarily hedging their positions with options contracts, they are simply closing out their short positions by buying the actual shares, likely at a loss.

In comparison, a gamma squeeze revolves around the trading of call options contracts. Gamma squeezes tend to see more violent price surges than short squeezes, although once the price of the stock rises above the strike price of the call options, the gamma squeeze may come to an end, though not without some amount of carnage. This is because the market maker is fully hedged at this point and no longer needs to buy more shares of the underlying stock. Gamma squeezes can see a rapid burst in price, but often fizzle out just as quickly as they started.

How does a stock go up with a gamma squeeze?

The key for a gamma squeeze is that multiple parties are buying shares, causing the sudden surge in price. The introduction of call options to the squeeze causes the rapid escalation of the stock. Both the market makers and the short sellers add increased buying pressure to the stock. The short seller will hedge their short position by buying call options as well, which in turn causes the market makers to buy even more shares.

You can begin to see how the situation escalates so fast. All of this buying pressure squeezes the price of the stock higher. As mentioned, once it reaches a certain price it tends to lose momentum unless the traders continue to buy more out of the money call options. As the price continues to rise, short sellers will likely be forced to close out their positions at a steep loss, which becomes part of the demand fueling the stock higher.

Is a gamma squeeze real?

Absolutely a gamma squeeze is a real event that happens in the stock market. It’s definitely not as common as a short squeeze, but gamma squeezes do happen from time to time. From the gamma squeezes for the meme stocks in 2021, more than one hedge fund was liquidated. This shows the danger and volatility that comes with shorting stocks - the potential to initiate gamma squeezes. So yes, gamma squeezes are very real, and are double-edged swords that can slash either way depending on the movement of the price of the stock.

When does a gamma squeeze happen?

For a gamma squeeze to happen, all of the elements of a short squeeze need to be in place as well. This means there needs to be a significant short-seller position against the underlying stock. The short sellers are generally the match that lights the fire so to speak.

From there, a group of traders or a very large whale trader needs to put significant pressure on shorts by buying short-dated call options for the stock. In this way, traders can essentially force the hand of market makers and short-sellers to organically raise the price of the stock.

How long does a gamma squeeze last?

This depends on the situation. Every squeeze has different circumstances and different traders involved. Typically, a gamma squeeze is an intense surge of the stock price that is short-lived. Once the strike dates for all of the options contracts have been passed by the price of the underlying stock, the market makers should be fully hedged and don’t need to buy up any more shares. This ends the buying pressure and effectively, the gamma squeeze as well.

AMC Gamma Squeeze Example

In June of 2021, the beloved retail stock AMC was the target of a coordinated gamma squeeze by Reddit traders. The intensity of the AMC gamma squeeze was felt across the market, as AMC’s stock hit an all-time high price of nearly $70 per share. The culprit? Social media discussion boards like r/WallStreetBets on Reddit planned an attack on short-sellers and hedge funds. The way they did this was to buy up as many shares of AMC as possible, and then proceed to buy call options contracts. The combination of the two forced market makers to gobble up shares of AMC, sending the stock soaring higher.

While AMC had seen a short squeeze earlier in the year in January, that squeeze paled in comparison to the intensity of the gamma squeeze in June. Could AMC see another gamma squeeze? Who knows...perhaps, if the conditions are right and short interest remains high. That being said, AMC continues lower -- so don't be a bagholder.

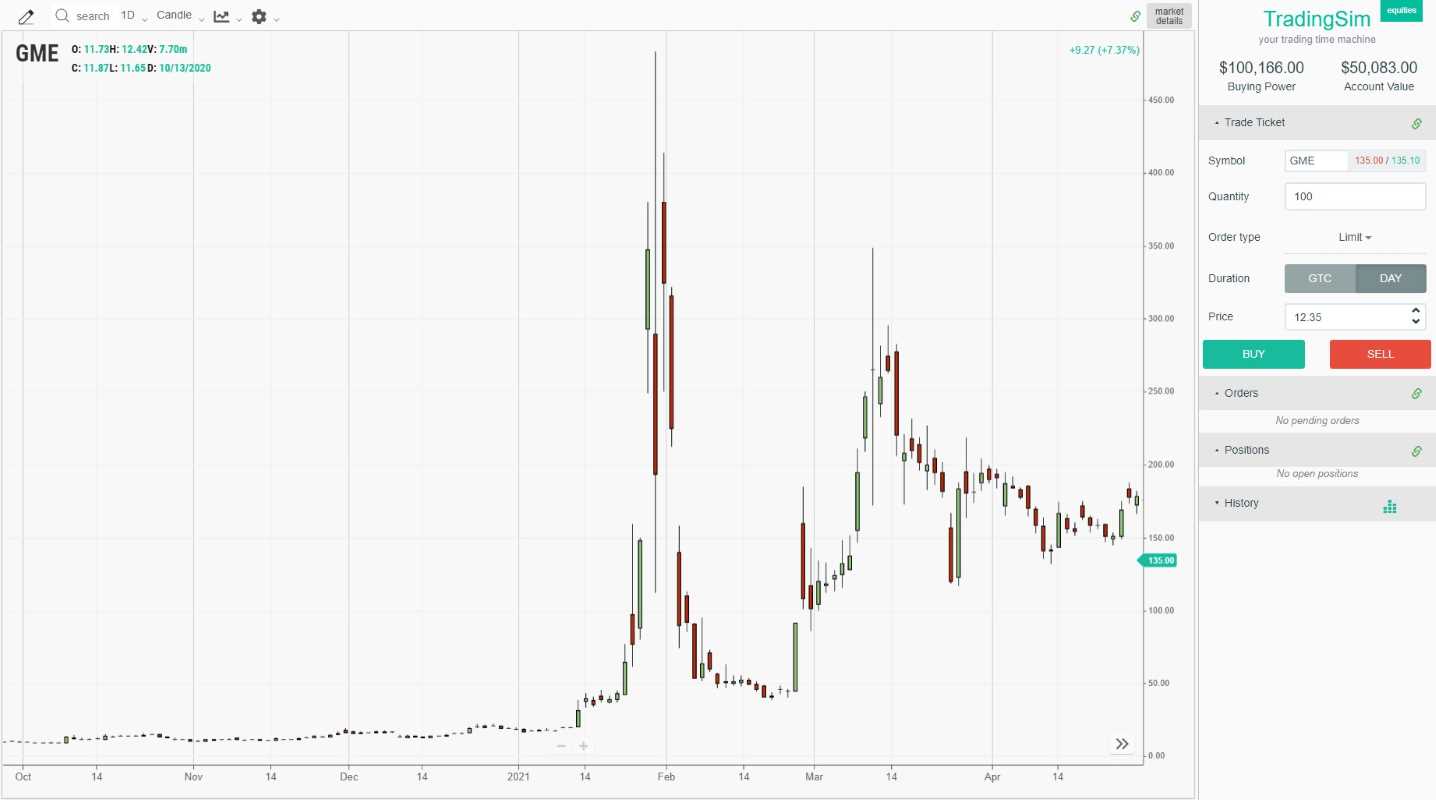

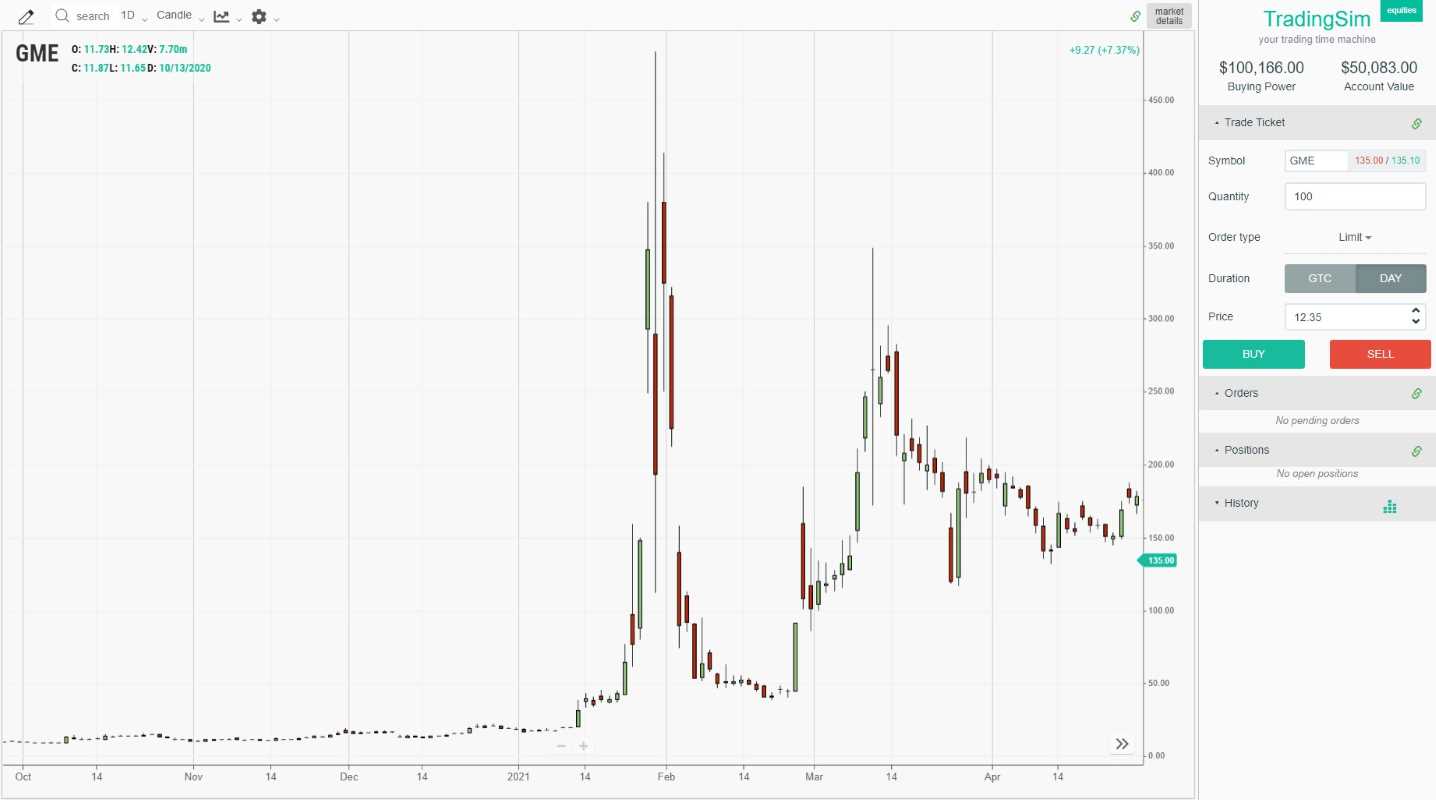

GME Gamma Squeeze Example

As large and impressive as AMC’s gamma squeeze was in June, nothing compares to the staggering gamma squeeze from GameStop just a few months earlier. The GameStop gamma squeeze in January of 2021 is one of the single largest gamma squeezes in the history of the stock market. Not only was GameStop’s short interest historically high, but the gamma squeeze was well-coordinated, and even well researched.

In a matter of weeks, GameStop’s stock price rose from just a few dollars to nearly $500 per share. The retail traders were relentless and routinely purchased hundreds of thousands of call options contracts in a single session. Of course, each option contract is made up of 100 shares of the underlying stock so you can imagine how many shares the market makers were forced to buy.

The GameStop gamma squeeze could have been even more intense were it not for certain brokerages, like Robinhood, turning off the ability to buy options for the stock. Traders were only able to sell options, which seriously reduced the buying pressure on the stock. This is just one example of alleged market manipulation by hedge funds during the meme stock revolution. GameStop’s stock is still trading in the triple digits, and the short interest in GME still remains fairly high. GameStop, according to HODLers, is still a threat to see another retail-fueled gamma squeeze in the future. However, dilution can affect the ability of a stock to squeeze.

Gamma Squeeze summary

Gamma squeezes are typically more intense and short-lived compared to short squeezes. While short squeezes revolve around short-sellers closing out their positions by buying stock, gamma squeezes are all about option contracts. Instead of simply buying common shares, traders will also buy out-of-the-money call options. In response, short sellers will also purchase call options to hedge their short positions. Both of these lead to market makers needing to buy up shares of the stock, which leads to the upward surge.

Gamma squeezes are fairly uncommon on the stock market, and generally, die out when the strike price of the option contracts is met. The two most well-documented examples of gamma squeezes occurred in 2021, for the meme stocks AMC and GameStop.

Economic Analysis

Economic Analysis